easyJet shares (LON:EZJ) have had a turbulent past couple of weeks due to the conflict in the Middle East. Given the geopolitical instability in the region, it’s worth assessing whether the stock is still worth buying.

A Sticky Relationship

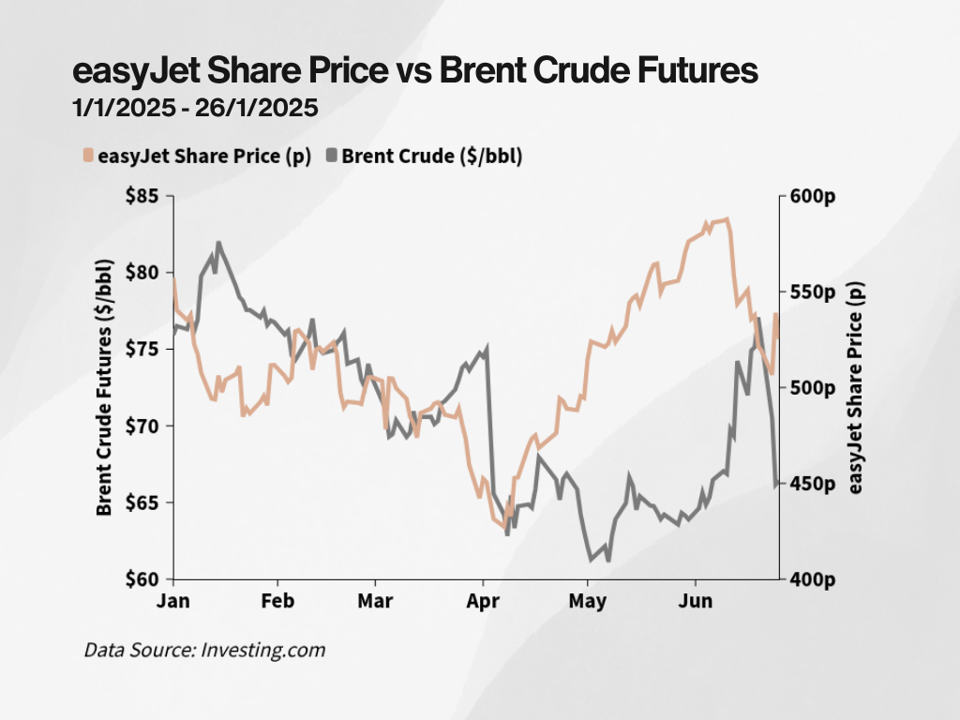

One can be forgiven for thinking of easyJet as an inverted oil stock since April, given how it’s been trading like one. Its share price has had an inverse relationship with oil prices, and it’s understandable considering fuel takes up 29.9% of easyJet’s headline airline EBITDA costs. As such, its cost base could skyrocket if oil prices spike. This can lead to margin contraction and lower earnings, which the market seems to be wary of.

That said, speculative calls made by big banks such as JP Morgan about oil climbing to $130/bbl haven’t come to fruition, and are unlikely to, in my opinion. I hold this view for two reasons – economic upheaval, and a ceasefire having been reached between Israel and Iran. In fact, since the US executed Operation Midnight Hammer on Iran’s nuclear facilities, oil prices have slid down to their pre-attack levels of around $68/bbl.

More specifically, despite the Iranian parliament’s vote to close the Strait of Hormuz – where about 20.0% of the globe’s oil supply flows through – its national security council has yet to sign off on it. 90.0% of Iran’s oil exports pass through the strait, and accounts for 76.5% of government revenue. Closing the strait would mean Iran facing a catastrophic economic collapse, which would severely undermine the regime’s stability.

Plus, Iran’s previous attempt to close the strait in the 1980s wasn’t a success, either, as the US Navy intervened then to protect shipping lanes. Not to mention, most of the strait’s oil exports go to many of Iran’s ‘allies’ such as China, while the US and Europe get most of their oil from other regions. China in particular, wouldn’t be too pleased with a disruption, given that almost half of its oil imports stem from the strait itself.

