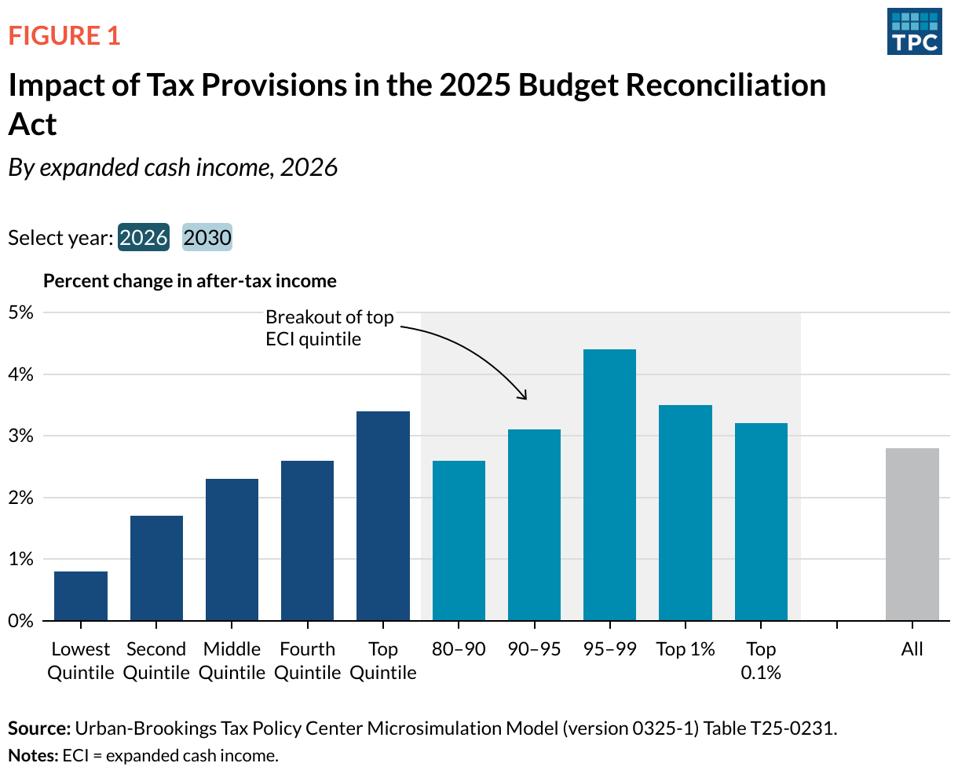

The Tax Policy Center finds that 85% of households will get a tax cut. Here’s how much your after-tax income will increase: for low, middle and high-income earners.

After wading through meetings and conversations with congressional Republicans, President Trump secured a huge legislative victory this week—before his self-imposed July 4 deadline.

The Senate passed President Trump’s huge domestic policy bill on Tuesday, and the House passed the same bill—without changes—on Thursday and forwarded the One Big Beautiful Bill to the White House for Trump’s signature on Friday. Trump is celebrating and will sign the bill into law with “beautiful planes flying over our heads.” The beautiful planes the president mentioned are expected to be B-2 bomber planes.

Among the many things Trump, his supporters and proponents of the big, beautiful bill will celebrate are the tax cuts. When he signs the bill Friday, President Trump will make his 2017 tax cuts permanent and expand tax breaks (in small and larger percentages) for low, middle and high-income earners and households all across the country.

After-Tax Income Increase by Income Bracket

The Tax Policy Center (TPC) completed a deep dive into the One Big Beautiful Bill, specifically related to Trump’s tax overhaul. The TPC finds that approximately 85% of households will receive a tax cut for 2026, and this will drop to approximately 70% of households by 2030.

Miriam Waldvogel with The Hill breaks down TPC findings as follows:

Of the 85% of households expected to receive tax cuts, the majority (60%)

“of the tax benefits would go to those in the top quintile of annual incomes, or about $217,000 or more. Those households would receive an average tax cut of $12,500.”

Low-Income Earners: After-Tax Income Resulting from Trump’s Bill

- For those earning less than $34,000, you’d see your taxes cut by approximately $150. This amounts to an average 0.8% increase in your after-tax income increase.

- If you earn between $40,000 and $50,000, it’s likely you’ll see your taxes cut by about $630. This amounts to an average after-tax income increase between 1.5% and 1.9% depending on your earned income within this range.

