The IAG share price (LON:IAG) has rocketed since the turn of the pandemic. Investors who bought the stock in late 2020 would have seen their returns almost quadruple. Even so, further upside is within reach, and a new all-time high isn’t out of the question.

Making Space For Growth

As IAG has made a habit of in recent times, the British Airways parent company managed to beat expectations yet again when it reported its Q2 results earlier this month. Although the stock reacted positively in early trading on the day, the IAG share price has since pared back on some of its gains, partly due to ambiguities surrounding guidance. But before getting into that, the firm’s Q2 numbers are worth noting.

Total revenue was up a decent 6.8% to €8.86 billion. This was led by a 4.9% increase in passenger revenue to €7.77 billion. Cargo revenue had another strong showing with a 9.9% increment to €311 million, as maritime trading routes in the Middle East continued to witness disruptions, benefitting air cargo. Other revenue surprised, too, with blowout growth of 29.8% to €780 million, thanks to more maintenance (MRO) and BA Holidays revenue.

Much of the passenger revenue was driven by a combination of capacity and continued yield expansion, albeit slower, as growth in the form RASK only ticked up 2.6% to 8.55¢, cooling from Q1’s 3.2%. This is because while capacity in the form of ASK grew 2.2% to 90,916k as IAG expanded its fleet and average sector lengths in the quarter, passenger growth dropped 0.8% to 31,624k. This pulled the group’s load factor down by 1.3% to 85.4%.

In fact, yields would’ve been lower had it not been for three factors. The first was the 2.8% decline in Iberia’s capacity, as engine maintenance on its A330 aircraft shrunk seat supply, while demand to LATAM remained strong, leading to stronger yields. The second was the timing of Easter in Q2, which was a slight tailwind for travel. The third was the persistent outperformance of IAG’s premium cabins outstripping the weakness in the Economy cabin.

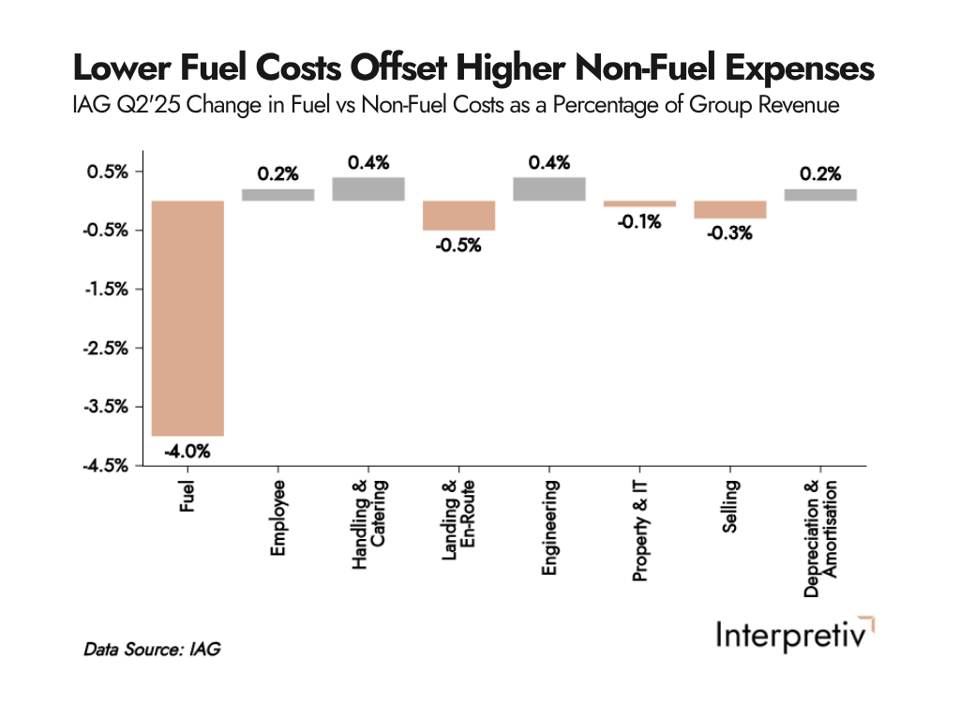

Regardless, IAG’s EBIT jumped 35.4% to €1.68 billion, beating consensus (€1.43 billion) again. This was down to cheaper fuel cost, as fuel CASK fell 12.7% to 1.99¢, offsetting more expensive non-fuel costs. While finance income stalled to €70 million from plateauing interest rates, so did finance costs to €212 million. Consequently, pre-tax profit soared 33.0% to €1.51 billion. Paired with share buybacks, and EPS leaped 27.6% to 23.6¢.

