Judge Ronald L. Buch has issued a warning to the syndicated conservation easement industry and their attorneys about the litigation that is piling up in the Tax Court. When I think of the Tax Court issuing sanctions, I usually think of stubborn pro se litigants like Brian Swanson. This May the Eleventh Circuit denied him relief from a $25,000 Tax Court frivolity penalty. You have to work your way up to that amount. Usually the Tax Court starts off with a warning. And that is what happened with Mr. Swanson, for whom I have a grudging admiration. Judge Buch’s warning, on the other hand, is going out to some of the best represented taxpayers currently in the Tax Court dockets and the attorneys themselves, but let’s look at the case that it came up in – Veribest Vesta, LLC.

About Veribest

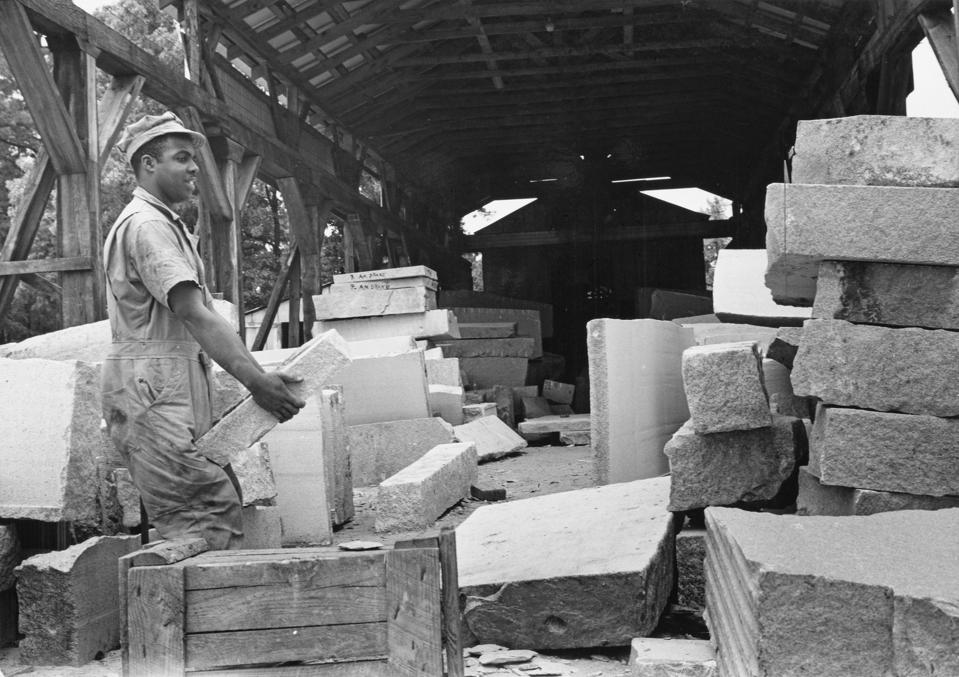

Veribest owned 55 acres of land in Oglethorpe County, Georgia near the city of Elberton. The parcel was referred to as the old Grimes quarry site. Elberton is known as the Granite Capital of the World as it sits on a granite belt that is approximately 35 miles long, 6 miles wide and 2 to 3 miles deep. By my reckoning that would make for over 130,000 acres where you know that if you dig deep enough you will hit granite. As Judge Buch observes, in order to mine granite as a business you need access to acres like that. You also need an experienced crew with a capable leader, capital to acquire the necessary equipment and to operate the business, and a market into which to sell the granite.

When Veribest donated a conservation easement on the old Grimes quarry site, all it had of the several requirements was the site. Since there is not a lot of buying and selling of easements, they are generally valued by taking the value of the land before the easement and subtracting from it the value of the land as encumbered by the easement. The argument is usually about the before value.

