Key News

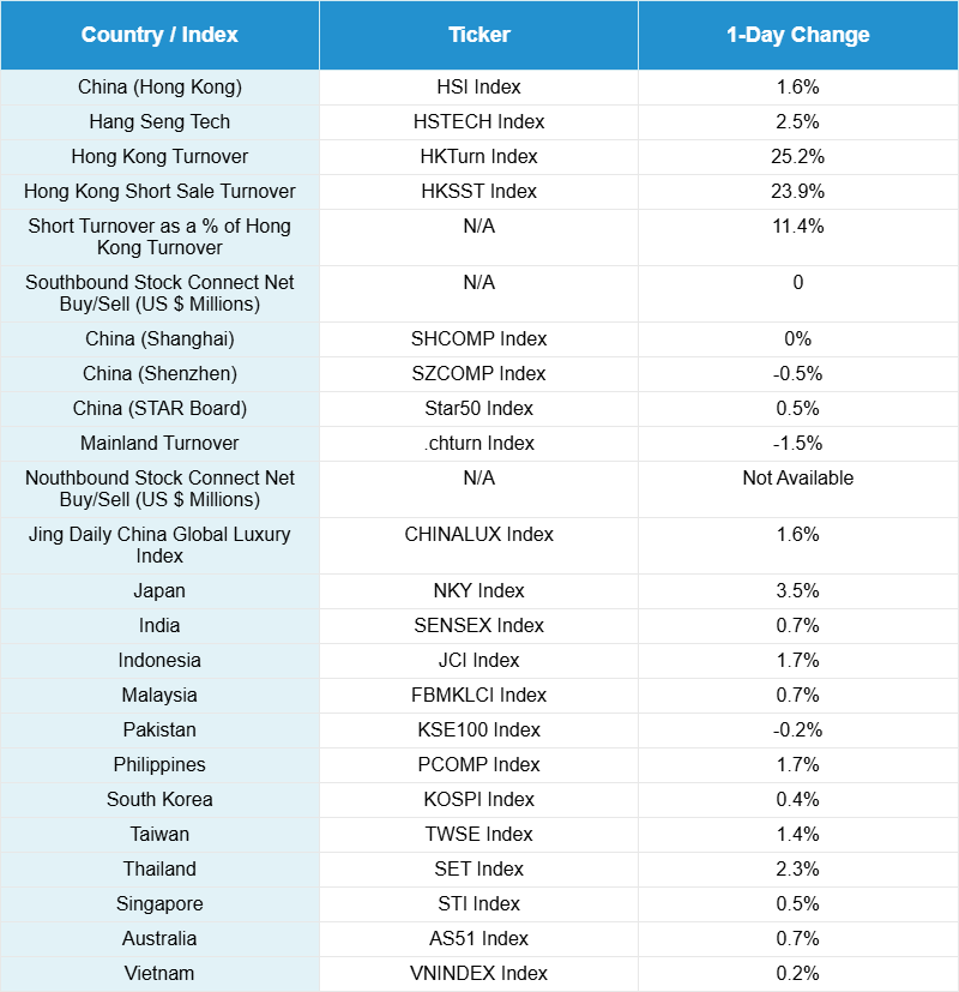

Asian equities posted strong gains overnight, led by Japan, which rallied on news of its new trade agreement with the United States.

Hong Kong stocks surged after President Trump indicated he may visit President Xi Jinping “in the not-so-distant future,” and the Philippines, Thailand, Indonesia, and Taiwan also posted substantial gains. President Trump’s meeting with Philippine President Ferdinand Marcos Jr. featured remarks quoted by Reuters: “We’re getting along with China very well,” helping bolster market sentiment.

China’s Ministry of Commerce confirmed that Vice Premier He Lifeng will meet U.S. Treasury Secretary Scott Bessent in Stockholm from July 27th to July 30th. Progress is expected for US-China trade talks, as the August 12th tariff deadline approaches. As we have argued in the past, any renewed interest from foreign investors in China’s equity market is likely to favor growth names, instead of banks or energy stocks.

Hong Kong surged on high volumes, driven by growth and internet stocks. The day’s top performers by value included Tencent Holdings (+4.94%), Alibaba Group (+2.46%), Meituan (+3.26%), Xiaomi (+0.78%), and Kuaishou Technology (+7.08%). Kuaishou announced it will be the exclusive Chinese distributor of major youth YouTube star Mr. Beast, marking a high-profile entry for the U.S. influencer into the China’s market.

Beyond improving U.S.-China relations, today’s rally got an additional lift from regulatory developments. Last Friday, the State Administration for Market Regulation (SAMR) met with Alibaba’s Ele.me, JD.com, and Meituan to address the ongoing restaurant delivery price war spurred by JD.com’s aggressive entry and deep subsidies. On July 1st, senior Chinese officials met to address overcapacity and price competition in steel, solar, cement, autos, and E-Commerce sectors. SAMR is now spearheading policy implementation.

Shanghai authorities announced that the main food delivery and instant commerce platforms have implemented three rectifications: the suspension of “zero Renminbi (CNY) purchase” promotions, a significant reduction in the scope of free marketing, and the establishment of a special working group for activity monitoring, price controls, and courier rights protections. While the Hang Seng Index, Shanghai Composite, and Shenzhen Component Index all remain above their pre-Liberation Day highs, the ongoing delivery price war has weighed on the Hang Seng Tech Index, with names like Alibaba, Meituan, and JD.com notably lagging.

Elsewhere, Baidu climbed 6.08% after announcing the establishment of a new artificial intelligence center in Nanjing. Home appliance stocks performed strongly, including Midea (+2.57%) and Haier (+3.15%), alongside gains for the insurance and banking sectors.

Southbound Stock Connect saw a rare net outflow, albeit modest at -$168 million. Hong Kong-listed stocks and ETFs rose consistently throughout the day, while Mainland China markets started strong but faded in the afternoon as profit-taking hit sub-sectors tied to the Yarlung Zangbo dam, including construction machinery, building materials, and steel. Banks, semiconductor companies, household appliance makers, and insurers posted gains, although the day was comparatively weak across the broader market. Trading in exchange-traded funds (ETFs) favored by the National Team saw above-average volumes, suggesting a possible “buy-the-dip” response from sovereign wealth fund arm Central Huijin.

Diplomatically, India-China relations improved. India is once again permitting Chinese tourists to apply for visas. They had been barred from doing so for five years.

In Hainan, the free trade zone announced an expanded list of goods exempt from tariffs for certain categories.

New Content

Read our latest article:

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.16 versus 7.17 yesterday

- CNY per EUR 8.39 versus 8.40 yesterday

- Yield on 10-Year Government Bond 1.70% versus 1.69% yesterday

- Yield on 10-Year China Development Bank Bond 1.78% versus 1.76% yesterday

- Copper Price +0.20%

- Steel Price +0.58%