The stock market has had a historic rally from its April 7 low. Since that time, the S&P 500 has rallied strongly to achieve new record highs. This up leg has climbed a wall of worry that has included a trade war, a conflict between Israel and Iran in the Middle East, the U.S. bombing Iran, as well as economic concerns and a Federal Reserve on pause. The next obstacle for the stock market rally to continue is Q2 earnings season, which commences next week with many of the large Financial stocks reporting.

So far, the S&P 500 has seen Q2 2025 revenue estimates hold steady over the past three months. However, there has been a noticeable drift lower in EPS estimates. EPS estimates have stabilized over the past month but remain only half of expected growth from mid-April. The coming reality versus the clear expectation for margin pressure should be closely watched. As Wendy Soong of Bloomberg notes, “Q2 earnings expectations should be a low bar to beat. The margin dip will be brief this quarter and margins will likely pick up again (later in the year) from cost-cutting and price increases from companies.”

As a result, for the full-year 2025, there has also been almost no change in revenue estimates over three months, but a slight downgrade to EPS estimates. This implies that EPS growth estimates have been pushed out a bit in the second half of the year. The graphs below track the movement of revenue and earnings estimates for Q2 and for full year 2025 respectively. Notably, while consensus expectations have fallen considerably for Q2 earnings, they have fallen only 70 bps for the full year.

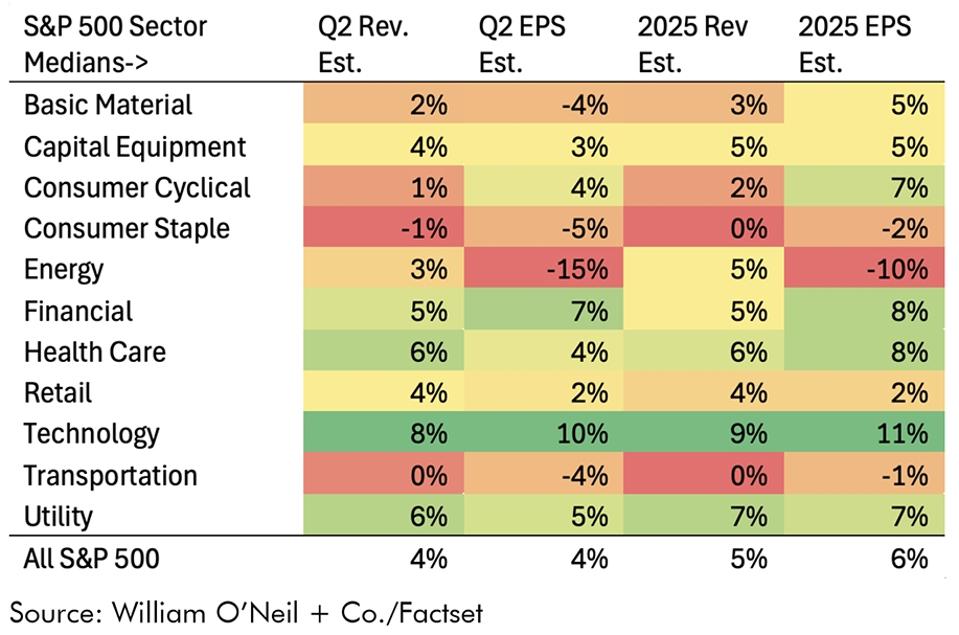

Table 1 shows by sector the median estimates for the quarter and for the full year. With regards to Q2, the most significant earnings estimates are Energy, which despite the conflict in the Middle East, are expected to fall 15% year over year and Technology, which continues to lead the market with an estimated 10% earnings growth. For the full year, Technology is again forecast to be the growth leader with 11% gains followed by Financial and Health Care at +8% each. Energy is estimated to be the worst performer for the full year as well with a 10% decline.

