Q4 has been the strongest period in any year, leading to 60% of all gains in the S&P 500.

There are facts to keep in mind about the month of October:

- It is the most volatile month

- It has brought some of the biggest 1-day drops

- The month usually closes on the upside

- The month of September closed up 3.5%, bullish for October

- The average month of October in a year ending in a 5 has been bullish 69.2% of the time for an average change of +2.8%.

As this favorable period begins, the ten-day moving average of advances less declines is oversold, a positive sign for the start of a rally. And, the new lows versus new highs condition is constructive. The next projected turning points are on the 7th (likely a high) and the 10th. A rally through the first week in October and further into yearend is highly probable.

From 1928, September has been the weakest month of the year. However, the S&P closed on the upside. Here is the subsequent performance when September has closed on the upside.

October: Up in 29 of 43 cases

November: up 34 times in 43 cases

December: also up 34 times in 43 cases.

All cycles point up. This includes the one, four, and ten-year cycles. Also, the dynamic composite cycle rises into January. The S&P targets are 6735, short-term, and 7460, due in 2026 if not in 2025. The NASDAQ Composite target is 26250.

The methods employed to select strong Q4 stocks are relative strength, seasonality, and cycles. In the S&P 100 index, the strongest stocks are technology and financial shares. Goldman Sachs, Morgan Stanley and US Bancorp have been the three strongest stocks in the month of October over the years.

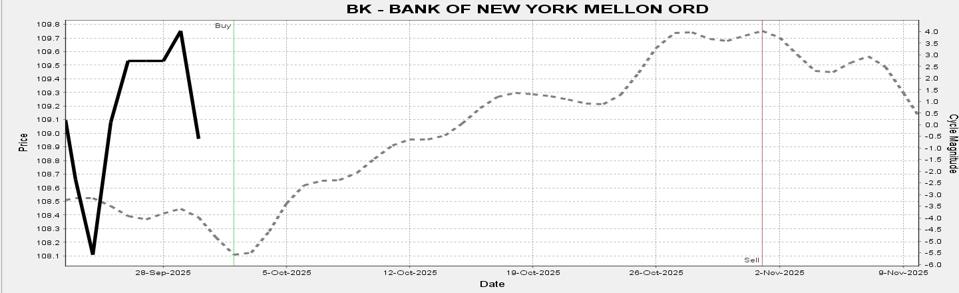

Bank of New York is rated highly in relative strength. The coming three months have been the strongest in any year over the last 46 years. The weekly cycle which is graphed below shows a buy signal on October 2nd. Buy BK and hold through Q4.

BK Weekly Cycle

Intel is number one in relative strength. Because the stock has emerged from a deep decline, it remains oversold monthly. The weekly graph below shows a reversal of the relative strength decline and higher lows in momentum, a recipe for higher prices.

Intel Weekly

Intel Weekly Cycle

Goldman Sachs ranks in the top ten in the relative strength scan. The stock has risen 81% of the time in the month of October over the last 26 years. Note that the monthly cycle dips here as depicted below, but the weekly cycle hits a low on the 12th. The monthly cycle and seasonality rise into yearend.

Goldman Sachs Monthly Cycle