Week in Review

- Asian equities were mixed this week, as Mainland China’s STAR Board and Shenzhen markets outperformed, while Taiwan and Korea underperformed.

- The total value of Mainland China’s stock market (i.e., Shanghai and Shenzhen) exceeded RMB 100 trillion for the first time ever on Monday.

- This week saw Q2 earnings reports from Baidu, Bilibili, Kuaishou, Xiaomi, and Xpeng, most of which exceeded company and analyst estimates, but high expectations led to mixed market reactions.

- The strong rally in semiconductor stocks was driven by China’s expressed concerns over Nvidia’s H20 chips being a security risk, giving local competitors a perceived edge, and the release of DeepSeek’s 3.1 large language model, the AI leader’s latest and greatest.

- In our latest video, Xiabing Su from KraneShares takes us inside the 2025 World Robot Conference in Beijing. Click here to watch.

Key News

Asian equities ended mixed in what was an interesting week that saw declines in Japan, Taiwan, South Korea, Australia, Thailand, and Indonesia.

Both Hong Kong and Mainland China had a very good day, with the latter having a very strong week as the Shanghai Composite closed above the 3,800 level.

Semiconductor stocks flew today, led by the Mainland-listed Cambricon Technology, which gained +20% bringing its market cap to RMB 500 billion, which is larger than Semiconductor Manufacturing (SMIC), Hygon, which gained +20%, Semiconductor Manufacturing International (SMIC), which gained +14% in Mainland China and +10% in Hong Kong, Gigadevice, which gained +10%, and the Hong Kong-listed Hua Hong Semiconductor, which gained +17.85% and Solomon Systech, which gained +10.64%. The chip and technology-heavy STAR Board gained +8.5%, along with very strong moves in tech hardware subsectors, including communications equipment and electronic equipment, as the Hong Kong-listed ZTE gained +15.13%.

Western media is stating the rise is due Nvidia halting production of the China-specific H20 semiconductor, as China’s government doesn’t want local companies buying the H20 due to back door security risk concerns and Commerce Secretary Lutnick’s “insulting” comments last month when he stated “We don’t sell them our best stuff, not our second-best stuff,…”.

In China, yesterday’s report about DeepSeek’s V3.1 release and the model’s “significantly improved” capabilities, which we wrote about yesterday, was the catalyst for today’s rally. Also fueling today’s rally was a 21st Century Business Herald report that RMB 500B of “new policy financial instruments,” i.e., stimulus, will be released, focusing on emerging industries such as the digital economy and AI. Then, the H20 production cut is mentioned.

When asked about the rumored production cut in their daily press conference, Ministry of Foreign Affairs spokesman Mao Ning stated, “As a principle, we have always believed that all countries should jointly maintain the stability and smoothness of the global supply chain.”

