Monthly bills are no problem for careful contrarian readers banking 8.8% yields in monthly dividends. Let’s discuss this rare but excellent dividend breed, the company or fund that pays monthly instead of quarterly.

Only 6% of dividend payers dish monthly. The rest are quarterly or annually, which will likely not be in time to cover your upcoming cell phone bill.

My monthly email from carrier Verizon arrives in a day or two. Another $267.26 will be debited from my account automatically on the 20th of August.

Fortunately, Verizon notes that there is “nothing I need to do” thanks to AutoPay. As if the automatic payment implies it costs any less money!

On the bright side of the phone ledger, we have no landline. The cell bill is it. But don’t fall asleep, bank account. All the other cord cutting exacts its pound of flesh!

For example, we “cut the cable cord” years ago. And replaced it with an equally pricey version, albeit a wireless one!

YouTube TV has a base plan of $82.99. However, my August 29 tab will be $131.95 plus tax.

How’d I manage a 50%+ premium? By demanding sports in 4K (+$9.99/month). And refusing to live a Sunday in the fall without NFL RedZone and its 6+ hours of live look ins across football games (+$10.99/month).

Oh, and the WNBA season ticket that I watch with my daughters during the summer.

Speaking of which, A/C is a must-have here in Sacramento! I paid the power company $187.76 two days ago and that’s a light month for our summers.

But the big one, the mortgage payment, dwarfs all. And oh yes, automatically deducted from our account on the first of August.

“Just” eleven years to go on the mortgage! We shortened to 15-years when we refi’d in 2021. My “basketball dad” car is paid off (2019 Acura MDX) and, while motivated to drive it “into the ground,” the odds are this car won’t be my last.

So the big monthly payment wheel keeps on spinning. I am sure you can relate to a few of these regular drains in your own life.

For which we have a solution: plug these monthly drains with monthly dividends.

How To Find The Best Monthly Dividends

But you observe, “Brett! You said only 6% pay monthly. How can I find them?”

Glad you asked! Our Contrarian Income Report has a “virtual monopoly” on the sector. We have 18 monthly payers yielding an average 8.8%. Think about that. A million bucks in the CIR monthly payer lineup generates $7,333.33 per month in passive income.

Plus, the original million invested in these “elite 18” stays intact. Or better yet, grinds higher! Since inception 10 years ago, our entire CIR portfolio has generated 10.7% in annual returns. And that’s mostly paid in cash dividends, with the majority dishing monthly.

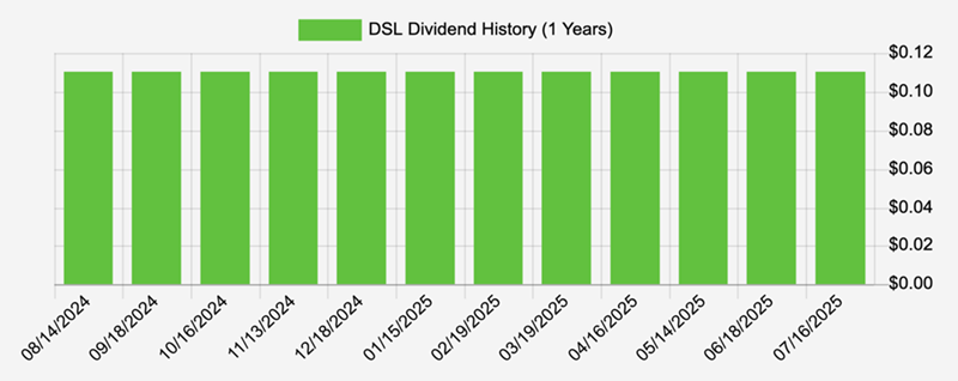

Our CIR monthly dividend GOAT (greatest of all time) is DoubleLine Income Solutions Fund (DSL). In April 2016, we added DSL to the CIR portfolio at a price of $16.99 per share.

Since then we have collected 111 monthly dividends that have totaled $15.27. That’s 90% of our initial buy price in payouts. It’s almost house money now!

Imagine investing in a simple fund that trades just like any blue-chip stock—and earning your entire investment back within 10 years via monthly dividends. With the regular payout stream still rolling strong!

And DSL is not a mere annuity. It’s way better. DSL is a bond fund run by the “bond god” himself Jeffrey Gundlach. The modern-day deity of fixed-income investing scours the globe to collect deals that power DSL’s monthly 11-cent divvie.

DSL yields 10.9% today. Investors with $100,000 invested in DSL shares enjoy $10,900 per year in passive dividend income. That’s $908.33 in monthly deposits and—oh!—that’s right: it’s autopay, but to you!

Enough to pay Verizon, YouTube TV and internet while air conditioning the house—with extra cash left over for a nice dinner!

And a $50,000 stake in DSL delivers $454.17 in monthly payouts. That’s still meaningful income to cover those every-30-day expenses.

Now, I wouldn’t pile everything into DSL today, when savvy investors can spread risk among 17 more solid monthly payers that deliver a green cash river too. This is diversification without di-worseification (thank you, Peter Lynch!). We want to retire on dividends, and the best way is to bulletproof our payout streams across asset classes, sectors and national borders.

And that’s our elite 18!

We are not hanging on the Federal Reserve’s next word. Nor are we glued to policymaker decisions. We are insulated from this noise by assembling an elite 8.8% paying portfolio of monthly dividend payers.

Brett Owens is Chief Investment Strategist for Contrarian Outlook. For more great income ideas, get your free copy his latest special report: How to Live off Huge Monthly Dividends (up to 8.7%) — Practically Forever.

Disclosure: none