Key News

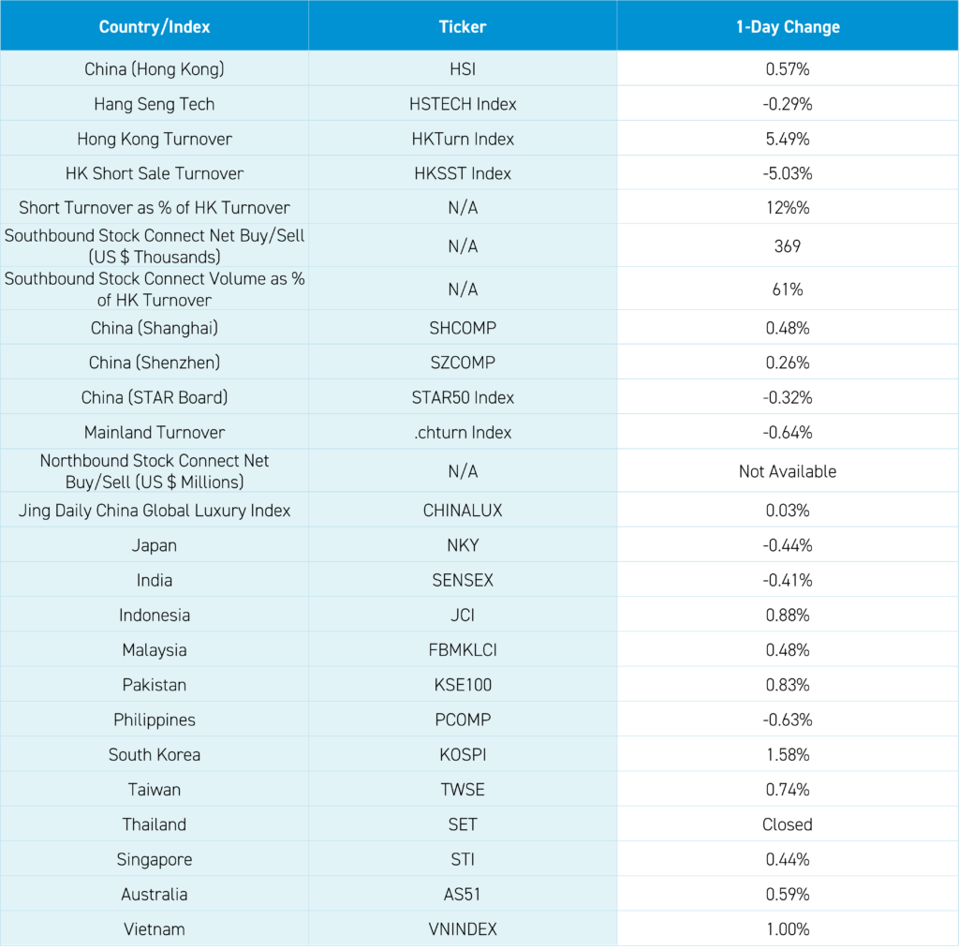

Asian equities were largely higher despite a new round of Trump tariff love letters as South Korea outperformed.

Taiwan Semiconductor Manufacturing Co. (TSMC) reported earnings after the close locally. Thailand was closed for Asarnha Bucha Day, which, according to Perplexity, commemorates the day when the Buddha delivered his first sermon, known as the “Dhammacakkappavattana Sutta” or “Setting the Wheel of Dharma in Motion”.

Before diving into today’s Hong Kong and Mainland China rally, it is worth pointing out that Southbound Stock Connect, the trading platform that allows Mainland investors to buy Hong Kong stocks (and vice versa), accounted for 61% of Hong Kong turnover. Readings above 60% are exceedingly rare, which indicates a lack of foreign investor participation, in my opinion. Despite good relative and absolute performance year-to-date and going back to January of 2024, there continues to be a lack of interest in China stocks. All you will read about today is Nvidia’s $4 trillion in market cap, which is despite a host of tailwinds forming for China’s equities. Mainland investors appear to have noticed, as Shanghai and Shenzhen broke out above their pre-Liberation day levels. Now, back to today’s note.

