Baidu Q2 Earnings Overview

Baidu reported Q2 financial results after the Hong Kong close today. While the percentage declines year-over-year (YoY) may be shocking to the uninformed, they were expected. Baidu’s results were basically in line with analyst expectations as revenue and adjusted earnings per share (EPS) were slight misses, while adjusted net income beat expectations slightly. AI Cloud was a bright spot, though weakness in the Core search is ongoing. While Baidu has never paid a dividend, they did spin off their stake in video platform iQiyi to shareholders. I was surprised there was no mention of dividends or buybacks in the press release, given how much cash the company has on hand.

Year-over-year (YoY) Results

- Revenue declined by -4% to RMB 32.71B ($4.57B) from RMB 33.90B and versus analyst estimates of RMB 32.74B.

- Revenue from Baidu Core was RMB 26.30B ($3.66B), decreasing by -2%

- Online Marketing Revenue was RMB 16.20B ($2.27 billion), decreasing by -15%

- Offline Marketing Revenue was RMB 10.00B ($1.40B), up +34%, primarily driven by the boost of its AI Cloud business.

- Adjusted Net Income declined by -35% to RMB 4.80B ($669MM) from RMB 7.40B and versus analyst estimates of RMB 4.54B.

- Adjusted EPS declined by -35% to RMB 13.58 ($1.90) from RMB 21.02 and versus analyst estimates of RMB 13.59.

