Xiaomi Q2 Earnings Overview

Xiaomi fell by -1.23% in Hong Kong trading but reported earnings after the market’s close.

- Revenue increased by +30.5% year-over-year (YoY) to RMB 115.96B from RMB 88.89 and versus expectations of RMB 114.90.

- Adjusted Net Income increased by +75.4% YoY to RMB 10.83B from RMB 6.18B and versus expectations of RMB 10.20B.

- Adjusted EPS increased.

- In the second quarter of 2025, electric vehicle (EV) total deliveries were 81,302 vehicles, which accounted for RMB 20.6 billion in revenue. This figure puts Xiaomi’s EV segment up to ~18% of revenue, which is up from ~7% of revenue YoY.

- Smart phones/AIoT accounted for 81.70% of revenue, which is down from 92.80% YoY.

Xpeng Q2 Earnings Overview

Xpeng fell by -1.85% in Hong Kong trading.

- Revenue increased by 125.30% YoY to RMB 18.27B ($2.55B).

- Vehicle sale revenue increased by +147.60% to RMB 16.88B ($2.36B).

- Vehicle gross margin was 14.30% despite Chairman and CEO Xiaopeng He stating the company faced “intense industry-wide price competition”.

- Adjusted net loss decreased to RMB 390 million from a loss of RMB -1.22 billion and versus loss estimates of RMB -851 million.

- Adjusted EPS decreased to RMB -0.20 versus loss estimates of RMB -0.62.

- Q3 revenue was RMB 19.60B to RMB21B versus estimates of RMB 21.06B.

- Q3 vehicle estimates were 113,000 to 118,000 versus Q2’s 103,181 and Q2 2024’s 30,207.

Key News

A bigger piece of news after the close was that the Ministry of Industry and Information Technology (MIIT) held a symposium on competition in the solar industry, highlighting efforts to standardize competition and promote the orderly exit of outdated production capacity. The MIIT will strengthen price monitoring and enforcement against practices such as sales below cost and false advertising. It will be interesting to watch how US-listed China solar stocks respond, as this could affect Hong Kong and Mainland markets tomorrow.

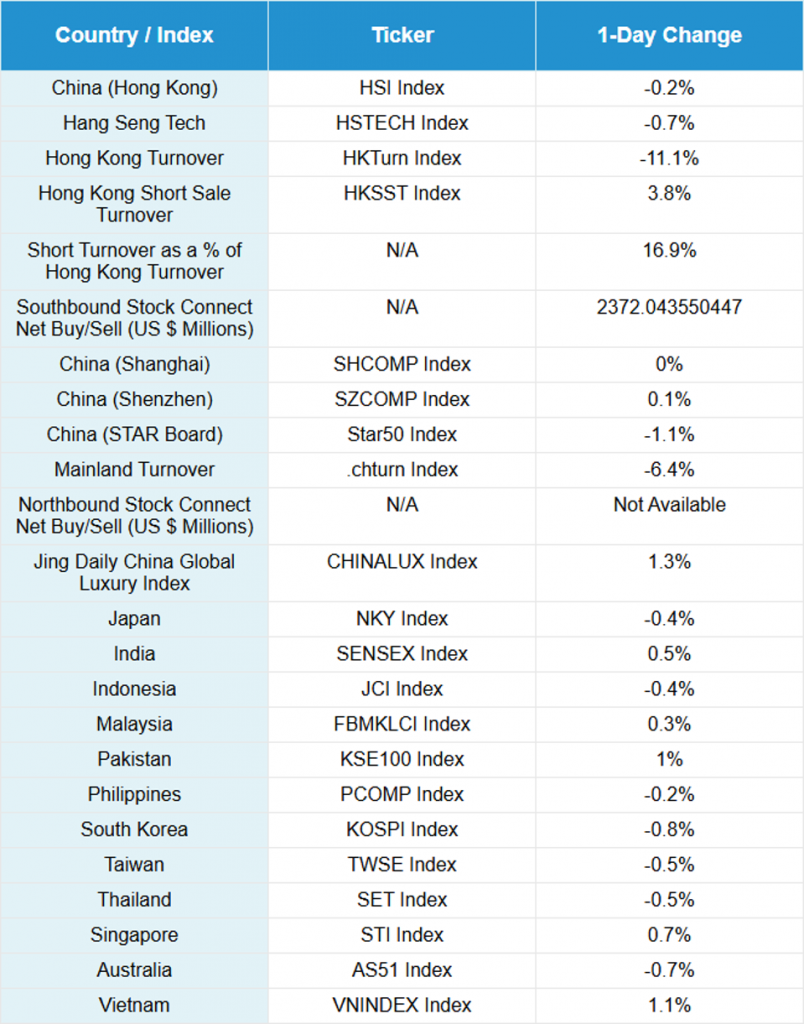

Asian equities were mixed as Vietnam gained 1%, Hong Kong closed lower for the fourth consecutive day, and Mainland China took a breather after its market cap hit a 10-year high .

Profit taking centered on growth stocks and sub-sectors, but Tencent (+0.94%) and electronics held up well, aided by Premier Li’s positive comments on domestic consumption. East Buy Holding was a notable decliner, dropping -20.89% in Hong Kong and -3.41% in Mainland China after reaching 52-week highs yesterday, reportedly on an unconfirmed rumor.

Meanwhile, Mainland investors bought the Hong Kong dip in volume, with $2.38 billion in net buying, and strong flows into the Hong Kong Tracker ETF following Friday’s $4.58 billion of net buying.

The 1 and 3-Year Loan Prime Rates (LPRs), set at 3% and 3.5% respectively, are not expected to change; the 3-year rate remains the reference rate for mortgages. Diplomatic relations between India and China seem to be improving, as China has agreed to sell rare earths to India following Foreign Minister Wang Yi’s visit.

Having returned from a family holiday, I’m still shaking off the proverbial mental fog, although my wife insists that’s a permanent state, and she’s got plenty of evidence, too. I missed that Tong Cheng Travel reported Q2 financial results yesterday after the Hong Kong close, posting beats in revenue, adjusted net income, and adjusted earnings per share (EPS). It is worth noting that 2020 revenue was RMB 5.93 billion, and the 2025 revenue estimate is RMB 19.51 billion, yet the stock has only risen 35% over the past five years. This is fairly typical in our space, where revenues multiply but stock appreciation lags.

New Content

Read our latest article:

Labubus: How Pop Mart’s Newest Craze Reflects Chinese Cultural Influence in the U.S.

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.17 versus 7.18 yesterday

- CNY per EUR 8.39 versus 8.39 yesterday

- Yield on 10-Year Government Bond 1.77% versus 1.78% yesterday

- Yield on 10-Year China Development Bank Bond 1.89% versus 1.91% yesterday

- Copper Price -0.18%

- Steel Price -0.91%