Figure 3 contains the median S&P 500 sector revisions to EPS over the trailing 90 days. Technology’s strength is underscored here again, as it is the only sector with positive revisions for both Q2 and the full-year 2025. Commodity sectors as well as cyclical sectors have seen the largest downgrades with Energy again being the worst with a -15% revision for the quarter and -8% for all of 2025.

While cyclical-oriented sectors have seen estimates clearly revised lower, there has also been a noticeable shift in money flows and relative performance towards these same groups. Investors may be anticipating an acceleration in economic activity in 2025. This is important as value and cyclical stocks have lagged Technology and the major growth areas of the market. For the bull market to continue, there may need to be rotation from the current growth leaders to these value and cyclical laggards. Indeed, recently some of these less expensive areas of the market have begun to perform better. Q2 earnings will be an important test of whether this can continue as many of these companies are forecast to have weak earnings results. Forward guidance will be the main determinant of whether these laggards can assume leadership or if earnings growth leader Technology continues to dominate the market. William O’Neil and Company will be studying the coming earnings results and stocks technical reactions to discern if a rotation is indeed occurring in the market. As always, we want to adopt the investment strategy that the market is showing us.

So related to this, four groups of stocks which will be interesting to follow into and through Q2 earnings.

- Leading and in many cases extended names which trended well into 52-week or all-time highs post-Q1 results.

- Lower-beta former leaders which have lagged sharply recently.

- Prior laggards which have had enough improvement to be considered for new leadership.

- Laggards which are rallying into significant overhead.

1) Using >95 RS Rating and looking for those stocks which made it back to 52-week or multi-year highs.

a. This group is characterized by high beta (median 1.6), fast growth (median 53% Q1 EPS growth), and strong earnings surprises (median 20% Q1 EPS beat). The median percent change from pre-Q1 earnings was almost 50%.

b. Groups with multiple stocks include Specialty Steel, Aerospace/Defense, Construction, Gaming, Foreign Banks, Investment Banks/Brokers, Biotech, Enterprise Software, Tech Services, and Contract Manufacturing.

c. With the median percentage from most recent pivot for this group at 30%, these are candidates to trim into Q2 earnings. The market has already begun some short-term rotation away from these leaders, in some but not all cases.

2) Using <1.2 beta, and strong 12-month outperformance (>+25% versus S&P 500 +12%) but 3-month underperformance (<+5% versus S&P 500 +20%).

a. This group has a median beta of 0.5, has fallen a median of 6% since pre-Q1 earnings, and despite posting good Q1 growth (median 25% EPS growth) only beat expectations by around 5%. While these mostly good quality names are still within bases and not broken, the lag has been severe as seen by the median 3-month RS Rating of 8.

b. Groups with multiple stocks include Gold Mining, Consulting, Autos (China EVs), Insurance, Wholesale Auto Parts, and Utilities.

c. The group likely needs to market to cool off to work better, but could be an interesting revisit as we approach the weaker seasonal period of August–September.

3) These are all coming out of or setting up in stage-one bases. They have gone from a <40 RS Rating 13 weeks ago, to an over 85 RS Rating currently.

a. The median percent change since pre-Q1 earnings is 42%, driven by median EPS growth of 29% and beats of 16%. Expectations for Q2 growth are lower than the first two categories, which could provide additional room to surprise.

b. Industry groups with multiple ideas include Auto Parts, Biotech, Discount Retail, Restaurants, Data Storage, and Semiconductors.

4) This last group is those with still poor (<50) RS Ratings, but strong (>80) 3-month RS Ratings.

a. This group is still a median of 35% off highs and mostly below 200-DMAs. Q1 EPS growth was mostly negative and missed by a median of 1%. Q2 EPS growth is also expected to be negative. These are candidates to sell into their recent strength and into significant overhead levels.

b. Industry groups with multiple ideas include Specialty Chemicals, Gaming, Leisure Products, and Biotech.

Kenley Scott, Director, Global Sector Strategist at William O’Neil + Company, made significant contributions to the data compilation, analysis, and writing for this article.