Lithium Americas is the latest company to get a boost from a potential U.S. government stake.

Shares of the Canadian mining firm surged 96% Wednesday, after the Trump Administration said it has requested an equity stake—which could be as much as 10%, according to Reuters—as Lithium Americas renegotiates a $2.2 billion loan with the Energy Department. Their Nevada mine is expected to produce enough battery-quality lithium to power roughly 800,000 electric vehicles every year.

Both the Biden and Trump administrations have praised the joint venture for reducing reliance on China-based products.

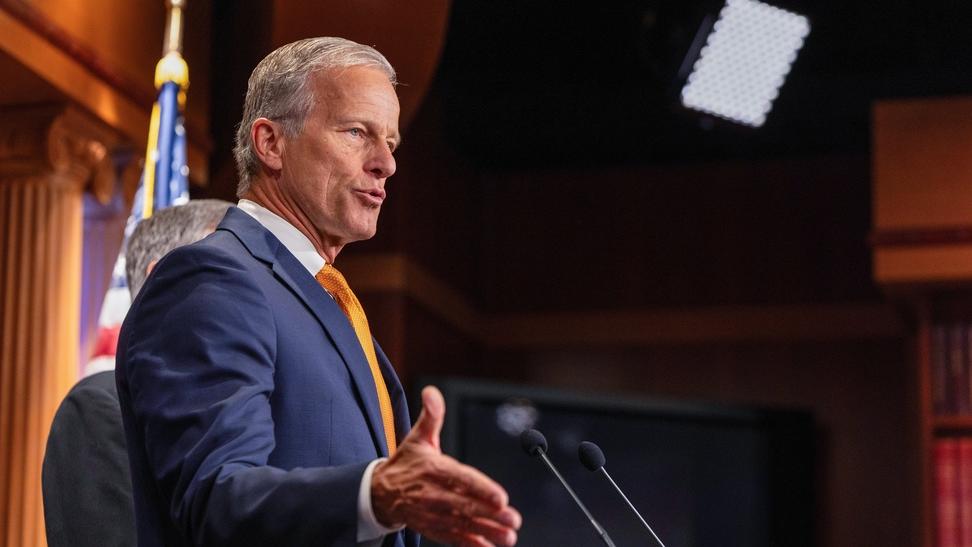

Senate Majority Leader John Thune became the most powerful Republican in Washington to cast doubt on President Donald Trump’s widely rebuked claim that taking Tylenol while pregnant could cause autism in children. Senator Bill Cassidy (R-La.), who is a medical doctor, also disputed Trump’s remarks, though both voted to confirm Health and Human Services Secretary Robert F. Kennedy Jr., who was with Trump for the announcement.

U.S. Commerce Secretary Howard Lutnick said the government is considering making its $1 million Gold Card Visa the only pathway to a U.S. green card. But immigration experts say that’s neither legal nor feasible, and one says the Gold Card likely won’t happen despite the hype.

Crypto trading firm GSR Markets filed to launch a new ETF that bundles various crypto treasury companies’ shares into a single fund, a move that would allow investors to easily gain exposure to firms buying up crypto, like MicroStrategy. The company’s Digital Asset Treasury Companies ETF would bundle companies that buy and hold cryptocurrencies on their balance sheets—known as digital asset treasury firms.

The White House’s budget office told federal agencies to prepare for mass firings if a government shutdown occurs next week, according to multiple reports. In a memo, the Office of Management and Budget reportedly asked agencies to single out programs that are “not consistent” with President Donald Trump’s agenda, but also notes that the firings will not be carried out if Congress passes a stopgap bill, potentially putting pressure on Democratic lawmakers.

In the latest reversal of Elon Musk’s DOGE cuts, hundreds of General Services Administration employees are being asked to return to work. The GSA, which manages federal buildings and property leases, had its staff slashed at its headquarters by 79%.

