Key News

Asian equities were mixed/lower overnight as Hong Kong, Mainland China, and the Philippines stood out as relative bright spots while the US dollar weakened versus the Asia Dollar Index.

The renminbi (RMB) rallied to 7.10 against the US dollar ahead of the anticipated Federal Reserve rate cut announcement. Hong Kong and Mainland China equities rallied as market sentiment improved on the back of the call between Presidents Trump and Xi last Friday, a possible resolution regarding TikTok, upbeat developments in artificial intelligence technology, and a determined effort by the Chinese government to stimulate domestic consumption.

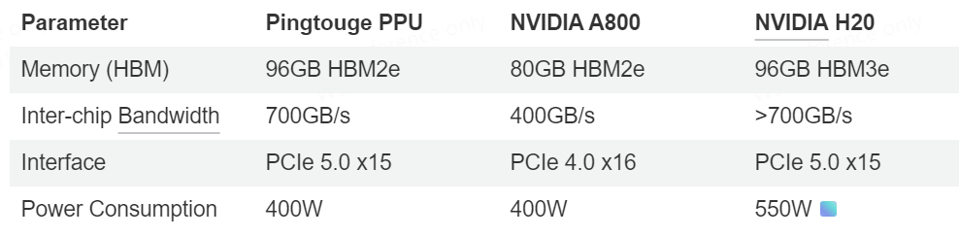

Hong Kong saw strong gains led by growth stocks with substantial volumes and heavy buying by Mainland investors through Southbound Stock Connect, totaling US $1.2 billion today and US $140 billion year-to-date. Alibaba gained 5.28%, trading volume soared 41% over the previous day and 50% above its one-year average, following prime-time coverage of its Pingtouge PPU chip on China’s evening news, which Wind data indicates is competitive with Nvidia’s H20 and A80 chips.

Skepticism remains over the Financial Times report claiming Chinese companies are banned from purchasing Nvidia chips, as the source cited “three people with knowledge of the matter,” and evidence does not seem to indicate a definitive policy shift similar to President Xi’s earlier handshake with Jack Ma, though Alibaba’s recent innovation was showcased to approximately 1.2 billion viewers.

Mainland investors continued their net buying streak in Alibaba, marking the nineteenth consecutive trading day with substantial inflows via Southbound Stock Connect. Baidu, Inc. jumped 15.72% amid several broker upgrades, as the company’s efforts in AI and semiconductor manufacturing were rewarded by the market; trading volume rose 236% over the previous day to 68 million shares, well ahead of its yearly average of 12.8 million, although Baidu is not eligible for Southbound Stock Connect, suggesting other drivers were at play.

Other growth leaders included Tencent Holdings Limited (+2.56%), Meituan (+4.89%), JD.com, Inc. (+5.15%), UBTech Robotics (+10.18%), Xiaomi Corporation (+2.48%), Contemporary Amperex Technology Co., Limited (CATL, +5.35%), and BYD Company Limited (+2.64%). NIO rallied 11.46% after raising US $1.16 billion through the issue of 160 million shares. Growth stocks also drove advances in Mainland indices, with Shenzhen and STAR Board outperforming the more value-oriented Shanghai, though overall breadth was narrower as losers outnumbered advancers.

Notable favorites such as CATL (+6.7%), Semiconductor Manufacturing International Corporation (SMIC, +6.93%), and BYD (+2.96%) all posted strong results. Huawei Technologies contributed to the tech focus with the release of “Top 10 Technology Trends for the Next 10 Years” as part of its “Smart World 2035” initiative, forecasting societal computing power increasing 100,000 times by 2035 and predicting that more than 90% of Chinese households will have intelligent robots within ten years, though energy constraints may temper expectations for the “holographic life space” concept and present advantages for China’s green energy strategy.

The Ministry of Commerce announced “Several Measures for Expanding Service Consumption,” designating fifty cities as pilots for policies aimed at boosting domestic demand, while the Ministry of Finance reported national tax revenue turned positive in August (+0.02% YoY) and the national general public budget expenditure rose by 3% year-to-date to RMB 17.932 trillion. Fiscal support also increased, as the National Government Fund Budget Expenditure jumped 30% year-on-year, driven by the issuance of ultra long-term special treasury and local government special bonds.

The Chongqing municipal government introduced additional measures to boost consumption, reflecting President Xi’s emphasis on developing a unified national market; while these are not market-moving, their implementation demonstrates the translation of broader Beijing directives to local action, which may risk policy misinterpretation. Finally, Hong Kong Chief Executive John Lee Ka-chiu delivered a policy speech focused on elevating Hong Kong’s standing as a financial center, with special emphasis placed on driving initial public offerings.

Alibaba HK Stock Price and Net Inflow From Mainland Investors via Southbound Stock Connect

New Content

Read our latest article:

Labubus: How Pop Mart’s Newest Craze Reflects Chinese Cultural Influence in the U.S.

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

CNY per USD 7.10 versus 7.11 yesterday

CNY per EUR 8.40 versus 8.40 yesterday

Yield on 10-Year Government Bond 1.83% versus 1.85% yesterday

Yield on 10-Year China Development Bank Bond 1.91% versus 1.92% yesterday

Copper Price -0.46%

Steel Price -0.35%