Five Below (FIVE) comes on my radar after beating second-quarter earnings and revenue estimates, issuing upbeat Q3 guidance, and raising FY25 EPS, revenue, and comps expectations above consensus. Q2 also marked a milestone, with sales surpassing $1 billion for the first time outside the holiday-driven Q4, highlighting the retailer’s growing year-round relevance.

Five Below continues to stand out as a beat-and-raise retail story, not just surpassing expectations but consistently lifting its full-year guidance across earnings, revenue, and comparable sales, signaling strong operational momentum.

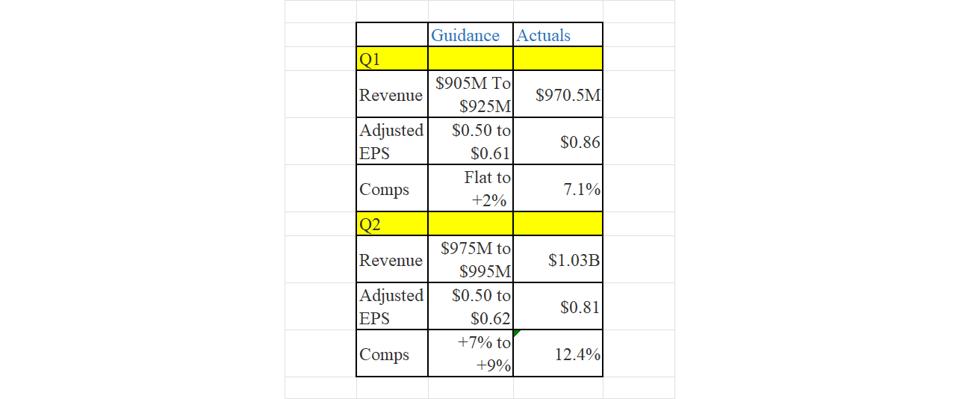

What’s particularly notable is the quality of these beats and raises, as these beats aren’t one-offs, but reflect steady operational progress across recent quarters. Beyond topping Wall Street’s estimates, Five Below also materially outperformed its own quarterly guidance in both Q1 and Q2.

Guidance Beats

Guidance for the first quarter: Net sales expected to be $905 million to $925 million based on opening approximately 50 new stores and assuming an approximate flat to 2% increase in comparable sales. Adjusted EPS expected to be $0.50 to $0.61.

Actual numbers reported for the first quarter: Net sales increased by 19.5% to $970.5 million from $811.9 million in the first quarter of fiscal 2024; comparable sales increased by 7.1%. Adjusted EPS was $0.86 compared to $0.60 in the first quarter of fiscal 2024, and beat the top end of guidance by 40%.

Guidance for the second quarter: Net sales expected to be $975 million to $995 million based on opening approximately 30 net new stores and 7% to 9% increase in comparable sales. Adjusted EPS expected to be in the range of $0.50 to $0.62.

Actual numbers reported for the second quarter: Net sales increased by 23.7% to $1.03 billion from $830.1 million in the second quarter of fiscal 2024. Comparable sales increased by 12.4%. Adjusted EPS was $0.81 compared to $0.54 in the second quarter of fiscal 2024.

Consistent Upward Revisions to FY25 Guidance:

Over the last three quarters, Five Below has raised its full-year FY25 guidance, underscoring growing business confidence:

Initial guidance for fiscal 2025 was provided while reporting results for the fourth quarter of fiscal 2024. At the time, Five Below guided for FY25 sales of $4.21 billion to $4.33 billion, adjusted eps of $4.10 to $4.72, on a comps rise of flat to +3%.

While reporting results for the first quarter of fiscal 2025, the retailer raised FY25 guidance to $4.33 billion to $4.42 billion in sales, on a 3-5% rise in Comps, and adjusted EPS of $4.25 to $4.72.

While reporting results for the second quarter, FY25 guidance was raised to $4.44 billion to $4.52 billion in sales on a 5-7% rise in comps, and adjusted EPS of $4.76 to $5.16.

Growth Drivers And Catalysts

Assortment and pricing discipline: By introducing incremental price points between $1 and $5 and avoiding big jumps to $15 or $20, Five Below is enhancing value perception and driving more effective upsells.

Traffic from newness and value: Constant product curation for newness and value continues to pull in value-conscious consumers.

Looking Ahead: Catalysts

Regulatory Tailwinds: The expected end of the de minimis exemption (which allows goods under $800 to enter the U.S. duty-free) could drive more budget-conscious consumers to domestic discounters like Five Below.

Seasonal Upside: With Halloween and the holiday shopping season approaching, Five Below is strategically positioned to benefit from increased discretionary spending in value channels.

Valuation Remains Attractive

FIVE trades at valuations well below its historical 5-year average. On a forward adjusted Price/Earnings (P/E) basis, FIVE trades at 17% discount to its historical number and at a 34% discount on a forward price to sales (P/S) basis. Even a partial reversion to historical valuation multiples implies meaningful upside.

Bottom line

Five Below is delivering on every front: outperformance vs. guidance, consistent upward outlook revisions, disciplined merchandising, alongside policy tailwinds. With a valuation still discounted relative to its history, FIVE offers investors a compelling beat-and-raise retail story heading into the holiday season.

Please note that I am not a registered investment advisor and readers should do their own due diligence before investing in this or any other stock. I am not responsible for the investment decisions made by individuals after reading this article. Readers are asked not to rely on the opinions and analysis expressed in the article and encouraged to do their own research before investing.