With stocks levitating higher, you just might be starting to peek at other investment ideas (like municipal bonds) to spread out your risk and, most importantly, boost your dividends.

It’s always a smart strategy, and especially so now. We ran through an easy way to diversify while grabbing yourself a healthy 7.9% payout in last Thursday’s article (click here to catch up if you missed it).

Municipal Bonds Cut Your Taxes, Boost Your Payouts—But Timing Matters

Which brings me to my favorite income plays, closed-end funds (CEFs), and in particular those that hold municipal bonds. (“Munis” are issued by state and local governments to fund infrastructure projects. Their dividends are tax-free for most Americans.)

In a second, we’ll look at one overpriced muni-bond CEF that’s about to tumble—and another kicking out a 7.4% dividend that’s trading at a rare discount (I’m talking 10% off its “true” value here).

How 8% Municipal Bonds Becomes 13% Yields

Muni-bond CEFs’ tax breaks can make a big difference. To give you a sense of just how much of a difference, the one muni-bond CEF in the portfolio of my CEF Insider advisory yields around 8%, but that could be worth 13% to you on a taxable-equivalent basis depending on your tax bracket.

Municipal Bonds Trailed the Pack in the First Half of ’25

Despite that, we do only hold that one muni-bond CEF now. That’s in part because, when you look at benchmark index funds for the S&P 500, high-yield bonds, REITs and munis, you’ll see that munis were the worst performers through the first half of this year.

However, with the recovery in the S&P 500, it seems that munis’ fortunes will probably change for the better as investors begin to fear a correction in the stock market and look for a steady, high-yielding (not to mention hugely tax-advantaged) alternative.

Over the last five years, the main muni-bond index fund has been basically flat. That’s partly because stocks have been on a solid run, drawing attention away from munis.

But here’s the thing: When this kind of lull in the muni-bond market happens, it’s usually followed by a strong showing, especially if the rest of the market pulls back.

Municipal Bonds Delivered in the 2008 Mess

From 2007 to 2009, for example, muni bonds made little progress until the 2008 market selloff sent them to surging. That gave muni investors an 8.3% annualized return in two years while stocks were crashing.

Fast-forward to the first half of 2025, and it looked like stocks were about to repeat what had happened nearly 20 years ago. But then they recovered, for the simple reason that, despite all the drama, the US economy is doing fine.

The economy’s continued strong growth is something we’ve been stressing at CEF Insider this year, despite the panic. And this is why we’ve held off on muni-bond CEFs instead of leaning into them.

Not everyone has done the same, however.

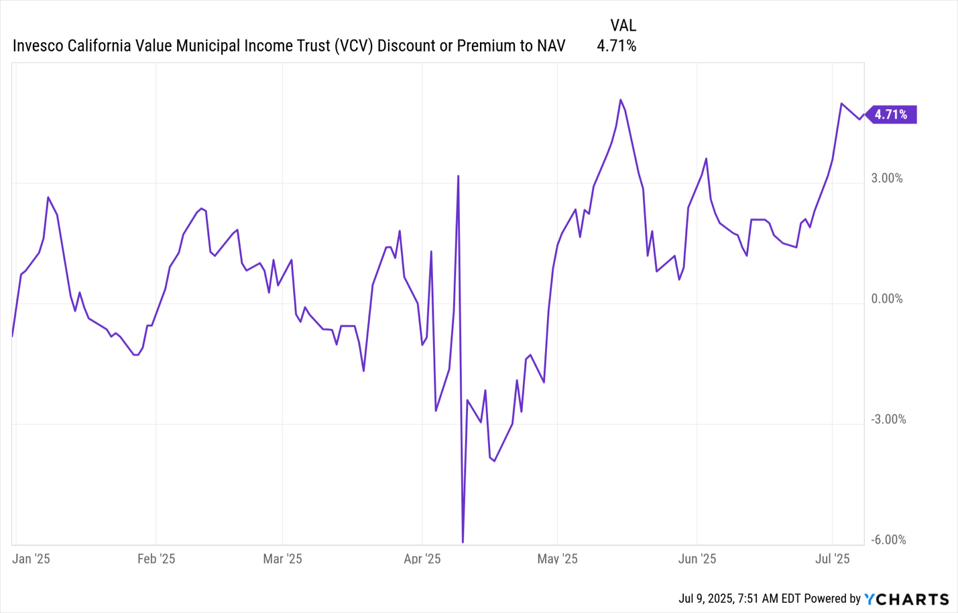

Top California-Based CEF Gets Bid to the Moon

Here we see that the Invesco California Value Municipal Income Trust (VCV) has ranged from a deep discount to net asset value (NAV, or the value of its underlying portfolio) to a nearly 5% premium in 2025. In other words, investors are currently paying almost 5% more than VCV’s portfolio is actually worth!

Trouble is, that stark premium does not reflect growth in the fund’s NAV. Therein lies the problem (and the risk).

VCV’s Portfolio, Market-Price Returns Part Company

On a total-NAV-return basis, VCV is down more than 6% in 2025, as you can see in orange above. More worrying is the fact that VCV’s total price return is nearly flat, after a rise that’s happened in the last few weeks.

In other words, the fund’s premium has been pushed up by investors not selling it in response to that NAV drop. That lack of a response is why I urge anyone holding VCV to sell now.

To be fair, this is a well-managed fund, and California has booked higher tax revenue in the last decade as industries (tech and media most obviously) have posted profit gains.

Plus, the fund’s 7.4% yield is higher than the average 6.4% yield across muni-bond CEFs tracked by CEF Insider. But that means VCV is a good buy when it’s underpriced, not now, when it’s overpriced.

And we definitely will want to buy underpriced muni-bond CEFs when we can, because this underperformance has lasted too long: Munis have been out of favor for about three years now, way longer than prior lulls.

Plus, stocks have recovered, despite the selloff earlier this year, and another selloff could cause selling in other markets, too. That would make muni bonds a good option for hedging risk elsewhere. VCV would be high on our list, but only when it swings to a discount.

But what if VCV doesn’t swing to a discount or keeps losing value, like it has been? In that case, we might consider a CEF like the abrdn National Municipal Income Fund (VFL), a 6.2% yielder trading at a 10.3% discount to NAV.

This discount is strange, since VFL holds bonds from several states, so it’s well diversified. Plus, munis are one of the world’s safest asset classes.

In other words, this deal can only stick around for so long.

For that reason, if you’re looking to get into (or add to your holdings of) muni bonds, take a look at VFL—or one of the other high-yielding muni-bond CEFs out there that aren’t trading for more than their portfolios are worth.

Michael Foster is the Lead Research Analyst for Contrarian Outlook. For more great income ideas, click here for our latest report “Indestructible Income: 5 Bargain Funds with Steady 10% Dividends.”

Disclosure: none