But even in the event of higher oil prices, it’s worth highlighting that easyJet remains well positioned to overcome any short-term spikes thanks to its well-hedged oil contracts. As a matter of fact, its H2 oil supply is hedged at a whopping 83.0% at $750/MT (the current spot rate has come back down to $714). Additionally, it’s already hedged about 45.0% of its fuel for FY26 at an average rate of $709/MT.

Flying Numbers

Regardless, geopolitical events – even prior to the missile exchanges between Israel and Iran – haven’t weighed on travel demand. After all, management reiterated its full-year guidance on the back of an affirming set of interim results. They’ve cited forward sales for H2 being up Y/Y, even before the peak summer booking period, with higher load factors, and the expectation for fuel CASK to drop about 8.0% for FY25.

This builds on a solid set of H1 numbers, where group revenue was up 8.1% to £3.53 billion. Primarily, passenger revenue grew a healthy 5.4% to £2.16 billion, as travel demand remained robust and was able to meet the higher capacity introduced. This was evident in the 1.2% uptick in easyJet’s load factor to 87.9%, as passenger numbers rose 7.6% to 39,371k, outpacing seat growth of 6.1% to 44,915k.

Meanwhile, ancillary revenue jumped 7.4% to £978 million. Nonetheless, the main growth driver was the company’s packaged holidays segment which realised a 28.6% increase in revenue to £400 million. According to the board, easyJet’s Holidays business expanded its market share yet again, by another 2.0% to 9.0%, as customer numbers leaped 27.3% to 1,067k. This was accompanied by a 1.0% rise in ASP to £578.

Although critics will point to the headline EBITDA turning to a loss this year (-£5 million), it’s worth noting that this was down to two main reasons. The first is the unfavourable timing of Easter, which falls in Q3 this year. The second was the promotional pricing for the launch of firm’s new winter leisure routes in order to stimulate demand and reduce winter losses moving forward.

CEO Kenton Jarvis mentioned that excluding the unfavourable timing of Easter this year, H1’s PBT would’ve been around £50 million higher at -£344 million, eking a marginal improvement from last year’s figure of -£350 million. This marks a step in the right direction towards easyJet’s medium-term goal of turning its historical winter losses into profit.

En Route to Higher Profits

That being said, zooming out of geopolitics, I am of the belief that easyJet is a great investment. I’m particularly impressed by the group’s medium-term targets, which remain in tact. This includes achieving more than £1.00 billion in PBT, of which £250 million will be generated from Holidays, along with a newer fleet bringing more than £3 of unit cost savings, amongst many other goals.

What’s more, the reallocation and launching of new routes to maximise profitability is beginning to pay dividends, alongside the closure of about 50 unprofitable routes. This summer, easyJet will operate out of its new bases in London Southend, Milan Linate, and Rome Fiumicino, where demand has reportedly been strong. Consequently, this should bring higher margins via more ancillary opportunities and higher load factors.

Moreover, with Holidays’ attachment rate still at a measly 6.4%, easyJet has plenty of opportunities to grow. This will be well complemented with the fact that competition on certain routes are also cooling. For instance, Wizz Air has retracted 14 of its head-to-head routes with easyJet this summer, which should give the Gatwick-based airline scope to grab more market share and customers over the busy holiday season.

It’s no secret that easyJet shares have essentially been in limbo over the past couple of years, having failed to breach 600p since 2022. However, the stock’s valuation looks extremely cheap, especially when taking its earnings growth since into consideration. Thus, I believe the market has overdone its fear on this stock, as I project easyJet’s EBIT margin growing by a full 100bps by FY28 to 7.41%.

Many of the stock’s key multiples such as EV/EBITDA (2.7) suggest easyJet is criminally undervalued when compared to its sector average (7.7). Paired with a relatively conservative PEG of 0.6 versus the sector’s 1.5, and there’s certainly a strong argument to be made here that the shares are trading at an absolute bargain, with earnings projected to grow at a CAGR of 16.4% through to FY28.