The Fed meeting is behind us. Rates have been cut. Now, investors are asking “What comes NEXT?” See what developments our top MoneyShow experts expect – and how YOU can target them for maximum profit.

In this episode of the MoneyShow MoneyMasters Podcast, Sean Brodrick of Weiss Ratings and John Eade of Argus Research unpack today’s market drivers, record equities, gold’s strongest year since 1979, and ongoing Federal Reserve interest rate cuts.

Sean explains why gold, mining stocks, and critical metals could be in a new supercycle, while John sees plenty of runway left for the bull market thanks to profit growth, lower rates, and tech leadership. They also debate whether AI is a bubble or a lasting market driver, how defense-tech and power grid expansion are creating opportunities, and where copper and lithium fit into the next leg of growth. Plus, they name their favorite stock picks in this environment.

Watch the podcast to find out where smart money is positioning ahead of 2026.

Don’t forget: Sean and John will be speaking at the 2025 MoneyShow/TradersEXPO Orlando, scheduled for Oct. 16-18 at the Omni Orlando Resort at ChampionsGate.Click here to register.

I just returned from the Beaver Creek Precious Metals Summit, one of the top mining conferences in the world, and I can tell you the mood was something like I haven’t seen since the early 2000s. The seeds of much larger gains are being planted, however, in three specific areas..

Suffice to say it was a hot bed of happiness. There were smiles all around, as the majority of junior mining companies have seen their share prices double or triple over the past couple of months.

(Editor’s Note: Brien will be speaking at the 2025 MoneyShow Masters Symposium Sarasota, scheduled for Dec. 1-3. Click HERE to register.)

Granted, some companies have lagged. Some of those deserve to be left behind…while others seem poised to catch up soon. The latter represent extraordinary opportunities.

First, gold and silver are headed much higher. I can’t tell you how many times I was asked, “How high is gold going, and how long will this last?” My answers were always the same: No one knows, so don’t believe anyone who tells you they do.

But if you use the three previous gold bull markets as a comparison, then this bull market will peak somewhere between $6,000-$8,000, with a small chance of going somewhere over $20,000 if there’s a full-on monetary reset with gold as the centerpiece.

The one thing we can be confident of is that a lot of money is being made at this very moment, and it seems very likely that much, much more will be made over the months and years ahead.

In the 2000s bull run, the initial move doubled and tripled the values of companies across the board. The entire market was bottomed out at the turn of the century, so there was a big catch-up necessary.

We’re seeing the catch-up period playing out now in the current market, as values are rising across the board. But much larger gains could be had in junior silver plays, companies with large gold and silver resources (and “optionality plays” with big resources that were previously uneconomic), and well-positioned exploration plays.

Chris Preston Cabot Value Investor

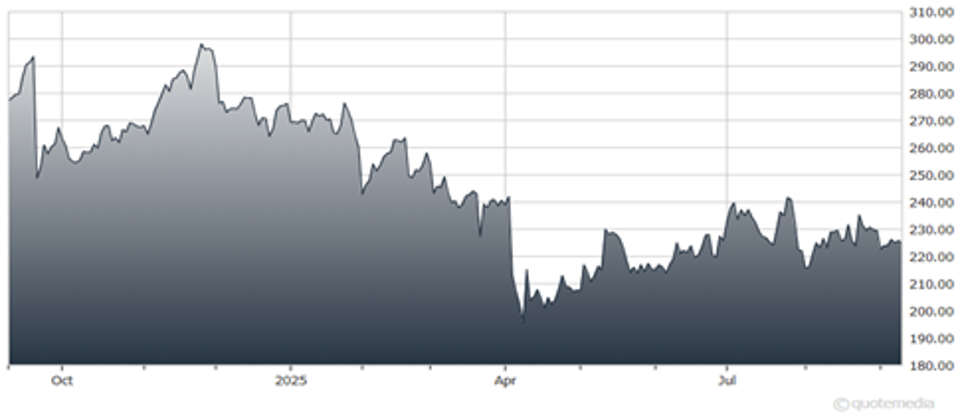

FedEx Corp. (FDX) needs no introduction. It’s the third-largest package courier in the world with a 17% global market share, behind only DHL (39%) and UPS (24%). Because it’s growing and pays a decent dividend (2.6% yield at recent prices), add FDX..

Like every package delivery company, FedEx’s sales and earnings peaked during Covid, when people around the world did virtually all of their shopping online and packages were zooming around the world like never before. While there hasn’t been a big drop off from the two Covid-enhanced years, sales have yet to eclipse their fiscal 2022 peak, while earnings haven’t come close to the fiscal 2021 top.

Still, this year (FedEx’s fiscal 2026 began in June) is on track to come closest to hitting those Covid highs, with analysts forecasting more than $89 billion in revenue and $18.53 in earnings per share. Next year, those numbers are expected to rise to more than $92 billion and $21.23 in EPS. These are projections, of course. But they’re reflective of a healthy and, in fact, incrementally improving global economy.

And yet, the stock still trades like it’s early April – at the height of post-Liberation Day market fears. Indeed, the stock is quite cheap on a price-to-earnings (12x forward estimates), price-to-sales (0.6x), and price-to-book-value (1.9x) basis. As long as the US and global economies don’t collapse between now and the end of the year, I think the stock could reach our target of $300 by Christmas.

Recommended Action: Buy FDX.