Key News

Asian equities retreated following yesterday’s strong gains as Vietnam outperformed and the Philippines lagged behind.

The most significant development came after the market closed, as Premier Li chaired a State Council meeting focused on regulating competition in the New Energy Vehicle (NEV) industry. The meeting emphasized the need to address “irrational competition” and called for effective government regulation to restore order in the sector. Additionally, the meeting highlighted the importance of “strengthening the domestic big cycle,” a reference to boosting domestic consumption and optimizing policies for trading in old consumer goods for new ones.

Solar stocks continued to benefit from the government’s “anti-involution” campaign, which aims to curb destructive price wars and promote sustainable industry growth. The renewed focus on electric vehicles (EVs) is notable, especially as “overcapacity” remains a key issue in ongoing US-China trade negotiations. This policy emphasis may play a role in future trade discussions between the two countries.

Separately, the China Chain Store & Franchise Association (CCFA) issued a statement warning that the intensifying “real-time retail price subsidy war” among platforms is disrupting fair competition. The association urged its members to resist “involution-style” price competition, which has led to a race to the bottom in sectors like restaurants and instant retail. This move reflects the broader anti-involution mandate filtering through the economy and may signal a turning point in China’s domestic deflationary pressures.

Nvidia CEO Jensen Huang’s recent speech has attracted significant attention. Mainland media have speculated about a potential partnership between Nvidia and Xiaomi following Huang’s comments about purchasing a Xiaomi car. It is striking how little analysis has been done of the contrasting results of Xiaomi and Apple, two of the world’s largest smartphone makers, in the vehicle industry. Xiaomi has succeeded, while Apple barely got off the ground.

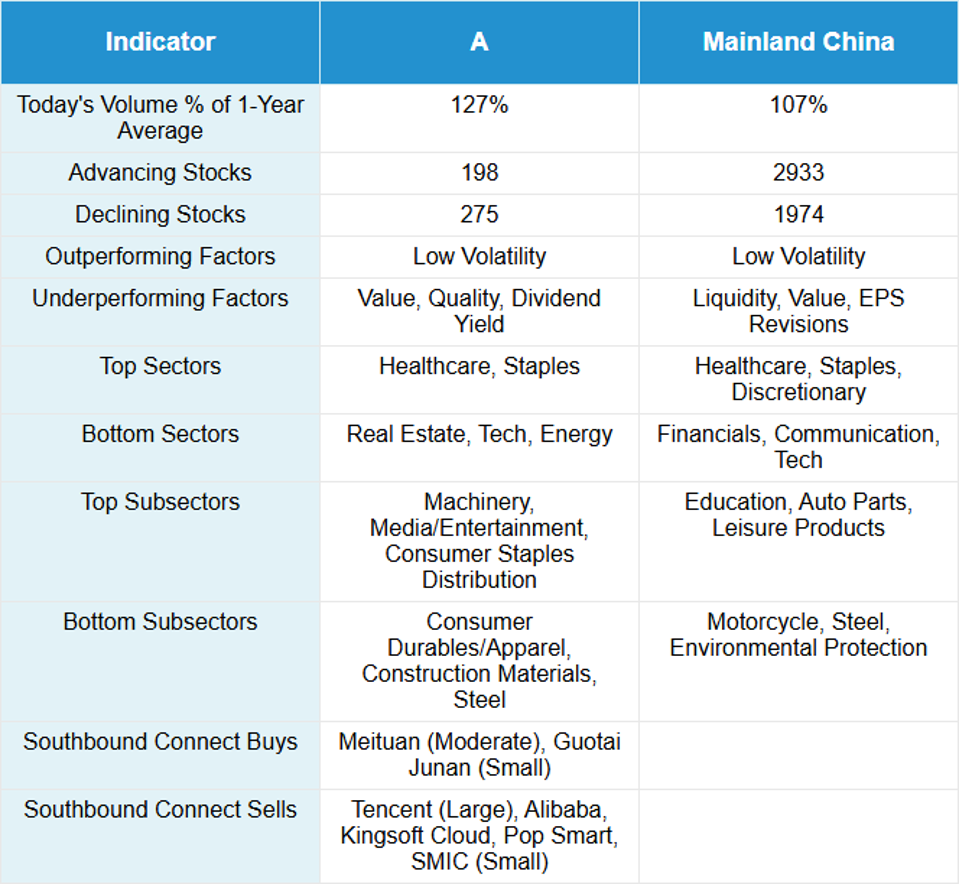

Hong Kong markets saw profit-taking, with high but lighter volumes compared to the previous day. Notable moves included Alibaba (+0.26%), Tencent (-0.19%), Meituan (-1.66%), Pop Mart (-4.03%) despite a positive preliminary profit release, and Guotai Junan (+4.93%).

Media and entertainment stocks continued to perform well, including Kuaishou (+2.13%), Tencent Music Entertainment (+2.37%), and Bilibili (+1.73%), all of which hit 52-week highs. In contrast, Hong Kong and Mainland China real estate stocks underperformed after the China Urban Work Conference ended without new policy initiatives, and June sales data remained weak.

Mainland investors purchased $204 million of Hong Kong-listed stocks and ETFs today via Southbound Stock Connect, bringing the year-to-date total to over $100 billion. Tencent continued to see net selling through Southbound flows, suggesting investors are using it as a funding source. The Mainland market was relatively quiet as attention shifted toward upcoming earnings releases.

A Mainland media source highlighted a statement from Unitree’s CEO, who noted: “The global vision for humanoid robotics technology and product development remains largely aligned, while countries may differ in cultural and industrial backgrounds.” He emphasized that China excels in hardware and manufacturing, while the United States leads in AI software ecosystems.

Finally, Nvidia’s market capitalization has surpassed the GDPs of India, the United Kingdom, France, Italy, Canada, and South Korea. As of July 2025, Nvidia’s valuation reached $4 trillion, making it larger than the economies of nearly every country except the United States, China, Germany, and Japan.

Live Webinar

Join us on Tuesday, July 22, 10:00 am EDT for:

China Mid-Year Outlook: Trade Deal Loading, Consumption & Innovation Locked In

Please click here to register

New Content

Read our latest article:

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.17 versus 7.17 yesterday

- CNY per EUR 8.34 versus 8.37 yesterday

- Yield on 10-Year Government Bond 1.66% versus 1.66% yesterday

- Yield on 10-Year China Development Bank Bond 1.72% versus 1.71% yesterday

- Copper Price +0.04%

- Steel Price -0.42%