Online B2B distribution? Amazon’s foray into B2B distribution worked fine for simple products like paper towels, but the moment specs get tricky their model broke down. Most industrial products live or die on context — temperature thresholds, compliance codes, compatibility quirks — essentially context. But that is precisely what large-language models (LLMs) excel at. AI is about to redraw the map of B2B distributors. Private-equity (PE) investors are circling the industry and all look for AI efficiency gains. However, the real prize, isn’t another wave of cost cuts—it’s a venture-building opportunity hiding in plain sight.

Déjà Vu — Data Did Not Work For Private Equity

In the mid-2010s, I already wrote about Private Equity funds that went on a purchasing spree with a simple thesis: merge data assets and sell at bigger multiple. I was skeptical. In my book Ask, Measure, Learn I cautioned that raw data without a focus on impact is just noise. You can plot a line with two points; a million more won’t raise valuation. Transformers will flip that script.

Generative AI Will Work Private Equity

For the past decade at Cornell, my focus has been to dissect how AI reshapes entire sectors. In eCornell’s open certificate program, “Designing and Building AI Solutions,” I apply AI solutions from e-commerce and healthcare to finance. Always discussing the core question: Where does AI unlock new value?

Transformer models — the engines behind OpenAI and Gemini — unlocking such new value. They embed context, the very ingredient Amazon lacked in their B2B push. Suddenly the “messy details” of industrial distribution turn into gold dust for an industry still playing catch-up on technology.

From Fax Machines To Fine-Tuned GPTs — B2B Distribution Can Cut Cost

If you want to understand the B2B distribution space, look no further than Ian Heller of the Distribution Strategy Group. Few people know the sector more deeply. He not only advises the industry’s leading players but also hosts of a conference dedicated to AI in B2B distribution. At the intersection of legacy systems and modern AI there were many fascinating use-cases:

- AI-Driven Order Entry – Endeveor transcribes faxed purchase orders (yes, faxes are still very much a thing) and injects them directly into ERP systems.

- AI-Powered Supply Chain Planning – Blue Ridge leverages predictive AI to smooth supply flows and optimize inventory levels.

- AI-Enhanced Sales Enablement – Kanava arms sales teams with a fleet of intelligent bots, streamlining lead qualification and product recommendations.

- AI-First Site Search – others offer ChatGPT-like interface for e-commerce discovery, replacing clunky filters with conversational relevance.

- AI In CRM – LEADsmart analyzes CRM data to recommend next-best actions and more targeted offers.

- AI For PIM Data Hygiene – Pimberly applies machine learning to clean up messy product information and enrich catalogs at scale.

All of these AI tools have one thing in common—they hit the bottom line fast. Better customer support? Lower service costs. Smarter sales enablement? More efficient conversions. It’s no surprise that private equity was part of nearly every conversation at the conference. Firms are shopping aggressively again, fueled by a familiar thesis: acquire platforms, deploy AI across the portfolio, and capture efficiency gains at scale.

This time, I’m not skeptical. In fact, they’re right. But here’s the catch: they may still be thinking too small. The real opportunity isn’t just cost savings—it’s a full-scale reinvention.

Why Is B2B Distribution Is Complicated

While cost reduction remains foundational, it is not where AI’s strategic value in B2B distribution ends. To understand the full potential, let’s revisit the core value of B2B distributors:

-

Customer Acquisition In A Fragmented Market

B2B distribution often serves thousands of small, highly specialized buyers. These buyers are not easily reached through traditional digital channels. Securing the right product — in the correct specification and quantity — is critical, particularly for high-value or high-risk applications. Much of this coordination happens through long-standing relationships built on trust. In many cases, a supply chain manager doesn’t consult a website — they call a known contact. These interactions aren’t captured in Google search results, but they are central to the transaction.

-

Deep Domain Expertise At Scale

Distributors offer more than logistics — they offer technical judgment. Understanding how polymers respond to 180 °C, or which valve coating will withstand caustic CIP cycles, is not trivial knowledge. It is accumulated through experience and often passed down informally. One executive told me: “You can’t sell electronics at the counter without at least two years of training.” Wait, what? Yes, B2B is that complex. This institutional expertise is often the reason customers choose distributors over direct manufacturers or generic platforms.