Real estate stocks surged +5.19% in Hong Kong and +2.38% in Mainland China, after the National Development and Reform Commission’s (NDRC) Urban and Small Town Reform and Development Center stated four “major actions of new urbanization with high quality” will be implemented in order to reach “new urbanization by 2035”. The policies include all of the below, though I bolded one of them in particular:

- “support the construction of a new round of qualified major projects”

- “allow the population to flow into cities….increase the recovery of idle land and the acquisition of existing commercial housing”

- “promote the coordinated development of new industrialization and new urbanization”

- “use fiscal, land, finance, tax , and other policies to support accelerate the introduction of industries”

- “promote new urbanization and rural revitalization”

Could the government take over unsold housing inventory to support people moving into cities from agricultural areas? That’s what this sounds like. Earlier this year, the Shenzhen Government took over distressed state-owned developer Vanke, a sign of unorthodox government involvement. Not to get too far ahead of ourselves, but, if real estate prices increase, the knock-on effects should be higher for consumer confidence and domestic consumption.

Building materials and industrials also gained on the prospect of a high level of new construction. It was an old school value rally, as banks, insurance and coal all had strong days, though I am not certain of the connection to the real estate news.

Healthcare was mixed, though Jiangsu Hengrui Pharmaceuticals gained +7.11% on an analyst upgrade.

Internet stocks were largely higher, especially versus the downdraft in their US-listed counterparts yesterday. Alibaba gained +0.29% in Hong Kong, versus a decline of -3.85% in New York yesterday. Trip.com gained +1.30% versus a gain of+1.34% in New York yesterday. Tencent fell -0.20% versus a decline of -0.80% in New York yesterday. NetEase fell -1.46% versus -2.27%. Baidu fell -1.19% versus -1.79%. JD.com fell -1.35% versus -3.36%. Bilibili fell -1.5% versus -3.57%. This appears to be American pessimism, rather than American exceptionalism.

We wrote yesterday about the potential opportunity in Asian high yield US dollar-denominated bonds, which include Chinese real estate developers. Also helping today’s move was distressed developer Logan Group, which gained +20.88% after creditors approved a debt restructuring plan.

The Ministry of Commerce (MoC) spokesperson, He Yongqian, did not confirm or deny a question on US Commerce Secretary Lutnick’s recent statement that trade negotiators from the US and China would meet soon. He also refrained from confirming whether Nvidia’s Jensen Huang would be visiting and meeting with government officials in a rumored China trip next week. One interesting information nugget from yesterday’s NDRC update on the 14th Five Year Plan was that China’s economy is expected to reach RMB 140 trillion, having grown by RMB 35 trillion during the period covered by the plan.

Domestic demand over the last four years has contributed 86.4% of economic growth, as consumption accounted for 56.2% of growth. This likely helps explain the China’s tough stance vis-a-vis US tariffs. The Ministry of Human Resources and Ministry of Finance (MoF) both stated that the basic pension payment for retirees will be increased by +2%, after having paid out RMB 6.8 trillion in 2024. The lack of significant support for retirees is a significant positive from a government budget perspective and explains an element of the US budget problem, as well.

Live Webinar

Join us Thursday, July 10, at 11 am EDT for:

$5 Trillion Humanoid Robotics Opportunity – Capitalizing On The Boom

Please click here to register

New Content

Read our latest article:

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.17 versus 7.18 yesterday

- CNY per EUR 8.41 versus 8.40 yesterday

- Yield on 10-Year Government Bond 1.66% versus 1.64% yesterday

- Yield on 10-Year China Development Bank Bond 1.72% versus 1.70% yesterday

- Copper Price -0.66%

- Steel Price +1.11%