Veribest valued the land at over $20,000,000 which after subtracting an after value of $100,000 yielded a charitable contribution of $20,310,000. According to Judge Buch locals understand quarry properties to be worth around $2,000 per acre. Contemporaneous sales records in the surrounding region reflect a range of values from $1,999 to $2,840 per acre. The old Grimes quarry according to evidence at trial was subpar, having been quarried and abandoned. Two years before the donation it had changed hands for $1,818 per acre. Nonetheless the IRS expert went wild and crazy and came in with a $3,000 per acre value, which Judge Buch views as a concession.

All that made for a donation value of $111,000. The difference between that and the $20,310,000 claimed by Veribest is according to Judge Buch “a vast difference. It is vast enough to qualify for the gross valuation misstatement penalty. I guess “vast” is a few steps up from “gross” even though it sounds a little classier.

The Valuation

At trial, Veribest presented two experts. One argued for a before valuation somewhere between $23 and $33.5 million and the other came up with $15,460,000. These were based on the present value of the cash flow from a hypothetical mining operation. As a backup, one of the appraisers computed a valuation based on hypothetical royalty income which came in at $12,170,000. The IRS before valuation based on comparable sales was $165,000. Judge Buch went with the IRS.

This result follows along with the recent Tax Court decisions in similar cases. The thinking is that a mining operation on the land is not inherent in the value of the land and that that is not how real estate changes hands. The principle is reinforced in this case by the fact that there had been quarrying going on and it was abandoned because the granite coming out was not of very high quality.

The Warning

This case is from the 2018 tax year so there is an actual assessment against the partnership of an “imputed underpayment” of $7,514,000 and valuation penalty of $3,005,880. This was based on a total disallowance of the charitable contribution. The result of the decision will pare that back very slightly. Assuming, as is likely, that the partnership will not be able to pay, the underpayment will get pushed out to the partners, but we really don’t have experience with how well that is going to work out in practice. 2018 is the first year that these new rules are in effect.

What really stands out about this case is the warning that Judge Buch issued. He pointed out that Code Section 6673(a)(1) which allows for a penalty of up to $25,000 where it appears that Tax Court proceedings have been instituted or maintained primarily for delay, the taxpayer’s position is frivolous or groundless or the taxpayer unreasonably failed to pursue administrative remedies. Frankly with the numbers floating around in this case and others $25,000 doesn’t seem like much a concern.

But there is more. Code Section 6673(a)(2) provides that when it appears to the Tax Court that an attorney has multiplied the proceedings unreasonably and vexatiously that such attorney may be required to personally pay the excess costs,expenses and attorneys’ fees reasonably incurred because of such conduct.

Judge Buch states that valuing a property at more than 100 times its actual value is patently frivolous. The value was arrived at not by valuing the property but by valuing a hypothetical business to be situated on the property. Judge Buch quotes from some recent cases.

“It is not credible to posit that a buyer would pay -for the easement property alone- the entire NPV of a hypothetical business on the property.”

He notes that the Tax Court has written that valuing land based on the going concern value of a business operating on the land “defies economic logic and common sense.”

He also has older appellate opinions that support the same notion. The Fourth Circuit when faced with a situation where the deduction was eight times what was paid a year earlier does not pass any reasonable smell test. And now he is facing a situation where 200 times was claimed.

Judge Buch then notes all the time and aggravation involved in the two week trial. He notes that True North Resources, the partnership representative in the case, has ten other cases before the Tax Court and provides warning that “continuing to pursue similarly incredible, nonsensical, and quite frankly, smelly arguments may result in sanctions on petitioner or its counsel”.

Other Tax Court Action

The case of Paul-Adams Quarry Trust LLC is scheduled for trial this week. Judge Emin Toro has ordered that the parties be prepared to discuss their views on Veribest and Rock Cliff Reserve, another syndicated conservation easement decision that did not go well for the taxpayers. There is an intriguing footnote Rock Cliff Reserve:

“Mr. Collins understood the valuation method for a conservation easement (the value of the land before the easement minus the value of the land after the easement) but repeatedly balked on the stand at admitting that the value of a conservation easement could not exceed the value of a fee simple interest in the land.”

