Like a modern-day Rip Van Winkle, if you had gone to sleep on Jan. 1 and awoke on June 30, you might think the first half of 2025 was smooth sailing for investors. The S&P 500 delivered a respectable 6.2 percent gain, better on an annualized basis than the long-term average of 10.3 percent. Bonds also contributed, with the Bloomberg U.S. Aggregate Bond Index rising 4.1 percent. On the surface, it all looked steady.

Those of us who stayed awake know the journey was anything but calm. In April, President Trump declared “Liberation Day” for trade policy, unveiling sweeping tariffs on imports from nearly every major U.S. trading partner. Markets recoiled, and in just one week the S&P 500 plunged more than 12 percent while both Value and Growth stocks suffered double-digit percentage losses. For many investors it was a gut-check moment, one of those stretches that tests conviction and tempts people to head for the sidelines.

Almost as quickly as the pain came it faded. The administration rolled back or delayed key elements of the tariff package, sentiment stabilized, and stocks rallied. By the end of June, the market had climbed 25 percent from the April lows, erasing the damage and putting indexes back near record highs.

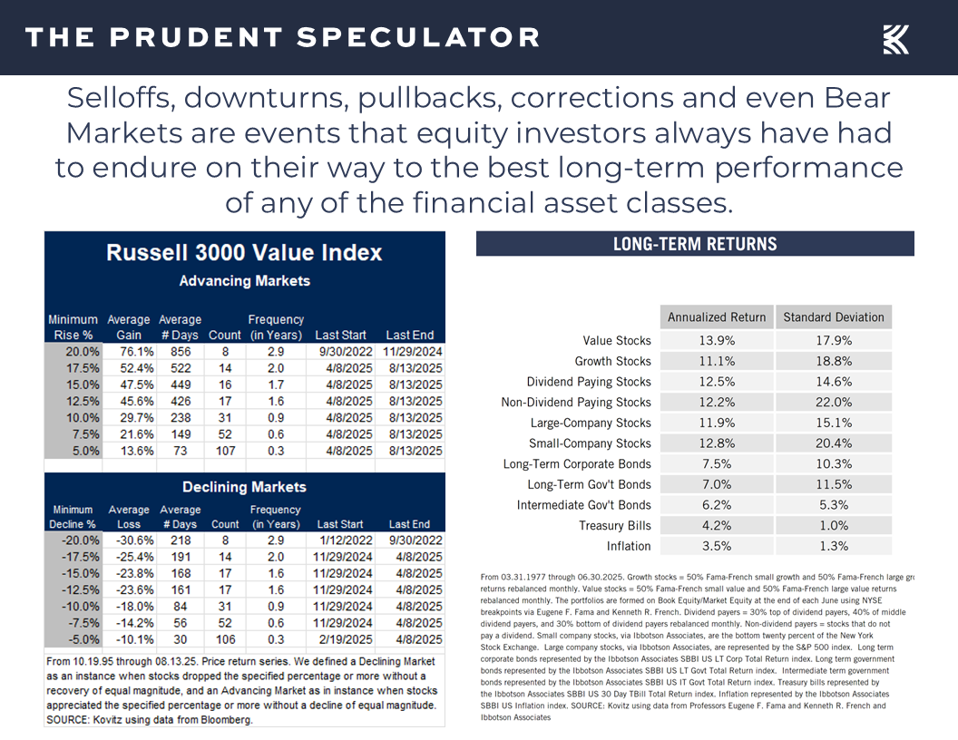

This pattern should feel familiar to long-term investors. Market history is full of episodes when volatility rattled nerves but rewarded those who held on. Over the past half-century since our newsletter was launched in March 1977, we have endured wars, recessions, pandemics, bubbles and busts. Through it all, equities have delivered annualized returns north of 11%. The lesson is that volatility is not a flaw in the system. It is the price of admission for building wealth through stocks.

That does not mean volatility feels comfortable in the moment. Investor sentiment surveys tell the story. The American Association of Individual Investors (AAII) Bull-Bear spread flipped sharply negative in April, with bearish sentiment topping 60 percent, rivaling levels seen during the Great Financial Crisis and the early days of Covid. Options data showed a surge in hedging, and the CNN Fear & Greed Index dipped into “extreme fear” territory. Yet for disciplined investors those are precisely the moments when opportunities emerge…and the good folks at AAII are still decidedly Bearish today…a positive for this contrarian indicator!

At The Prudent Speculator, we like to remind readers that uncertainty is the friend of the long-term buyer of stocks. Some of our best returns have come during periods when headlines screamed danger but valuations quietly improved. When fear lingers yet fundamentals remain sound, bargains abound.

With hindsight, that was evident in the first half of 2025. Beneath the headline indexes, we found dispersion in valuations. While flashy growth names commanded premium multiples, many high-quality dividend payers traded at discounts even as earnings and cash flows improved. For us, that was fertile ground for adding to positions.

The secret to investing success, if there is one, is to avoid being scared out of stocks. It requires patience and a willingness to go against the crowd when sentiment is darkest. Market timing might seem alluring, but history shows it is nearly impossible to execute consistently. Time in the market, not timing the market, is what builds wealth.

As I reflect on the chaotic first half of 2025, I see not turbulence to be avoided but opportunity to be embraced. As is usually the case, monitoring only the surface can be misleading. The undercurrent of volatility in the first six months reminded us that fear and uncertainty are part of the ride, and that is why stocks reward those with the fortitude to stay invested. I see no reason to alter this viewpoint today.

Latest Buckingham Portfolio Purchase: Comcast (CMCSA)

Comcast (CMCSA) is a global media and technology company, delivering broadband, wireless and video through Xfinity, Comcast Business and Sky; producing, distributing and streaming entertainment, sports and news through NBC, Telemundo, Universal, Peacock and Sky; and running theme parks and attractions through Universal Destinations & Experiences. CMCSA earned $1.25 per share (vs. $1.16 est.) and revenue was $30.3 billion (vs. $29.8 billion est.) in Q2. Content and Experiences revenue grew 6%, led by Theme Parks (Epic Universe opened at Universal Orlando Resort). Peacock grew 20% and now represents more than one third of NBCUniversal’s total volume. In

2026, the network will broadcast the Milan Cortina Olympics, Super Bowl LX, NBA All-Star Game, FIFA World Cup (Telemundo) and BravoCon. Comcast expects moderated

broadband ARPU as it switches to new pricing structures and improved results from Epic Universe as soft opening costs phase out. The NBCUniversal cable network spinoff

is expected later this year under the name Versant. The P/E ratio of 7.5 is cheap and analysts expect the “E” to grow from $4.33 per share last year to $4.91 in 2027.

Strong free-cash-flow supports the 4.0% dividend yield.

*****

For those who like what I have to say in this forum, further market analytics and stock picks can be found in my newsletter, The Prudent Speculator.