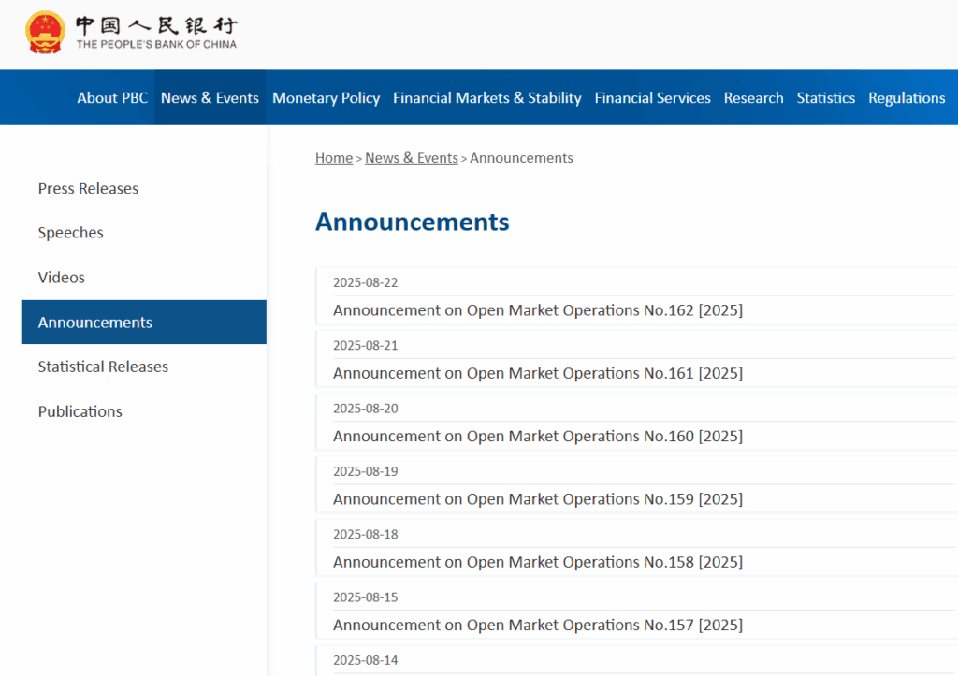

Another contributor was that the People’s Bank of China (PBOC), China’s central bank, continues to inject liquidity into the system, announcing RMB 600 billion worth of medium-term lending facility (MLF) operations for the sixth month in a row, as monetary policy continues to support the economy. The PBOC also conducted RMB 361.2 billion worth of reverse repurchase operation following yesterday’s RMB 253 billion. That is a big tailwind for Mainland equities! I screen-grabbed the number of recent reverse repo announcements as a mainland media eloquently stated, “The continuous injection of medium-term liquidity reflects the coordination and cooperation between monetary policy and fiscal policy, which helps to promote the process of easing credit and better meet the financing needs of enterprises and residents.”

If the US Fed cuts, we might get a China interest rate cut. Hong Kong-listed growth stocks had a strong day, led by Tencent, which gained +1.18%, Alibaba, which gained +1.99%, Meituan, which gained +1.11%, Trip.com, which gained +1.86%, CATL, which gained +2.96%, Xiaomi, which gained +2.34%, and Kuaishou, which gained +4.39% after yesterday’s strong results. Individual names that made big moves today included XPeng, which gained +13.6% following CEO He Xiaopeng’s purchase of 3.1 million shares in the open market, which increases his stake to 18.9%. Bravo! It is great to see such conviction. Retailer Miniso gained +20.58% following strong Q2 results and subsequent sell-side analyst upgrades. Robosense Technologies surged +13.1% on an analyst upgrade. Bilibili fell -6.15% following yesterday’s results and “concerns” about new games being delayed, though one analyst did increase her price target. After the close, it was announced that Pop Mart, JD Logistics, and China Telecom will be added to the Hang Seng Index on Friday, September 5th.

Premier Li and the State Council had a meeting “on the implementation of large-scale equipment replacement and consumer goods exchange policy, studied the opinions on releasing sports consumption potential and further promoting high-quality development of the sports industry….”.

Mainland investors were net buyers of Hong Kong-listed stocks and ETFs via Southbound Stock Connect, though Connect volume was only at 56%, indicating they were accompanied by foreign investors, with participation picking up. Volumes have been very strong, particularly in China, as there was increased chatter about Mainland investors moving back into stocks from low-yielding bonds and bank deposits.

It is almost the end of the summer in the Northern hemisphere. No, that doesn’t just mean the kids are going back to school. It also means it is time for MSCI’s Semi-Annual Index Review, which will require passive managers globally to rebalance their ETF and index fund portfolios after it is released next Friday. With the Mainland China and Hong Kong rally, we should see a nice increase in China’s weight, i.e. a net buy, though I do not have the dollar amount at my fingertips. It also wraps up Q2 earnings, as PDD, Trip.com, Meituan, and Alibaba will all report earnings.

I wrote about the DeepSeek move yesterday, but I clearly did not anticipate today’s market reaction. Candidly, I would have bought call options on a STAR Market ETF in hindsight. (I did this following the September 2024 stimulus announcement when I noticed the market hadn’t priced in the news. I made so much in two days that I started speaking in a Hungarian accent, i.e., I felt like George Soros. Unfortunately, I am beholden to a 30-day hold. You can guess what transpired over the next 28 days.) Anyway, I will do my best to point out opportunities in the future.

New Content

Read our latest article:

Labubus: How Pop Mart’s Newest Craze Reflects Chinese Cultural Influence in the U.S.

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.18 versus 7.18 yesterday

- CNY per EUR 8.33 versus 8.34 yesterday

- Yield on 10-Year Government Bond 1.78% versus 1.77% yesterday

- Yield on 10-Year China Development Bank Bond 1.89% versus 1.87% yesterday

- Copper Price 0.14%

- Steel Price -0.45%