The 2025 Ryder Cup, a biennial golf competition between the U.S. and Europe, offers no prize money, but that doesn’t matter much for the tournament’s five highest-paid golfers, who collected a combined $358 million over the past 12 months. Leading the list of the Ryder Cup’s highest-paid players is Jon Rahm, with an estimated $99 million, followed by U.S. golfer Scottie Scheffler, with an estimated $90 million, and Rory McIlroy at $87 million.

Sheena Zadeh’s clean beauty company Kosas capitalized on the minimalist makeup trend, bringing in $150 million in annual sales, Forbes estimates. As she reportedly explores a potential sale, skincare-focused brands are drawing interest from investors and buyers, reflected in recent deals like Elf’s purchase of Hailey Bieber’s skincare brand, Rhode, for $1 billion.

A new lawsuit accuses the Department of Education of withholding income-driven repayment plans and their benefits, a delay that could harm millions of student loan borrowers. Plus, some borrowers could face a huge tax bill as a result of a coming change in tax laws if the department does not cancel their loans before January 1.

DAILY COVER STORY

In March 2020, as the Covid-19 pandemic began to devastate the finances of consumers in the Philippines, the consequences were dire for Santa Monica-based Tala, the fintech company that makes small loans of up to $500 to low-income consumers in the Philippines, Mexico and Kenya.

Historically, 10% of Tala’s customers had regularly failed to pay back their loans. That rate tripled in the second quarter of 2020. While most American fintech companies were enjoying a spike in digital transactions, Tala all but shut down most of its business.

The firm laid off 20% of its customer service staff in the Philippines and Kenya and cut other costs dramatically. The emergency measures paid off—after a year, Tala was able to return to its pre-pandemic lending levels. It raised funding in 2021 at a valuation of $800 million from investors including fellow fintech lender Upstart, Kindred Ventures and Revolution Growth.

Since then, the company has been growing steadily. Revenue is up 35% from a year ago and is now running at an annualized rate of $340 million. Against that background, Tala has launched an ambitious plan to double its lending by the end of 2027 through expansion to new countries and new technology for assessing risk that it says allows it to safely approve more individual applicants.

A lot is hinging on this. After 11 years of lending, Tala is still losing money, though founder and CEO Shivani Siroya says the company “could be profitable at any time,” if it gave up on its growth ambitions. In classic Silicon Valley-style, it’s betting it can grow its way to profitability and do so in a business that is inherently risky.

WHY IT MATTERS “Siroya expects Tala will break even by the end of the first quarter in 2026,” says Forbes senior editor Jeff Kauflin. “Some major fintech lenders have followed the same strategy of putting off profitability for many years. After operating in just three countries for most of its history, Tala this week entered a fourth, Guatemala, and over the next three to six months, it plans to go live in five more. It plans to do that with a rebuilt tech infrastructure that lets it make more personalized risk assessments and expand faster into new countries.”

MORE The Fast-Growing Fintech Bringing Stripe-Like Payments To Latin America

Jimmy Kimmel’s first monologue since ABC reinstated his show is quickly garnering record viewership. The YouTube view count may have been boosted by the fact that some station owners refused to broadcast his return:

19 million: The YouTube views on Kimmel’s return monologue as of Thursday morning

Nearly a third: The number of ABC stations nationwide owned by Nexstar and Sinclair, which did not air the episode

A ‘direct violation of the First Amendment’: Kimmel said of the threat made by FCC Chairman Brendan Carr

Career gaps have long been stigmatized, but they’re increasingly becoming the norm. Provide context for the break with a dedicated section on your résumé, and highlight any skills you developed during that time. Be prepared to confidently and honestly discuss the gap during interviews.

The IRS will phase out paper tax refund checks for individual taxpayers by the end of the month. About how much does it cost to issue a paper check, according to the U.S. Department of the Treasury?

A. $0.10

B. $0.25

C. $0.50

D. $1.25

Thanks for reading! This edition of Forbes Daily was edited by Sarah Whitmire and Chris Dobstaff.