Middle-Income Earners: After-Tax Income Resulting from Trump’s Bill

- If you earn between $50,000 and $75,000 per year, you’re likely to see an after-tax income increase of $1,000, give or take for averages.

- For those earning between $75,000 and $100,000, you’d see (on average) your taxes cut by approximately $1,700. You’d get about a 2.3% increase in your after-tax income increase.

- If you earn between $100,000 and $200,000, it’s likely you’ll see your taxes cut by about $3,000. This amounts to an average after-tax income increase of 2.5%.

High-Income Earners: After-Tax Income Resulting from Trump’s Bill

- For those earning between $217,000 and $318,000, you’d get a tax cut of about $5,400. This reflects an average 2.6% percent after-tax income increase.

- If you earn between $318,000 and $460,000, your tax cut would amount to approximately $8,900; this is an after-tax income increase of 3.1%.

- If you earn between $460,000 and $1.1 million, you’d likely receive a $21,000 tax cut. This would be a 4.4% after-tax income increase. Of all the levels, this specific income bracket of high earners is expected to see the largest percentage gain (4.4%) in after-tax income of all the groups.

- For the top 1 percent and top 0.1 percent of earners—people making $1.1 million up to $5 million—you’d see an after-tax income increase of between 3.2% and 3.5% respectively.

Though I’ve described Waldvogel’s breakdown of TPC’s findings, you can review TPC’s analysis for yourself. Other tax analysts have reviewed the tax implications for earners as well. Explore these findings by the Institute on Taxation and Economic Policy (TEP) that demonstrate how the big, beautiful bill will, “give $117 billion in tax cuts to the top 1% in 2026.”

TEP outlines how different high earners will receive different tax cuts depending on where they live—not only what they earn.

Regardless of where you look, you’ll find similar results. Trump’s tax cuts aren’t distributed evenly by percentage across all income brackets. Higher earners get a larger tax-cut percentage. The tax cuts, while benefitting earners at all levels, provide higher percentage cuts to higher earners as a whole.

The dilemma here is that those who need the safety-net programs the most will be at the greatest risk to lose them and yet, these same people (low-income earners) receive a smaller tax-cut percentage and will see the smallest after-tax income increases.

But, those who are less likely to depend on safety-net programs (middle and high-income earners) stand to benefit with progressively larger after-tax income increases.

Does Trump’s Big Beautiful Bill Hurt More than It Helps?

While Democrats had a problem with the big beautiful Trump bill, they weren’t alone. Congressional Republicans publicly “savaged” the bill before ultimately voting for it.

Emily Peck with Axios says that the bill, “slashes food and health benefits for the poorest Americans, while giving tax cuts to higher earners — blowing a hole in the nation’s safety net, according to healthcare experts and advocates for lower-income people.” She goes on to summarize experts as saying,

“the cuts could unleash a tidal wave of pain — overcrowded emergency rooms, an increase in chronic health care issues, more medical debt, and more folks going hungry.”

There are arguments on both sides for who wins and who loses. The bill makes a lot of cuts. In addition to tax cuts, the big, beautiful bill makes cuts to—and puts restrictions on—some of America’s core safety-net programs to include Medicaid, the Affordable Care Act and the Supplemental Nutrition Assistance Program (SNAP: aka food stamps).

A primary issue of concern for opponents of the bill that Trump will sign into law Friday is that when you offset the tax cuts with the financial, health and food benefit losses for families, households and income earners, the tax cuts could get drowned out on the scale.

The worry is that millions of families and income earners will ultimately experience a financial deficit instead of a gain because the programs and services they may lose outweigh any financial gain they’ll get from the tax cuts.

With all of this, there are indeed some winners in the big beautiful bill. Among the many, I’ve described four key winners to be:

- President Donald Trump

- Employers, corporations, small businesses and manufacturers

- High-income earners

- Employees who earn overtime and tip income

But, if people come to believe or experience that the country’s poor, needy, disabled or elderly are worse off because safety-net programs were sacrificed to fund tax cuts for the upper class, will the tax cuts matter?

However, if people come to believe or experience that America is taking care of the needy, poor, disabled and elderly while simultaneously providing tax cuts, Trump’s bill could be viewed by more Americans—even the worried Republicans—in a positive light.

Recommended reading:

Trump Signs The Bill Today: 4 Winners Of The New ‘Big Beautiful Bill’

How Long Will The Federal Hiring Freeze Last? Implications For Government Employees