On August 14, 2025, Starz Entertainment Corp. (NASDAQ: STRZ, $13.50 Market Cap: $0.2 billion), a one of the leading media and content company, reported modest results with a miss on revenues and Adjusted EPS compared to consensus estimates (for more information, visit spinoffresearch.com). The company reported revenue of $319.7 million in 2Q25, down 8.0% YoY from $347.6 million in 2Q24, due to lower OTT subscriber additions and continued pressure on linear revenue. Operating loss was $26.9 million in 2Q25, compared to a $10.1 million operating income in the prior-year period. The company reported an adjusted OIBDA of $33.4 million in 2Q25, down from $56.3 million in 2Q24, mainly due to higher content amortization costs from new series premieres. As a result, the adjusted OIBDA margin decreased to 10.4% from 16.2% in 2Q24. Net loss for the quarter was $42.5 million, versus a net income of $4.2 million in 2Q24. Diluted loss per share was $2.54 in 2Q25, compared to the diluted earnings per share of $0.26 in 2Q24. STARZ ended the quarter with 12.2 million U.S. Over-The-Top (OTT) subscribers, a sequential decline of 120,000. Total U.S. subscribers reached 17.6 million, down 410,000 from the previous quarter. These declines were mainly due to continued pressure on linear subscribers and fewer OTT subscriber additions (primarily due to the underperformance of BMF Season 4, which did not meet expectations). However, Starz Entertainment reported strong performance from the Outlander prequel, Blood of My Blood (premiered on August 8, 2025), which surpassed expectations and became the third-highest series premiere in Starz history for subscriber additions. Additionally, the company expects sequential revenue and OTT subscriber growth in upcoming quarters, supported by a robust content lineup including hit series like Force, Raising Kanan, and the return of Spartacus.

On May 8, 2025, the Company’s Board of Directors approved a change in Starz’s fiscal year-end from March 31 to December 31. The date of Starz’s next fiscal year-end will be December 31, 2025. As a result of the change, the company will file a Transition Report on Form 10-K for the nine-month transition period from April 1, 2025, to December 31, 2025.

Valuation and Recommendation

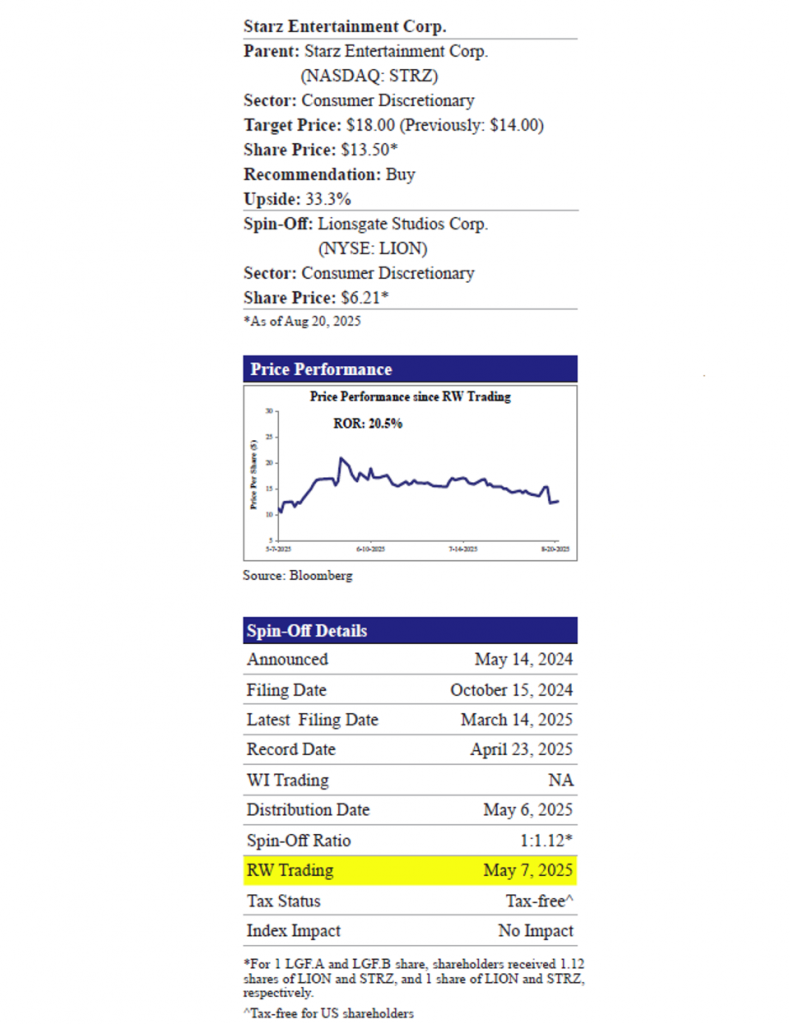

We value Starz Entertainment Corp. (STRZ) using the EV/EBITDA methodology. Our intrinsic value of $18.00 per share (Previously: $14.00) is based on the 2026e EV/EBITDA multiple of 4.4x (~8% discount to the closest peer AMCX multiple). We maintain our ‘Buy’ rating on the stock with an implied upside of 33.3% from the current market price of $13.50 as of 8/20.

It is worth noting that Starz is one of the few premium content brands capable of serving as a complementary add-on service to existing providers. Therefore, Starz could become a potential takeover target for any of its major competitors, which would help them expand their content offerings. Risks to our STRZ target price include slower growth or a decline in the subscriber base and increased competition from well established, larger players.

