Key News

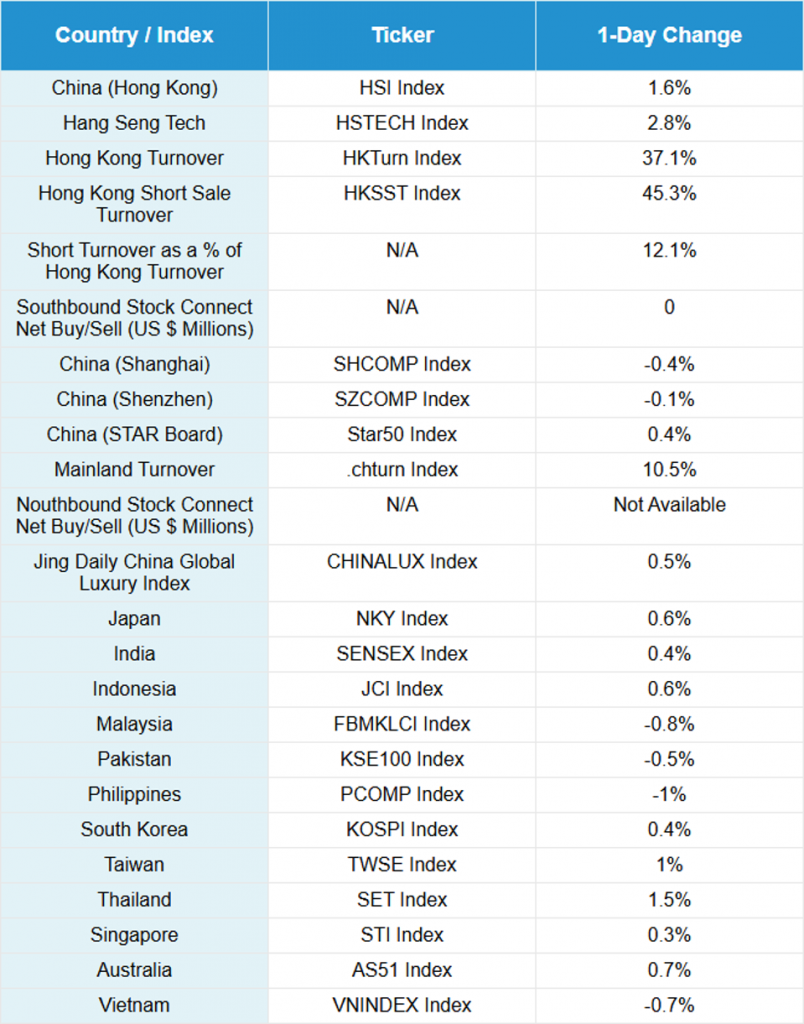

Asian equities had a strong day except for the Philippines.

Three catalysts today fueled Hong Kong and the STAR Board’s rise, though that same news weighed on the Mainland’s Shanghai and Shenzhen. The three catalysts were: June/Q2 economic data, President Xi’s speech at Central Urban Work Conference, and Nvidia’s Jensen Huang stating that the US government would allow the sale of H20 chips to Chinese companies.

Another key catalyst for Hong Kong, after last week’s focus on “anti-involution” (self-destructive price wars and competition), we saw the first implementation of the top-down directive on E-Commerce as the directive makes its way down the bureaucracy for local government implementation.

Let’s start with the economic data:

- Q2 GDP rose by 5.2% year-over-year (YoY) versus expectations of 5.1% and Q1’s 5.4%.

- GDP year-to-date (YTD) rose by 5.3% YoY versus expectations of 5.3% and Q1’s 5.4%.

- June Retail sales rose by 4.8% YoY versus expectations of 5.3% and May’s 6.4%.

- June Online Retail Sales YTD rose by +8.5% YoY.

- June Online Retail Sales of Physical Goods YTD rose by 6% YoY, accounting for 24.9% of total retail sales of consumer goods.

- June Industrial Production increased by 6.8% YoY versus expectations of 5.6% and May’s 5.8%.

- June Fixed Assets Investment YTD increased by 2.8% YoY versus expectations of 3.6% and May’s 3.7%.

- June Property Investment YTD fell by -11.2% YoY versus expectations of -10.9% and May’s -10.7%.

