As the deadline for funding the U.S. government once again looms, the headlines are dominated by warnings of disruption, furloughs and political gridlock. Investors understandably grow uneasy when Washington dysfunction captures attention, but history offers an important reminder: markets have endured repeated shutdowns without losing sight of the long-term trajectory higher.

Historical Evidence – Shutdowns & Stocks

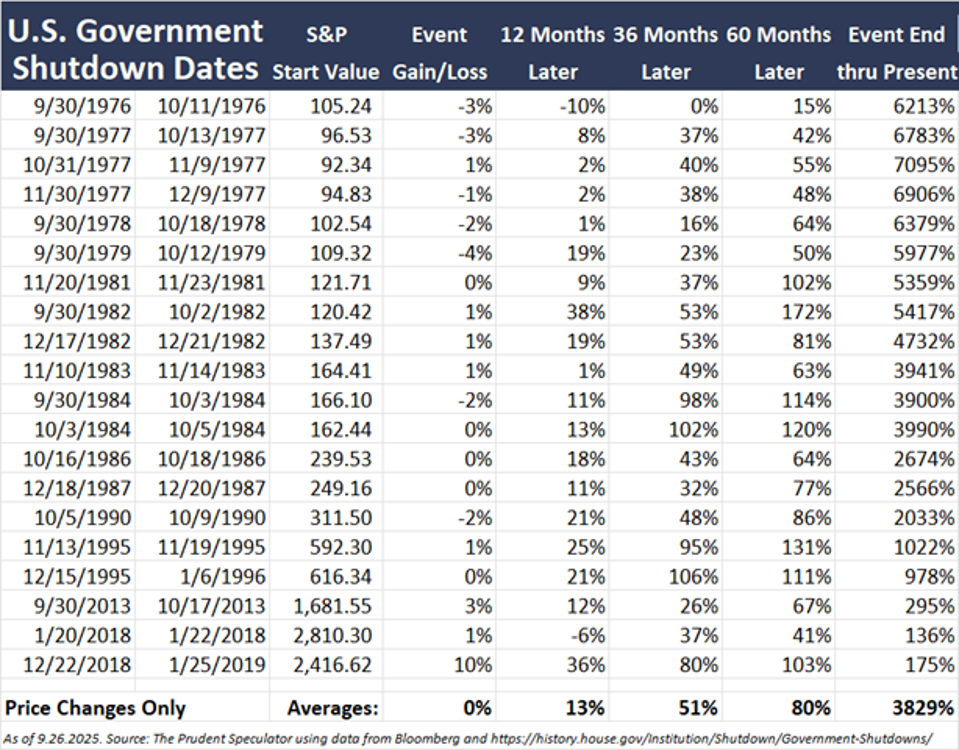

Since 1976, there have been 21 government shutdowns, some lasting only a few days and others extending for weeks. Each was accompanied by a chorus of worries that an already fragile economy might stumble. Yet the numbers show that the S&P 500, while sometimes slipping during the shutdown window itself, generated stronger-than-average gains in the year that followed. In fact, the accompanying table illustrates that the average 12-month price return following a shutdown was a healthy 13%, compared with a long-term annualized total return gain of roughly 10% for the index. At three- and five-year intervals, the results are also compelling, with stocks appreciating 51% and 80% on average, not including dividends.

Of course, no two periods are identical. Economic backdrops differ, inflation trends shift and today’s tariff and trade policies add a layer of uncertainty not present in some earlier shutdowns. Still, the enduring pattern highlights an essential truth: equity markets are remarkably resilient. Headlines and political drama may shake sentiment in the short term, but businesses adapt, consumers continue to spend, and long-term shareholders have been rewarded for their patience.

This perspective aligns with what we at The Prudent Speculator have always emphasized. Time in the market matters far more than timing the market. While setbacks, crises and shutdowns can rattle nerves, the steady march of compounding returns for equity investors has dwarfed the noise of temporary disruptions. The lesson from decades of data is that those who keep their discipline through the turbulence are the ones who capture the lion’s share of wealth creation.

To be sure, there is no guarantee that the next 12 months will follow this historical script. Markets must navigate interest rate volatility, evolving trade dynamics and political uncertainty that extends well beyond Washington’s budget fights. Yet, history counsels against panic. Investors who focus on the fundamentals, remain diversified, and hold a long-term orientation are better equipped to navigate whatever short-term headlines may come.

I continue to believe in the value of stock picking and in equities as the most effective wealth creation tool available to the masses. For those willing to look beyond the noise of shutdown politics, I offer two stocks to consider for purchase.

Bargain-Priced Stocks

Deckers Outdoor (DECK) designs and markets footwear and accessories. DECK serves customers in the U.S. (64% of revenue) and abroad, with 57% of revenue through wholesale distribution partners and the remainder direct to consumer (DTC).

Hoka is DECK’s fastest-growing brand. It grew sales 20% y/y to $653 million in fiscal Q1 2026, propelled by a loyalty program, better inventory management and a growing retail presence (48 global stores). UGG sales rose 18.9% in fiscal Q1 to $265.1 million.

Management expects near-term tariff headwinds, particularly if levies on Vietnam stick, but looks to mitigate most of the impact via higher prices down the road. Investors have questioned if Hoka and UGG can keep up with lofty targets and new product launches, while trade challenges threaten to upset DECK’s multi-year global growth effort.

I think the concern is legitimate, but DECK’s 40% plunge in price this year more than reflects the transgressions. Moreover, there’s not much evidence Hoka sales are materially slowing and UGG continues to be popular, even outside of colder seasons. Plus, the balance sheet has nearly $1.5 billion of net cash.

Devon Energy (DVN) is a U.S.-focused independent oil and gas producer with a premier multi-basin portfolio anchored by the Delaware Basin, where it holds 400,000 net acres and produces nearly 500,000 BOE per day. Complementary scale comes from the Rockies, Eagle Ford and Anadarko, which together add another ~340,000 BOE per day.

The commodity mix remains balanced at 46% oil, 27% gas and 27% NGLs, supporting resiliency across price cycles. Devon has steadily improved capital efficiency, delivering back-to-back quarters of higher oil volumes with lower spending, and has reduced its capital expenditures forecast for the full year.

Free cash flow is projected between $2.5 billion and $3.7 billion, based on WTI prices of $55 to $75. Devon has pledged to return up to 70% of free cash flow to shareholders, splitting returns between a growing fixed dividend (recently raised 9%) and consistent buybacks of $200 million–$300 million per quarter. DVN trades for 8 times NTM earnings and yields 2.7%.

*****

For those who like what I have to say in this forum, further market analytics and stock picks can be found in my newsletter, The Prudent Speculator.