Is The Industry Based On Nonsense?

When I first heard about the idea of buying land and then selling it to people who would take deduction for donated conservation easements, I thought it was one of the stupidest ideas I had ever heard. That’s because I believed that an easement could not be worth more than the fee simple interest in the land and that the market for unimproved land, while imperfect, is not full of a lot of stupid people.

Although the notion that an easement can be worth more than the land was floating around, I had not seen it being argued in court until recently. Jones Day made the argument in Beaverdam Creek Holdings. Judge Goeke was not impressed. Jones Day is representing Paul-Adams Quarry Trust. It is difficult to give the Jones Day argument justice without going longer than I care to here. Basically the idea is that only sales between fully knowledgeable and capable parties count as comparable sales. So when the syndicator buys land from a farmer for $1,000 per acre, it is possible that the land can really be worth $100,000 per acre. Here is an article in Bloomberg Tax written by Jones Day people that explains it more fully.

Reaction

Lew Taishoff has a piece titled Judge Buch Says It All Here where he quotes more extensively than I do. Jack Townsend has a passionate piece – Tax Court Rejects a ******** Tax Shelter False Valuation Claim with Warning of Sanctions for Taxpayers, their Counsel, and Expert Witness Proffering the ******* (7/16/25; 7/18/25). I bowdlerized his title based on my understanding of the standards of this platform. The ******* represent Townsend’s characterization of abusive tax shelters. The poetic reference is to bovine excrement. Kirsten A. Parillo has Tax Court Warns of Frivolous Argument Penalties in Easement Cases behind the Tax Notes paywall. In that piece she quotes Frank Agostino, who represents taxpayers – “Having an expert testify that in his or her professional opinion DCF produces the most accurate value is within the province of the expert. The trial attorney has an obligation to represent the taxpayer zealously. It should be a rare case where damages under section 6673 are appropriate. Those cases are resolved by summary judgement.”

I followed up with Mr. Agostino and he wrote me the following:

“The Veribest Vesta decision is a stark warning for attorneys and taxpayers who rely on non-cash charitable contribution deductions, especially in the context of conservation easements. The Tax Court made clear that even a ‘qualified appraisal’ by a credentialed expert will not protect taxpayers from severe penalties if the Tax Court judge concludes that underlying assumptions are speculative or unsupported by the facts. For practitioners, the message is clear: formal compliance with appraisal requirements is not enough if the Tax Court judge concludes that the facts do not support the claimed value. As the legal landscape evolves, especially in light of recent Supreme Court decisions on administrative penalties, there may be growing calls to expand taxpayer and tax practitioner access to jury trials in valuation penalty based cases to ensure procedural fairness and maintain trust in the tax system.”

I also heard from Steve Small, an authority on private land protection, who has probably done more than anyone to expose abusive conservation easements in the interest of preserving the legitimate use of the technique.

“The rule for valuing federal income tax charitable contribution donations has been the same for decades, in both easement cases and any other valuation of charitable gift cases: willing buyer, willing seller, comparable sales in the relevant marketplace. The price you recently paid for the property is the best evidence of fair market value.

There are no other acceptable methods. In very limited circumstances a DCF can be ok but only in situations that are not based on fanciful assumptions. A “correct” value determined by a “correct” DCF should be substantially close to a value determination by comparable sales.

The problem is that counsel for well bankrolled syndicators have been trying to convince people that the rule is something different. It’s not. They keep blowing smoke, with claims and arguments that are nothing more than red herrings. They are bluffing, the wizard is still behind the curtain, all of these efforts are a totally valid attempt, under the American judicial system, to convince the IRS and the courts that the rule is something different – it is not something different. They are simply representing what they believe to be the best interests of their clients, that’s all.

But enough is enough. The courts are FINALLY starting to say “what part of ‘willing buyer willing seller based on comparable sales in the relevant marketplace’ don’t you understand?””