- June Residential Property Sales YTD fell by -5.2% YoY versus May’s -2.8%.

The stronger-than-expected Q2 GDP and Industrial Production may diminish hopes for significant stimulus, though we should anticipate continued consumer subsidy support in auto, home appliances, and electronics. This view would weigh on Mainland China since it is predominantly held by local investors.

Overnight, we also had President Xi’s speech at the two-day Central Urban Work Conference, which concluded today. The post-meeting release’s key takeaway to me was the statement that “China’s urbanization is shifting from a period of rapid growth to a period of stable development, and urban development is shifting from the stage of large-scale incremental expansion to the stage of improving quality and efficiency.” The seven tasks were focused on vague terms such as quality, green and smart while lacking specifics.

I’m not surprised the release from the top echelon of the government lacked specifics, as they prefer to utilize “subtle signs” rather than come out and tell you. However, there was no indication that the government would buy more unused inventories and issue more government bonds to support purchases, which is why the Hong Kong and Mainland China real estate sector underperformed today.

Lastly, Nvidia announced that “The U.S. government has assured Nvidia that licenses will be granted, and Nvidia hopes to start deliveries soon”. The US Commerce Department’s export approval of its H20 chip to Chinese companies removed a $15 billion potential hit to revenue. Nvidia’s CEO, Jensen Huang, is expected to speak at the China International Supply Chain Promotion Expo tomorrow. AMD is expected to receive similar approval for its MI308 chips after taking a hit of $1.5 billion in revenue. Tencent and TikTok’s parent company, Bytedance, are reportedly filing purchase paperwork.

Mainland China semiconductor stocks delivered a mixed performance on the news, while both Hong Kong and Mainland technology hardware and equipment companies outperformed, benefiting from their role as suppliers for products utilizing Nvidia chips. Kingsoft Cloud surged 16.81% on the news, whereas Semiconductor Manufacturing International Corporation’s (SMIC) Hong Kong listing declined by 1.83%. Among the most heavily traded names in Hong Kong, Alibaba jumped 6.97% with 195 million shares traded, a sharp increase from 65 million shares the previous day, as short sellers were squeezed. Tencent Holdings rose 3.5% with 27 million shares traded versus 11 million previously, and Meituan advanced 4.38% on volume of 89 million shares, up from 37 million the day before. Bilibili also gained 7.94%, following an analyst upgrade.

In regulatory developments, Zunyi City’s Chamber of Commerce released a statement titled “A Call to End Involution-Style Subsidies and Unfair Competition on Food Delivery Platforms.” This reflects the central government’s top-down directive, which is now being implemented through the bureaucratic hierarchy and could help e-commerce companies avoid destructive price wars.

On the M&A front, The Wall Street Journal reported that Chinese regulators approved Synopsys’s acquisition of Ansys, ending a prolonged review process. In international relations, Treasury Secretary Bessent appeared on Bloomberg TV, advising investors not to worry about the U.S. tariff deadline of August 8, as talks are “in a very good place.” He also mentioned meeting with Vice Premier He Lifeng. Stepping back, the trajectory of U.S.-China relations has improved significantly compared to the previous administration, and a meeting between the two leaders may be in the works, with a possible early September state visit.

After the close, Pop Mart rose 1.08% during the session and subsequently announced preliminary first-half results, with revenue rising over 200% year-over-year and net profit up 350% year-over-year.

Despite lagging the Hang Seng Tech Index, the Hang Seng Index closed above 24,500, breaking through a short—to intermediate-term resistance level. The next target is 24,800. The Hang Seng Tech Index faces resistance at 5,500, with 6,000 farther out.

Live Webinar

Join us on Tuesday, July 22, 10:00 am EDT for:

China Mid-Year Outlook: Trade Deal Loading, Consumption & Innovation Locked In

Please click here to register

New Content

Read our latest article:

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

CNY per USD 7.17 versus 7.17 yesterday

CNY per EUR 8.37 versus 8.37 yesterday

Yield on 10-Year Government Bond 1.66% versus 1.67% yesterday

Yield on 10-Year China Development Bank Bond 1.71% versus 1.73% yesterday

Copper Price -0.46%

Steel Price -0.32%