Key News

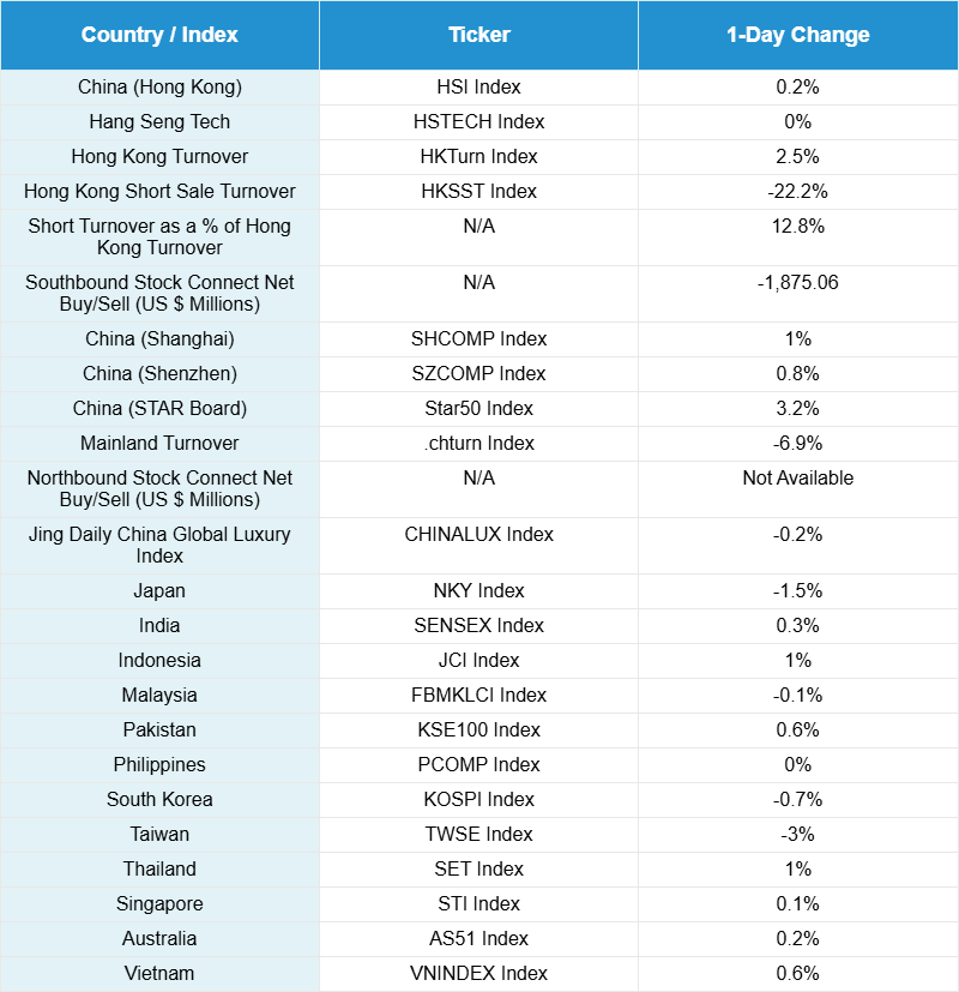

Asian equities were mixed as Mainland China, Thailand, and Indonesia outperformed, while Japan, Taiwan, and South Korea lagged.

Mainland China and Hong Kong traded lower for most of the session until a surge of buying in Mainland growth stocks lifted the Mainland market, as Hong Kong benefited to a lesser degree.

At 2 p.m., coinciding with the Mainland’s sharp rally in growth stocks, DeepSeek announced the launch of Version 3.1 on WeChat. The company stated the new version’s “multi-step reasoning performance has increased by 43% compared with the previous version, providing more accurate solutions for fields such as mathematical computing, code generation, and scientific analysis.” Around the same time, a Mainland media report published the updated holdings of the National Social Security Fund, revealing twenty-five new positions across various sub-sectors.

Stepping back, there is increased chatter about rising margin activity on the Mainland, higher Southbound Connect buying of Hong Kong stocks, and how investors may reallocate from bonds to equities, given the dividend yield on stocks now exceeds both the 1-year deposit rate and the 10-year Treasury yield.

US Treasury Secretary Bessent’s comments describing the US-China relationship as “status quo” were generally viewed as positive, as was the White House launching a TikTok account.

China’s 1-year and 5-year Loan Prime Rates were left unchanged, as expected, at 3.0% and 3.5%, respectively.

In Hong Kong, several companies reported strong financial results, lifting shares in individual names. Pop Mart (+12.54%) announced a mini-Labubu for cell phones. Meanwhile, other outperformers today included Apple supplier Sunny Optical (+9.74%), Laopu Gold (+8.84%), Fuyao Glass (+15.19%), and Hong Kong Exchanges (+1.71%), after strong first-half results. However, Hong Kong-listed healthcare stocks fell despite Wuxi Biologics (+2.82%) and WuXi AppTec (+0.30%) both posting strong earnings. The sector likely remains weighed down by the threat of potential pharmaceutical tariffs, a policy that, if implemented, could have significant repercussions for Medicare and Medicaid suppliers. That is a topic above my pay grade!

Yesterday’s huge inflow into Hong Kong-listed ETFs reversed today, leading to significant outflows and a rare Southbound Stock Connect net sell of -$1.88 billion.

Although Hong Kong snapped its four-day losing streak and the Hang Seng closed above the 25,000 level, the Mainland market saw a broader and much stronger advance, as all sectors finished higher. Growth and small-cap stocks outperformed, and the STAR Board had a particularly strong day.

China Evergrande Group (3333 HK), a poster child for China’s real estate crisis, will delist from the Hong Kong Exchanges on August 25th. We have long warned investors about the delisting risk of distressed real estate developers’ equities, and the potential for dilution through new share issuance. Bonds, however, are a different story, as bondholders have a claim on assets. I’ll continue to note and personally enjoy the attractive yields available in the space.

New Content

Read our latest article:

Labubus: How Pop Mart’s Newest Craze Reflects Chinese Cultural Influence in the U.S.

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.17 versus 7.17 yesterday

- CNY per EUR 8.36 versus 8.39 yesterday

- Yield on 10-Year Government Bond 1.78% versus 1.77% yesterday

- Yield on 10-Year China Development Bank Bond 1.90% versus 1.89% yesterday

- Copper Price -0.38%

- Steel Price -0.70%