Transatlantic Turbulence Worries

So, here’s why the IAG share price failed to rise. As mentioned earlier, investors are wary of a slowdown in the North America (NA) market. Demand in the NA region measured through RPK saw its first contraction in almost 3 years, as passenger numbers shrank 1.6% to 3,655k, while capacity rose 1.8% to 29,070k. This came as a result of a slowdown in US spending habits from President Trump’s uncertain tariff policies which began in April.

This is a particular concern for shareholders, as IAG’s main market and bulk of profit comes from the NA region, especially for its biggest airline, British Airways (BA). For that reason, there’s some anxiety surrounding IAG possibly over-expanding its NA capacity without demand keeping up. As a consequence, this could put downward pressure on ticket prices, resulting in flat or even negative yields, and ultimately hurt profits.

There are, however, two silver linings that came about from the earnings call which could calm some investors’ nerves. Firstly, management mentioned seeing a stabilisation in NA ticket yields mid-way through Q3, as a little more clarity was provided by the White House on its trade policies recently. Second of all, NA capacity out of BA’s main hub in Heathrow is expected to remain flat in Q3, which should help with yield preservation.

On that basis, I expect the rate of contraction in NA’s RASK to bottom out in next quarter’s figures. I’m forecasting BA’s RASK to mark its biggest decrease of 1.5% in Q3 to 9.59¢, before recovering slightly to a better -1.3% in Q4. But regardless, thanks to the bigger capacity being introduced to IAG’s fleet, alongside higher spending in premium segments and growth in other regions, I remain bullish on IAG’s prospects going into the winter.

After all, I’m anticipating yields in other regions and airlines (particularly Iberia and Aer Lingus) to continue growing strongly. Most of this should come from the continuous hot demand between Spain and LATAM, benefitting Iberia tremendously. With LATAM capacity from Madrid estimated to be down again in Q3, the robust demand should keep Iberia’s yields rather elevated and should more than offset the capacity shortfall.

Higher Levels To Come?

Regardless, it should still go without saying that my Q3 forecasts are still too early to be concrete. Revisions to both the up and downside remain open this early into the quarter, but I remain bullish on IAG’s prospects regardless, as I don’t envision travel demand slowing meaningfully and derailing the investment thesis at play.

And while headlines indicated that the FTSE 100 stalwart fell short of not upgrading its FY25 guidance, there were, in fact, a couple of notable ones. Most prominently, CEO Luis Gallego mentioned that he now expects fuel costs to come in a whole €400 million less than Q2’s guidance – now at €7.10 billion, thanks to smart fuel and currency hedges. Plus, non-fuel CASK is also now only seen to tick up by 3.0% from a previously guided 4.0%.

Moreover, I’m excited about the medium-term prospects of the new revenue management system being trialled. It has the potential to improve yields through the removal of class buckets by creating more price points, while also keeping prices more attuned to real-time supply-demand dynamics. For instance, IAG will be able to offer upgrades for less, which should theoretically stimulate higher spend per customer and fill excess supply.

I believe the current weakness in the NA market will subside by the new year as trade policies stabilise, and should spearhead a transatlantic rebound – although, this hypothesis is contingent on the both the UK and US labour markets not weakening significantly. Regardless, if timed correctly, rate cuts can be a further tailwind for IAG’s business.

I hold the view that the IAG share price has more room to run, despite some potential short-term volatility. The stock still trades at a cheap valuation with an EV/EBITDA of 3.1, which is still below its sector (7.8) and historical (4.0) averages. What’s more, at my projected CAGR of 11.1%, its PEG of 0.6 is more than half of its sector’s 1.4. Thus, I have a price target of 470p, just shy of its all-time high of 495p in 2018, with room for further upgrades in the future.