AbbVie stock (NYSE: ABBV) rallied 11% in a week, largely driven by a key development that boosted the entire sector: Pfizer’s agreement to lower its drug prices for Medicaid and a White House decision to grant a three-year exemption from 100% import tariffs. Since the market sees this event as broadly positive for pharmaceutical companies, ABBV’s stock has risen significantly. The question now is: given this recent climb, how does AbbVie compare to its peers across metrics like size, valuation, growth, and margins?

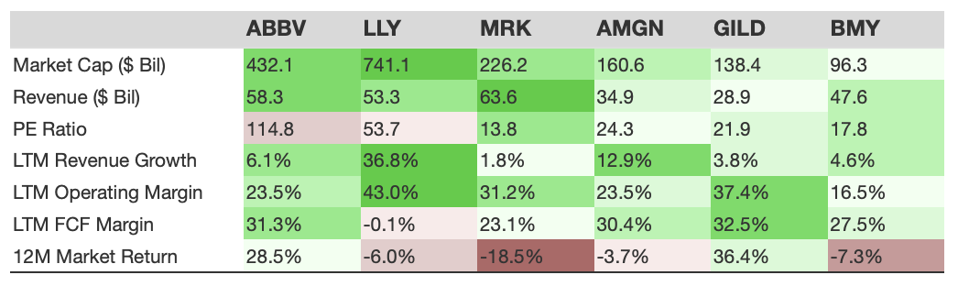

- ABBV’s operating margin of 23.5% is considerable, yet lower than most competitors, trailing LLY (43.0%).

- ABBV’s revenue growth of 6.1% over the past year is moderate, surpassing MRK, GILD, and BMY, but falling short of LLY and AMGN.

- ABBV’s stock has increased by 28.5% in the last year and is trading at a PE of 114.8, although competitors like GILD have produced higher returns.

For some context, AbbVie develops pharmaceuticals that include treatments for autoimmune diseases, plaque psoriasis, pancreatic insufficiency, and hypothyroidism through innovative drug development and manufacturing within the United States.

While comparing peers is essential, the Trefis High Quality Portfolio assesses much more and is designed to mitigate stock-specific risks while offering potential upside. In fact, it has comfortably outperformed its benchmark—a combination of the S&P 500, Russell, and S&P MidCap indexes—and has achieved returns exceeding 91% since its inception. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride, as evident in HQ Portfolio performance metrics.

Why is this significant? ABBV has recently risen by 15.3% in a month—comparing its performance with peers helps contextualize stock behavior, valuation, and financials—questioning whether it is genuinely outperforming or underperforming, and importantly, can this trend continue? Read Buy or Sell ABBV Stock to determine if AbbVie remains a sound investment. Additionally, there is always the risk of a decline following a significant rally—review how the stock has fluctuated and rebounded in the past through the ABBV Dip Buyer Analysis perspective.

Revenue Growth Comparison

Operating Margin Comparison

PE Ratio Comparison

Investing in a single stock without comprehensive analysis can be risky. Consider the Trefis Reinforced Value (RV) Portfolio, which has outperformed its all-cap stocks benchmark (combination of the S&P 500, S&P mid-cap, and Russell 2000 benchmark indices) to produce strong returns for investors. Why is that? The quarterly rebalanced mix of large-, mid-, and small-cap RV Portfolio stocks provided a responsive way to make the most of upbeat market conditions while limiting losses when markets head south, as detailed in RV Portfolio performance metrics.