-

Physical Distribution Networks

Shipping logistics still matters. When a critical piece of machinery is down, waiting two days for a $1 part is not an option. Proximity to the customer remains a competitive advantage, especially in industrial settings where uptime is paramount.

Yet these three pillars only scratch the surface. As Jason Hein, from B2B eCommerce Association, noted:

“There are multiple dimensions of context in B2B—product, customer, geography, and application—and each adds its own layer of complexity. The math gets terribly complicated really quickly.”

AI solutions that fail to recognize this risk oversimplifying what is, in reality, a deeply layered decision-making process. To further complicate matters, much of this context is still undocumented—especially on the customer and application side. That’s why so many AI-driven CRM solutions are emerging: not just to act, but to observe, extract, and structure contextual signals automatically.

The AI Opportunity Private Equity Hasn’t Priced In For B2B Distribution

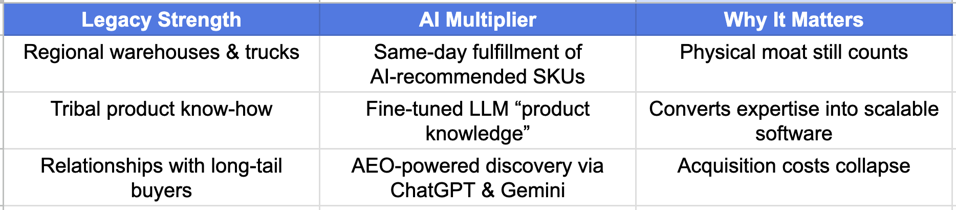

Transformers have the potential to fundamentally reshape two first value drivers of B2B distribution: expertise and customer acquisition. This is not merely a case for operational efficiency; it’s a business model shift. It’s an inflection point that private equity — and increasingly, venture capital — should not overlook.

Expertise, Scaled: B2B Distribution & AI

A fine-tuned, domain-specific LLM can capture and deliver what once lived only in the minds of seasoned technical staff. The accumulated knowledge behind decades of “call Bob in tech support” scenarios — spec sheets, material tolerances, compatibility nuances — can now be made instantly accessible at zero marginal cost.

Consider a distributor of industrial containers: A distributor will ask with questions such as: Is the container for food use? Will it hold hot or cold liquids? Is it oil-resistant? Is it stackable? These questions require contextual understanding and product-specific knowledge — areas where general-purpose models like OpenAI’s GPT may fall short. But a bespoke LLM, trained on a distributor’s internal documents, customer service logs, and historical sales data, can deliver precise answers in seconds.

Customer Acquisition, Reimagined Is B2B Distribution

Much of B2B customer acquisition is still relationship-driven. It’s not about Google searches — it’s about trust. Joe, the long-time rep your supply chain manager calls, knows exactly what’s needed and when. These transactions aren’t indexed on a website, yet they drive real business.

What if ChatGPT or Gemini could replicate that trust? What if a buyer’s query — typed in natural language — could route directly to your fine-tuned AI, delivering a recommendation as accurate as Joe’s? That’s the promise of Answer Engine Optimization (AEO) and Generative Engine Optimization (GEO) — ensuring your expertise is not just digitized, but discoverable at the moment of intent.

In this new model, discovery no longer depends on trade shows, cold calls, or client dinners. It happens in the flow of work, through AI interfaces already embedded in how people search and decide. In short: the economics of acquisition are flattening. B2B is entering a new era — driven not by proximity or personality, but by context and computation.

A Blueprint For The AI-Native B2B Distributor

B2B Distributors At An Inflection Point

AI won’t kill the B2B distribution industry — it will unbundle and rebundle it around expertise. The winners will pair their distribution with fine-tuned large language models, turning complexity into subscription-like revenue. Whether you’re a PE partner eyeing roll-ups or a 50-year-old wholesaler, the question is no longer “How do we cut cost?” It’s “How fast can we productize what we know with AI?”

Join The Conversation

Industries — like B2B — are shifting due to AI. Where are we heading? Share your thoughts and join the discussion on LinkedIn.