Eli Lilly stock (NYSE: LLY) surged 5% yesterday, initially driven by news of a Pfizer deal with the White House to lower drug prices in exchange for tariff immunity. Following this, reports surfaced that the broader pharmaceutical companies are in active discussions with the administration regarding discounted drugs.

The recent focus on drug-pricing agreements between the White House and the pharmaceutical industry at large creates a dynamic and, we believe, opportune landscape for specific investments.

While consistently selecting top-performing stocks is challenging, maintaining an objective and consistent investment strategy can be a critical source of alpha and provide a meaningful market advantage.

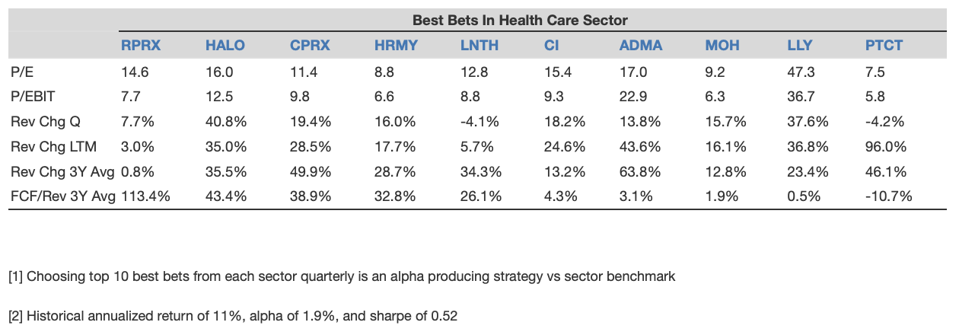

We believe that LLY is one of the Best Bets in the healthcare sector. This analysis will outline a specific selection strategy that identifies stocks that, based on their current valuation levels, possess superior growth and cash flow margins compared to their sector counterparts. We categorize these top holdings—including LLY—as our Best Bets for this environment.

Before we dive in, if you seek an upside with less volatility than holding an individual stock like LLY, consider the High Quality Portfolio. It has comfortably outperformed its benchmark—a combination of the S&P 500, Russell, and S&P MidCap indexes—and has achieved returns exceeding 91% since its inception. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride, as evident in HQ Portfolio performance metrics. Separately, see – Wait For A Dip To Buy Hims & Hers Health Stock

Best Bets In the Health Care Sector

This presents a robust method for evaluating stocks. When you invest, you are making a transaction, and naturally, you would want to maximize the value of the price you are paying. This is precisely what makes this approach effective.

What Is Our Selection Process?

We scour the entire sector, attempting to identify other stocks that offer lower valuations but higher revenue growth and greater cash-generating ability.

If we find no such alternatives, we designate the stock in question as one of the “best bets”. We then refine the selection to the top 10 best bets based on free cash flow margins.

- We utilize P/E and P/EBIT ratios as measures of valuation

- For growth, we analyze revenue growth from the last quarter, over the past 12 months, and the average of the last 3 years

- Finally, we assess the past 3 years’ average free cash flow margin as an indicator of cash-generating capacity

How Effective Is This Selection?

According to an extensive backtest covering nearly a decade, choosing such stocks and holding them for at least a quarter proves to be a legitimate portfolio strategy capable of surpassing the sector index XLV.

Here are the statistics for the period from 12/31/2016 to 6/30/2025:

Remember, investing in a single stock without comprehensive analysis can be risky. Consider the Trefis Reinforced Value (RV) Portfolio, which has outperformed its all-cap stocks benchmark (combination of the S&P 500, S&P mid-cap, and Russell 2000 benchmark indices) to produce strong returns for investors. Why is that? The quarterly rebalanced mix of large-, mid-, and small-cap RV Portfolio stocks provided a responsive way to make the most of upbeat market conditions while limiting losses when markets head south, as detailed in RV Portfolio performance metrics.