OBSERVATIONS FROM THE FINTECH SNARK TANK

If you’ve ever spotted a suspicious charge on your debit or credit card, you’re not alone. How your bank or card issuer handles credit card fraud disputes has a bigger impact than you might think. It affects your stress levels, your trust in your financial provider, and even your decision to continue doing business with them.

A new report from Cornerstone Advisors and Quavo dives into the realities of card fraud and the customer experience that comes with resolving it. The key finding: it’s not just about correcting the fraudulent charge—it’s how you’re treated throughout the process.

Credit Card Fraud Explosion

Fraud is widespread: FinCEN data shows that credit and debit card fraud has steadily grown over the past five years, evolving from a relatively modest baseline of 15k–20k monthly reports in 2020–2021 to a sustained surge above 30k per month by 2022.

Card-based fraud has become an entrenched and durable threat vector for financial institutions. According to Dr. David Maimon, Head of Fraud Insights at SentiLink:

“Threat actors routinely advertise compromised credit and debit card details, often automating the process through messaging platforms where buyers can interact with chatbots to browse and purchase data. Stolen card details are openly traded in underground markets, and some services even present organized lists of card types and issuing banks to make selection easier.”

The Credit Card Fraud Experience is a Differentiator

You may be likely to experience fraud on your credit or debit card, but your experience needn’t be a nightmare. How your bank resolves the issue is critical. The experience—from the moment fraud is detected to the final resolution—determines whether you trust your bank more or less afterward. It can even influence whether you’ll continue using that bank or card provider. The fraud dispute/resolution process includes:

- Fraud identification/reporting. According to Cornerstone Advisors’ research, in 60% of fraud cases, the card issuer detected the suspicious activity first. Most people reported that it was easy to recognize the fraud on their account, and were satisfied with how simple it was to report the fraud. Most financial institutions responded quickly, within minutes or hours, once the fraud was reported.

- Replacement. The speed of receiving a new card varied widely. Only a third of cardholders received a replacement card within two business days. Another 45% waited between three and five days, while 20% waited more than five days. During this waiting period, only about half of those affected were given virtual access to their new card number so they could use it online or through digital wallets.

- Provisional credit. This temporary refund should be issued while the bank investigates the fraud claim, as required by law. Despite this requirement, only 42% of cardholders reported receiving provisional credit. Another 42% said they did not receive it at all, and the remaining respondents were unsure. This uncertainty can create stress, especially if the fraudulent charge impacts your ability to pay bills or cover daily expenses.

- Investigation. The investigation process itself often leaves much to be desired. Most consumers couldn’t upload documents or track the progress of their claim, and 82% reported that they had no way to submit additional documentation to support their case. Additionally, 60% said they had no access to a self-service portal or app that could provide updates on their claim. Only half of the people surveyed received timely status updates during the investigation.

Eventually, most fraud claims are resolved in the consumer’s favor. But how long did it take to get there? A little more than half of consumers said their issue was resolved in less than a week, while a quarter had to wait between one and two weeks. Sadly, 20% of cases took longer than two weeks to resolve—a long time to wait when your financial life is disrupted.

Communication is key during the fraud resolution process. Although most people said that their card issuer clearly explained the process, only 53% felt they were kept well-informed throughout the entire process. This means many banks and card issuers have room for improvement when it comes to keeping customers updated and reassured.

The Impact of the Credit Card Fraud Experience

How your bank handles fraud disputes has a profound impact on trust, loyalty, and future engagement. Cardholders who rated their fraud experience an “A”—90 points or higher on a 100-point scale—were significantly more likely to have confidence in their bank’s ability to protect their money.

These high-satisfaction customers were also more likely to continue using their card, to purchase additional products from their financial provider, and to say that the fraud experience strengthened their relationship with the institution.

In contrast, consumers who gave their experience an “F” were far less likely to keep using the card and overwhelmingly said the fraud event damaged their trust.

Leaders in the Credit Card Fraud Experience

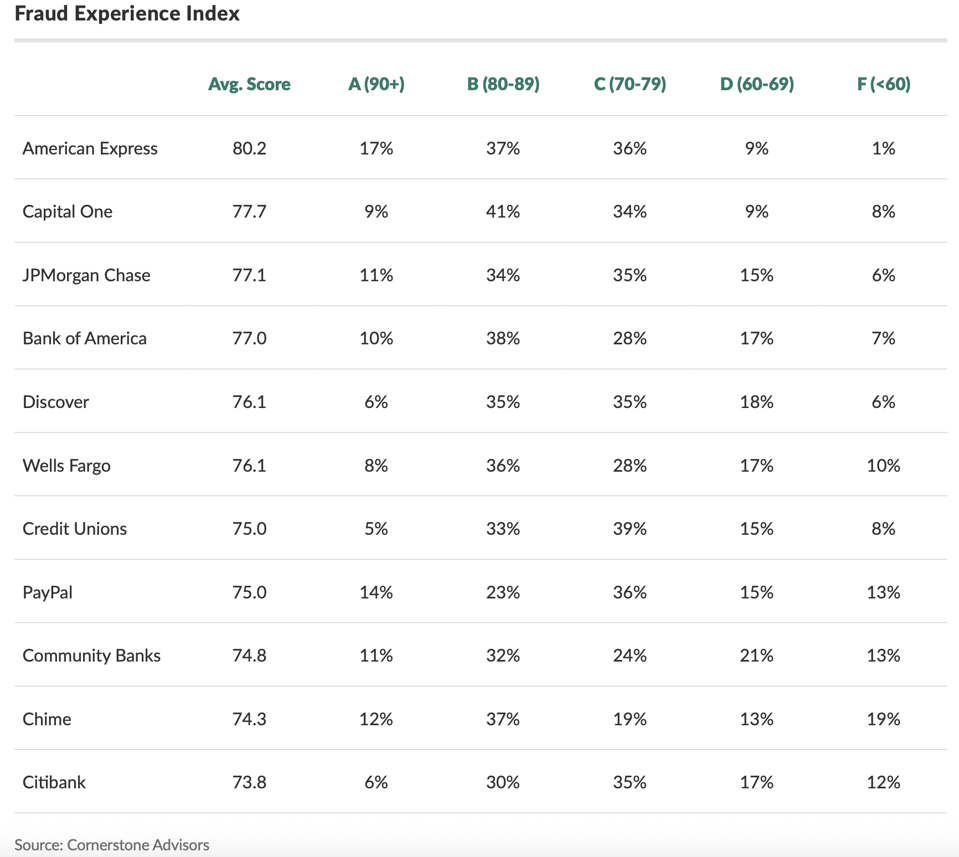

The report ranked the performance of major credit and debit card issuers. American Express was the top performer, earning an average score of 80.2. Seventeen percent of AmEx customers gave the company an “A,” nearly double the national average.

On the other end of the spectrum, Citibank and Chime received lower marks. Chime had the highest percentage of “F” scores, and more than half of Citibank cardholders gave their experience a grade of “C” or “D.”

Credit and debit cardholders should expect and demand a fraud resolution experience that is fast, transparent, and fair. That means clear explanations, real-time updates, timely provisional credit, and user-friendly tools like mobile apps and portals.

Fraud may be inevitable, but a frustrating, opaque, or lengthy response should not be. Cardholders have every right to expect better. Banks and card companies that deliver a strong fraud experience build trust—and customer loyalty. Those that don’t may find themselves losing business in an increasingly competitive marketplace.

Credit card fraud is inevitable these days, but the dispute/resolution process doesn’t have to be a painful one. Consumers should hold their financial providers to high standards and demand a better fraud experience. After all, it’s your money—and your peace of mind—that’s on the line.