If you’ve been following the luxury sector, you’ve probably seen your fair share of sobering news.

On the surface, it may look like the era of high-end handbags and bespoke suits is coming to an end. But dig a little deeper, and a different story emerges—one filled with possible opportunity for the patient, value-oriented investor.

I’ve studied markets for decades, and if there’s one thing I know, it’s that cyclical downturns have often presented the best entry points. I believe the current luxury slump is no exception. In fact, the data tells me we may be on the verge of a comeback.

Luxury’s Slow Year May Be the Setup for Its Next Great Comeback

Last year, global luxury sales posted their weakest performance since the 2008 financial crisis—excluding the COVID years—and 2025 isn’t off to a roaring start, either. Bain & Company projects sales will shrink by another 2% to 5% this year. That’s not what you’d expect from an industry that’s historically grown at twice the rate of global GDP.

But here’s the thing: This isn’t the first time luxury has hit a soft patch, and in the past, it’s come back stronger.

Take 2015, for example. Back then, consumers began to turn away from flashy logos, and major brands like Louis Vuitton were forced to rethink their design philosophy. The result? A pivot to more understated, timeless styles like the Capucines bag, now one of LV’s bestsellers. Sales bounced back, and those who kept the faith were rewarded.

The Return of Chinese Tourists

No discussion of luxury is complete without China. Before the pandemic, Chinese travelers accounted for roughly two-thirds of their luxury spending outside of China. That changed when the pandemic hit, and many brands pivoted to local markets.

Now, with international travel picking up again, we may be on the cusp of a reversal. Chinese tourists are venturing back into Europe, where luxury goods often sell for 5% to 45% less than in China due to taxes and pricing strategies. That price gap could create an incentive to buy abroad.

To be clear, sales in mainland China are still soft. Bain estimated a 20% drop last year, and some brands like Richemont reported a 23% decline.

But we don’t think the secular tailwind of rising wealth in China has gone away. In 2024 alone, over 141,000 new millionaires were minted in China—more than 380 a day. Over time, that wealth could find its way into high-end purchases, whether from Western brands or increasingly popular domestic designers.

America’s Quiet Wealth Boom

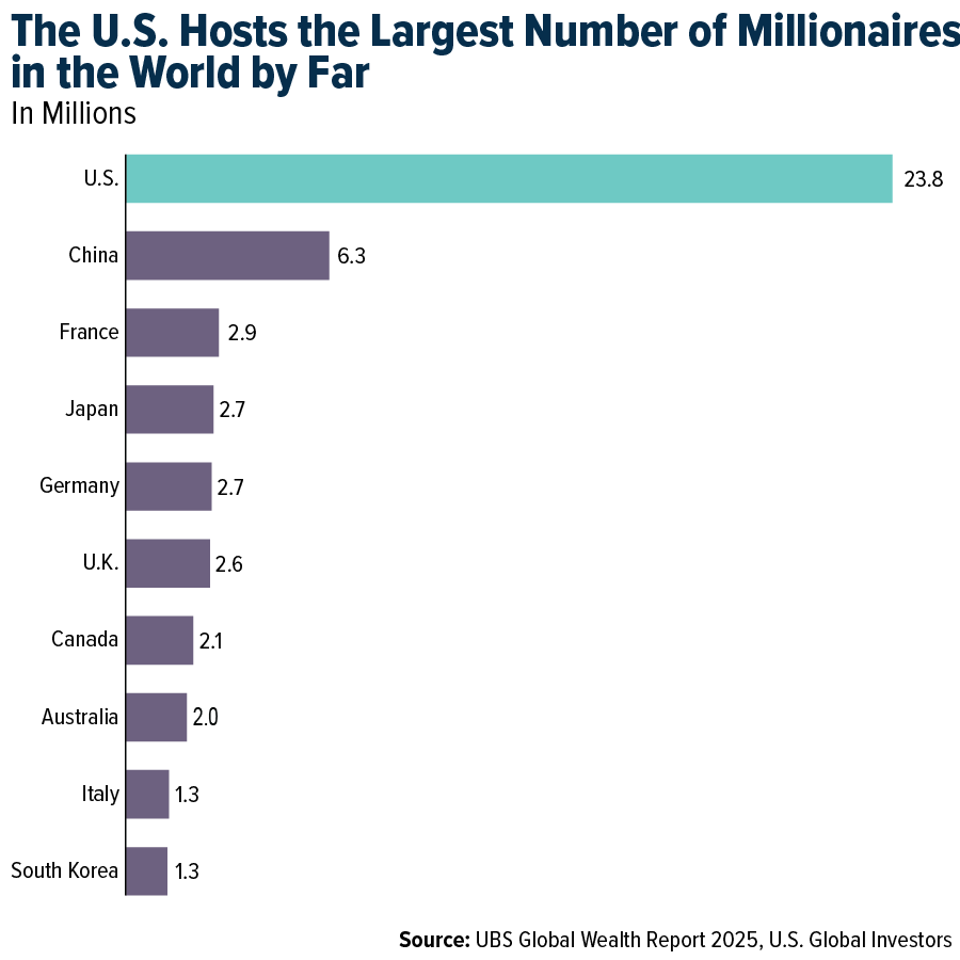

Closer to home, the U.S. continues to lead the world in absolute wealth. According to the latest UBS Global Wealth Report, the country now boasts nearly 24 million millionaires—more than the next seven countries combined. That’s nearly 40% of the world’s total.

And that number is only expected to grow. UBS forecasts that 5.3 million Americans will join the millionaire club by 2029, a nearly 9% increase. This matters because luxury demand has tended to track wealth creation more than overall GDP.

Good news, then, that financial markets are booming. The S&P 500 recently hit an all-time high, before Trump announced a new battery of tariffs. Bitcoin, often a leading indicator of risk appetite, touched $120,000. That tells me that investor confidence is healthy.

When you pair that with a tax environment that favors high earners (thanks in part to the One Big Beautiful Bill), the case for luxury demand staying strong looks compelling, at least to me.

Mixed Financial Results

Not all brands are hurting. Hermès reported an 8% increase in revenue for the first half of 2025. Prada’s total sales rose 9%, with its trendier Miu Miu line surging a whopping 49%. Even Richemont, which owns Cartier, saw group sales rise 6%, despite Chinese weakness.

As for the laggards, Gucci’s sales fell 26% in the first half, dragging down Kering’s overall numbers. Some, like LVMH, are using this period to buy back shares. Bernard Arnault, the group’s founder and CEO, has personally bought over $1 billion worth of LVMH stock this year.

As I often say, follow the money, especially when it’s coming from insiders.