OBSERVATIONS FROM THE FINTECH SNARK TANK

The deposit displacement numbers are staggering—and deeply concerning for banks and credit unions. According to research from Cornerstone Advisors and Investifi, more than $3 trillion has slipped out of banks’ and credit unions’ coffers and into the hands of fintechs, neobanks, and digital investment platforms over the past few years.

This isn’t just a passing trend—it’s a full-scale displacement of deposits that threatens the foundation of community financial institutions. And at the center of this disruption lies an unexpected culprit: consumer investing.

The New Face of Deposit Displacement

It’s no secret that fintechs and neobanks have been gaining market share, particularly among younger consumers. What may surprise bank and credit union executives is the scale and demographic breadth of the deposit outflow. Over the past few years:

- Fintech investment accounts have attracted $2.15 trillion in deposits from megabanks, regional banks, and community financial institutions.

- Fintech savings accounts have siphoned off another $1.05 trillion.

While younger generations—Gen Z and millennials—are often assumed to be driving this shift, Cornerstone’s study found that Gen Xers and baby boomers accounted for 65% of the funds flowing into fintech investment platforms. In other words, this isn’t just a young person’s game—it’s a systemic challenge across all age groups.

Deposit Displacement: The “Paycheck Motel” Problem

At the center of the situation is the changing role of the checking account. Increasingly, Americans treat their checking accounts like paycheck motels—temporary places for their money to stay before it moves on to higher-yield savings accounts, investment platforms, and other alternative financial services.

On average, Americans rate their primary checking account a lukewarm value rating of just 7.8 out of 10, with younger generations even less impressed. More than a third of Gen Zers and 40% of millennials say they’d be “very likely” to open a new checking account if they found a better option.

Fintechs and digital banks have seized on this dissatisfaction by offering more than just slick apps—they’re bundling checking accounts with features like:

- Fee-free overdrafts (e.g., Chime’s SpotMe)

- Instant cash advances (e.g., Dave’s ExtraCash)

- Integrated investing options

These offerings don’t just capture deposits—they reshape consumer expectations of what a financial relationship should look like.

Deposit Displacement’s Looming Investing Threat

Historically, banks and credit unions haven’t worried much about losing deposits to investment accounts. But times have changed. Today, nearly half of Gen Zers and millennials are investors, and the majority of their accounts were opened with fintechs—not traditional financial institutions—and in fact, 17% of zillennials (Gen Z and millennials) opened investment accounts through cryptocurrency exchanges.

Many of these young investors use fintech investment providers for checking, savings, and even credit cards—not just for investments. Worse, a quarter of zillennials plan to shift an existing banking relationship to a fintech in the next 12 months.

Crypto Exacerbates Deposit Displacement

The rise of cryptocurrency is amplifying this threat. Cornerstone’s research found that:

- 25% of Gen Z and 33% of millennial investors hold crypto assets.

- On average, Gen Z and millennial investors have 25% of their investable assets in cryptocurrencies.

- Among zillennial investors, 20% have more than half their portfolio in crypto.

And the momentum is growing. A third of zillennials and nearly 20% of Gen Xers plan to invest in crypto this year.

Banks and credit unions that dismiss crypto as a fringe fad risk are missing the broader investing shift that’s pulling deposits—and entire relationships—out of the traditional banking ecosystem.

Do Robinhood Customers Understand Its Business Model?

At the center of the investing-led deposit displacement is Robinhood who has amassed more than $18 billion in deposits—despite the company’s fines and business model.

A conversation on X between Frank Rotman, co-founder of VC firm QED Investors, and a friend who used Robinhood as an on-ramp into the trading world raises questions about how well-informed the fintech’s customers are about how it operates. Here’s a snippet of the conversation:

Frank: What do you like about Robinhood?

Friend: It’s free and super easy. They don’t make any money on my trades so I can move my money around a lot. I like trying a little of this and a little of that and it works because its free.

Frank: Do you realize they make money by selling your order flow to electronic trading firms? They make a little on stock trades, more on crypto and even more on options.