2025 Outlook

Starz Entertainment’s 2025 outlook indicates a strategic shift toward digital first growth and cost efficiency amid industry challenges. Management remains optimistic about sequential growth in Q3 and Q4. Its content lineup, led by hits like Outlander: Blood of My Blood, Force, Raising Kanan, and the return of Spartacus, is fueling strong engagement, with the Outlander prequel achieving the third-highest subscriber gains in Starz history. Starz still expects to reach $200 million in adjusted OIBDA by year-end and convert 70% of that into free cash flow by 2026. Key challenges include managing content costs, subscriber churn, and competitive pressures. Still, efforts such as producing lower-cost original content (e.g., Fightland, which costs 30% less per episode) and maintaining ARPU through bundled offers are helping reduce risks. Without planned price increases and with potential M&A opportunities on the horizon, Starz is positioning itself as a lean, content-focused platform aimed at profitability and audience retention.

Earnings Call Highlights

• Although the company experienced a sequential decline in OTT subscribers, primarily due to the underperformance of BMF Season 4, Starz Entertainment reported strong performance from the Outlander prequel, Blood of My Blood (premiered on August 8, 2025), which surpassed expectations and became the third-highest series premiere in Starz history for subscriber additions. Additionally, the company expects sequential revenue and OTT subscriber growth in upcoming quarters, supported by a robust content lineup including hit series like Force, Raising Kanan, and the return of Spartacus. Further, the management noted that ARPU has remained consistent, with a slight decline due to more customers on multi-month offers, which helps reduce churn. CEO Hirsch stated that Starz has done two rate increases in the past two years but does not plan further increases soon, focusing instead on subscriber growth through new distribution platforms.

• Furthermore, the company is prioritizing a digital-first network strategy, targeting key demographics like women and underrepresented audiences, leading to a successful transition. Additionally, Starz is adopting a strategy to lower content costs, with a goal of reaching a 20% margin run rate by FY28, which is expected to boost profitability.

• Starz Entertainment finished the quarter with a net debt of $573.5 million. Over the past twelve months, the company’s total Adjusted OIBDA leverage ratio was 3.2x. For the third quarter, Starz expects leverage to rise to about 3.5x due to timing issues related to content payments.

In 2Q25, revenue was $319.7 million, down 8.0% YoY from $347.6 million in 2Q24, which was affected by lower OTT subscriber additions and ongoing pressure on linear revenue. Operating loss was $26.9 million in 2Q25, versus an operating income of $10.1 million in the previous period. The company reported an adjusted OIBDA of $33.4 million in 2Q25, compared to $56.3 million in 2Q24, mainly due to higher content amortization costs related to new series premieres. As a result, the adjusted OIBDA margin declined to 10.4% from 16.2% in 2Q24. Net loss for the period was $42.5 million, compared to a net income of $4.2 million in 2Q24. Diluted loss per share was $2.54 in 2Q25, compared to the diluted earnings per share of $0.26 in 2Q24.

Starz finished the quarter with 12.2 million U.S. Over-The-Top (OTT) subscribers, a decrease of 120,000 from the previous quarter. Total U.S. subscribers were 17.6 million, down 410,000 compared to the prior quarter. These declines were mainly driven by continued pressure on linear subscribers and fewer OTT subscriber additions, mainly because BMF Season 4 did not meet expectations for audience size. Including Canada, total North American subscribers reached 19.1 million, reflecting a decline of 520,000 sequentially. Canadian subscribers fell by 110,000 in the quarter due to ongoing declines in linear subscribers and lower OTT additions.

Valuation

EV/EBITDA Valuation: We value Starz Entertainment Corp. (STRZ) using the EV/EBITDA methodology. Our intrinsic value of $18.00 per share (Previously: $14.00) is based on the 2026e EV/ EBITDA multiple of 4.4x (~8% discount to the closest peer AMCX multiple). We maintain our ‘Buy’ rating on the stock with an implied upside of 33.3% from the current market price of $13.50 as of 8/20.

Our fair value is highly sensitive to fluctuations in adjusted EBITDA and EV/EBITDA multiples. Our base case intrinsic value is $18.00 per share. If the Adjusted EBITDA varies by +/- $10 million and the EV/EBITDA multiple shifts by +/- 0.5x, the intrinsic value changes by approximately 50%. The table below outlines the changes in adjusted EBITDA and EV/EBITDA multiples, and their impact on the target prices for Starz Entertainment.

Company Description

Starz Entertainment Corp.

Starz includes the Media Networks business, which consists of the following product lines: (i) Starz Networks, which includes the domestic distribution of Starz branded premium subscription video services through over the-top (OTT) platforms and U.S. multichannel video programming distributors (“MVPDs”), including cable operators, satellite television providers and telecommunication companies (collectively, “Distributors”) and on a direct-to-consumer basis through the Starz App and (ii) LIONSGATE+, which represents revenues primarily from the OTT distribution of the Starz premium subscription video services outside of the U.S. (formerly STARZPLAY International). The company strategically decided to exit seven LIONSGATE+ (formerly STARZPLAY International) international territories, France, Germany, Italy, Spain, Benelux, the Nordics, and Japan, to streamline the business. For FY24, the company recorded revenues before intersegment eliminations of $1.6 billion.