In consumer money transfers, there is no route that sees a greater amount of money sent through it each year than the US-Mexico corridor. Every month, billions of dollars are sent by migrants in the US to their friends and family in Mexico, with billions of dollars more being sent by others to their own loved ones across the rest of Latin America.

The size and strength of this market has served as a critical foundational element for the US-based consumer money transfers industry for decades, with providers seeing tens, and in some cases hundreds, of millions of dollars in revenue from the region every quarter.

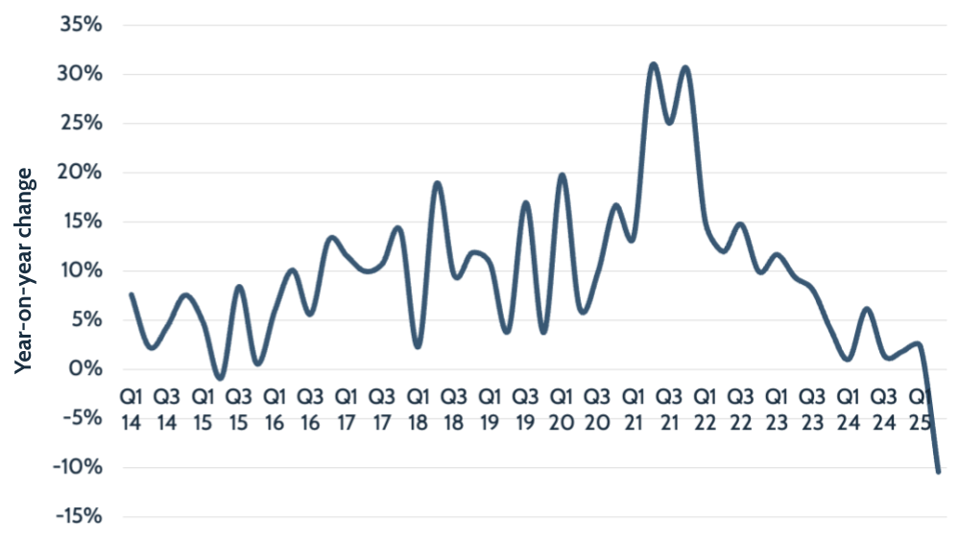

However, the most recent quarter – which covers April to June 2025 – has seen a change. While flows of money are still vast, the amounts being moved are down on previous years. Recently released data from Banco de México (Banxico), Mexico’s central bank, shows that the number of remittances sent by workers from the US into Mexico dropped by 10% in Q2 2025 versus the same period in the previous year.

This drop is unprecedented. Over the twelve-year period Banxico publishes records for, only one other quarter, Q1 2015, has seen any form of year-on-year decline in the volume of remittances sent from the US and Mexico. Back then, however, the drop was less than a single percent.

The decline has not come entirely out of nowhere. For the previous eighteen-month period, growth in remittance volumes from the US to the country had been slowing. However, a double-digit decline is highly significant, with around $1.7bn less sent in the most recent quarter versus the same period in the previous year.

Availability of data for other Latin American countries varies, although industry reports suggest that others are seeing similar, albeit potentially less pronounced, slowdowns.

Year-on-year change in workers’ remittances from the US to Mexico, Q1 2014 to Q2 2025

Why is the US sending fewer money transfers to Latin America?

There are a variety of factors that are likely to be playing a role, however the single biggest cause of this drop is generally attributed to increased activity from the US’s Immigration and Customs Enforcement agency, as well as changes in immigration-related policy, which appear to have directly reduced the number of migrants who are present in the US both legally and illegally.

While data on the number of migrants living in the US is not collected frequently enough to be available for 2025 as yet, US Department of State data shows that the number of immigrant visas issued to people from Mexico declined by 27% between May 2024 and May 2025.

The US Customers and Border Protection agency similarly reports a marked reduction in the number of people it either turns away from legal ports of entry from Latin America or identifies attempting to cross other parts of the US’ southwest land border. Having typically seen monthly totals around or above 100,000 across 2024, this metric has dropped to monthly rates of around 12,000 since February and in July declined to slightly below 8,000.

This reduction in migrants is shrinking the pool of potential senders of remittances, and is likely to be the direct cause of the drop in flows to Mexico. However, the upcoming remittance tax, which imposes a 1% tax on all money transfers sent in cash, may have a further impact.

The impact on the remittance industry

For providers of consumer money transfers and remittances to the US to Mexico corridor and the wider US to Latin American market, a decline in the number of potential customers has inevitably had an impact. Western Union, for example, saw its revenue from North America drop by around 10% in the latest quarter, which the company attributed to immigration policy in its earnings call with investors.

Euronet, which owns consumer remittance brand Ria, did not share revenue impact in the region, focusing instead on the success of the division globally, but CEO Michael Brown did point to “evolving immigration dynamics” in the US as a headwind in the sector.

However, Intermex, a retail-focused remittances player with the vast majority of its business in the US to Latin America region, saw a very pronounced hit, with a 17% reduction in active customers and a 6% decrease in revenue versus the previous year. The company did see an increase in amounts sent by its customers, suggesting that those still in the US to send remittances are increasing what they send home in response to the reduced number of senders, but the hit to the company has been severe.

Having seen its share price slump over the last few months, in August Intermex accepted a purchase offer from Western Union at $16 a share – a premium on its current value, but below what it was trading at earlier this year.

With many small players also operating in the sector, there are likely to be others that struggle to weather the current market headwinds, but Western Union remains convinced that the current state of affairs is just temporary. During the acquisition announcement, Western Union CEO Devin McGranahan described it as a “time horizon arbitrage opportunity” and is betting that, despite the migration drop, the market will return before long.