Friend: First I’ve heard of it. They don’t charge me anything so to me its free.

Supposedly, zillennials want “authenticity” from the companies they do business with. (Sources: 1) a 2019 Deloitte study focused on “a generation’s search for authenticity;” 2) a Huffington Post article titled Millennials Want Brands To Be More Authentic. Here’s Why That Matters; and 3) a CNBC article that claimed “Gen Z craves a personal, authentic connection.”)

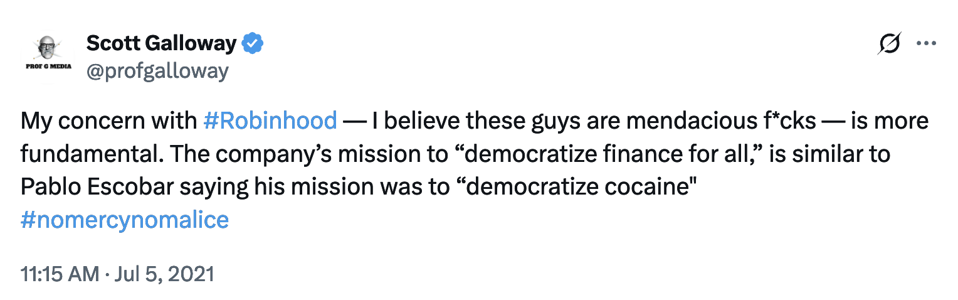

But is there any fintech less “authentic” than Robinhood? Its claim to “democratize finance for all” is nonsense. As Scott Galloway tweeted:

A consumer survey from Cornerstone Advisors asked Robinhood users what impact trading with the brokerage firm had on their financial lives. No surprise, nearly nine in 10 customers said Robinhood made it easier for them to buy and sell stocks.

But only a little more than half (54%) said the digital brokerage helped them become more educated about investing, and just 37% credited the firm with helping them improve the overall return on their investments.

The latter shouldn’t come as a surprise.

A report titled The Good, The Bad, And The Ugly About Payment For Order Flow suggested that there is some benefit—in terms of lower order price—from payment from order flow (PFOF) to retail customers. But the report concludes that the downsides of PFOF far outweigh the benefit to the average retail investor.

Because Robinhood makes money by selling order flow, it will always place the needs and priorities of the companies that pay for that order flow over the needs and wants of its users.

The $2 Trillion Deposit Displacement Opportunity

The deposit displacement crisis isn’t irreversible. Cornerstone estimates that banks and credit unions can realistically reclaim about a third of the nearly $2 trillion in funds lost to fintech investing platforms.

The key? Developing integrated investing services that:

- Allow consumers to invest directly from their checking account.

- Offer bundled financial wellness features like credit score monitoring and subscription management.

- Provide seamless, mobile-first investment experiences within existing digital banking platforms.

- Deliver targeted education to demystify investing, especially for young consumers who believe they don’t have enough money to get started.

In fact, 70% of non-investing Gen Zers and Millennials report having more than $5,000 in savings—plenty to open an investment account. The problem isn’t capability—it’s awareness and access.

Community banks and credit unions can’t simply “market harder” or “be cool like Robinhood” to win back lost deposits. They must:

- Reimagine their checking and savings products to integrate investing.

- Partner with fintechs or investtech providers to embed seamless investment options.

- Equip consumers with tools and education to overcome investing barriers.

- Expand digital capabilities to meet the expectations set by neobanks and crypto platforms.

Conclusion: A Deposit Displacement Call to Action

The $2 trillion deposit outflow isn’t just a threat—it’s a wake-up call. Banks and credit unions have a limited window to evolve their product offerings, digital experiences, and customer education strategies to stem the tide.

Those that move quickly to integrate investing into their core banking relationships can not only defend against deposit displacement but unlock new growth opportunities.

For a complimentary copy of the report Stemming the Deposit Outflow: The $2 Trillion Investing Opportunity for Banks and Credit Unions, click here.