Week in Review

- Asian equities were mixed for the week as Mainland China’s STAR Board and Pakistan outperformed, while the Philippines and India underperformed.

- Trump signed an executive order in support of the deal to have a consortium of US technology companies, including Oracle, purchase 80% of TikTok’s US operations and gain a license to its algorithm, valuing the company’s US operations at $114 billion.

- Alibaba announced a $53 billion investment plan for AI and a partnership with Nvidia, though details are scant so far, which helped power STAR Market equities and other AI-related stocks higher this week.

- Xiaomi released the Xiaomi 17, which will go head-to-head with the iPhone 17 in China and includes a screen on the back, right after Apple’s ecosystem suppliers experienced a significant re-rating on optimism or iPhone 17 sales.

Key News

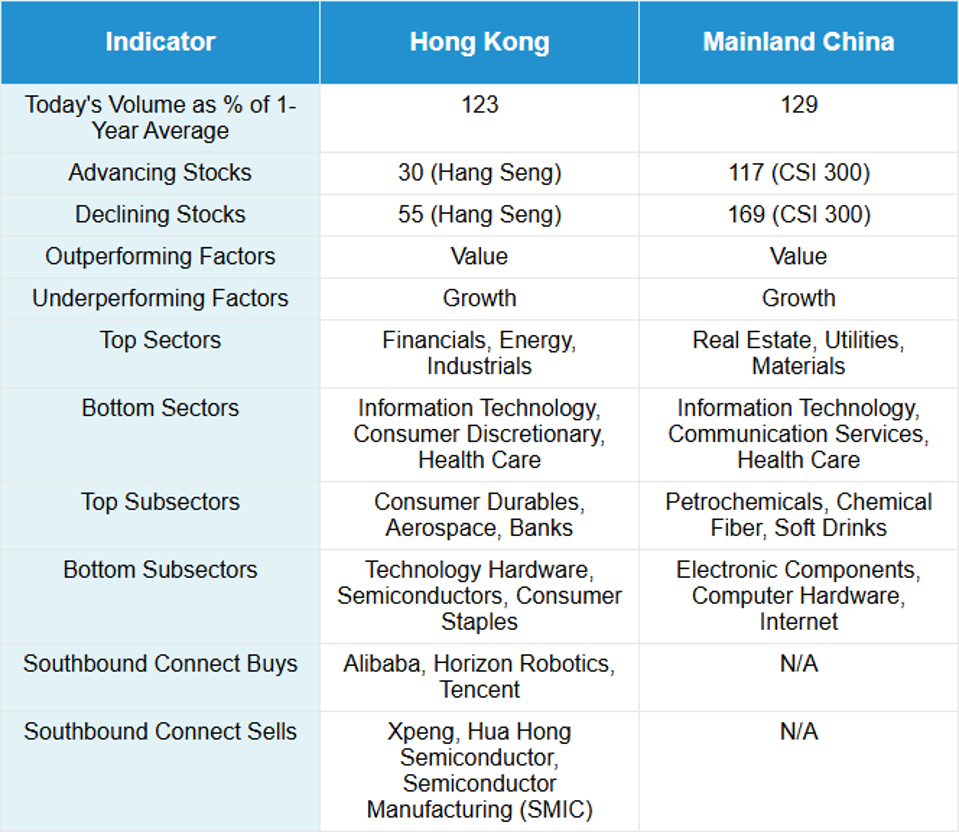

Asian equities were mostly lower overnight as Pakistan and Indonesia outperformed, while Hong Kong and Korea underperformed.

Mainland China and Hong Kong’s declines were partially driven by Trump’s announcement of tariffs on pharmaceutical and furniture imports from China. However, the US President said that the tariffs would immediately be waived for companies building facilities to produce drugs in the United States for the local market. That’s great! This is the kind of deal-making we have been looking for, where China’s firms are invited to start up local production, which many of them already have. Health care was one of the worst-performing subsectors, though, as a result, in both Hong Kong and the Mainland.

Chip and hardware maker Luxshare fell 6% overnight and was the most heavily traded Mainland stock by value. Luxshare recently rose on news that it has been tapped by OpenAI to produce an Alexa-like home assistant device. It looks like some serious profit-taking in a great company! It is up 16% from Friday last week.

Mainland investors bought a net $1.6 billion worth of Hong Kong-listed stocks and ETFs, as their inflows turned positive after going negative briefly earlier in the week.

Last night appeared to be another bout of profit-taking in key technology names that have outperformed. Value stocks and sectors outperformed growth in Hong Kong and the Mainland. It appears that Powell’s comments on stocks being somewhat overvalued (especially technology) might not have fallen on deaf ears in China. But, remember that China technology is still heavily discounted versus its US peers. For the internet sector, the earnings multiple discount for China from the US remains around 30%, despite double-digit returns this year in multiple internet names.

The TikTok deal, should it happen (fingers crossed, though it seems likely), is significant, but highlights something that we already theorized: TikTok US is not worth zero! Moreover, it was never going to be banned because Congress knows that once many of its users turn 18, they would not vote for whoever was involved in banning it. The $14 billion valuation given to the platform is likely low, as it is being sold under the proverbial “gunpoint”, but it is not too shabby. TikTok US is likely not profitable currently, due to high spend on promotions, though the potential is definitely there. For ByteDance, the real opportunity is in the rest of the world for TikTok, other than India because it is actually banned there.

Live Webinar

Join us Tuesday, October 7, 2025 at 10 am EDT for:

Anthropic’s Surge & The Potential Benefits of Pre-IPO Exposure in AI ETFs

Please click here to register

New Content

Read our latest article:

Are Commodity Executives The Best China Economists?

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.13 versus 7.13 yesterday

- CNY per EUR 8.34 versus 8.31 yesterday

- Yield on 10-Year Government Bond 1.88% versus 1.88% yesterday

- Yield on 10-Year China Development Bank Bond 1.96% versus 1.96% yesterday

- Copper Price -0.51%

- Steel Price -0.80%