Update from January Sell-Off in Artificial Intelligence

January 27, 2025, saw several dozen stocks related to artificial intelligence infrastructure post lag single day drops, in many cases just days after reaching 52-week highs. The news of a large language model being developed (DeepSeek) for much cheaper than had been previously thought capable was released. Shortly after, we looked for past precedent of stocks dropping very quickly from highs and for what the playbook going forward had been.

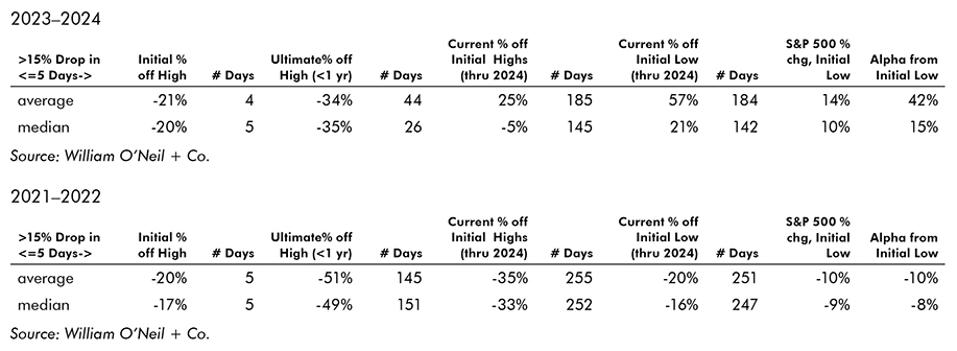

We looked back over the past four years, and here when stocks above the $10B market cap dropped at least 15% from 52-week or all-time highs within a five-day period, and tracked their trajectory going forward.

Considering very different general market environments, it may be useful to separate the results into two time periods, 2023–2024 and 2021–2022.

Some notes on the results from above:

- In both periods, stocks regularly fell further from the initial drop. But the general market clearly affected the results.

- In 2023–2024 cases, the group of stocks made their ultimate low a median of about five weeks off highs and were off 35%.

- In 2021–2022 cases, the group of stocks made their ultimate low a median of about 22 weeks off highs and were off 49%.

- In 2023–2024, the group of stocks actually outperformed the S&P 500 after the initial drop, while in 2021-2022, the initial drop was a general sell signal.

- 2023–2024 generated median alpha of 15% after first low. About 59% of these stocks made it back to highs within one year.

- 2021–2022 generated median alpha of -8% after first low. About 30% of these stocks made it back to highs within one year.

Separating the groups by those who made it back to 52-week highs and those who did not (using a forward one-year period from the initial low), the results are below.

A decent indicator of whether or not a stock would make it back to highs has been the 200-DMA. Not surprisingly, those with a breach of the 200-DMA made it back to highs less often.

Some examples. First from 2023–2024 we can look at four basic categories of outcomes below. For each stock example, the month in parentheses is the month of the initial drop from highs.

- Rapid Recovery – Back to highs much faster than others which made it back to highs. About 17% of stocks were in this group.

- Examples include RKLB (December 2024), HOOD (October 2024), CAVA (July 2024), MSTR (March 2024), and SMCI (February 2024).

- More Typical Recovery – Those which made it back to highs, in or around median length of time. About 25% of stocks were in this group.

- Examples include SN (October 2024), CLS (July 2024), RDDT (July 2024), DKNG (August 2023), and SPOT (July 2023).

- Below Typical Recovery – Those which did make it back to highs within a year, but took a more extended period of time. About 17% of stocks were in this group.

- Examples include Expedia (February 2024), ONON (August 2023), PCOR (August 2023), and TOST (July 2023).

- No Recovery to Highs – Many with significant lag since initial drop. About 40% of stocks were in this group.

- Examples include AMD (March 2024), MEDP (July 2024), FSLR (June 2024), and ASML (July 2024).

And from 2021–2022 we can look at four cases. Notice the very different percentage breakdowns in each category.

- Rapid Recovery – Back to highs much faster than others which made it back to highs. About 5% of stocks were in this group.

- Examples include FCX (January 2022) and OXY (July 2021).

- More Typical Recovery – Those which made it back to highs, in or around median length of time. About 15% of stocks were in this group.

- Examples include SLB (June 2022), TYL (March 2021), and NET (February 2021).

- Below Typical Recovery – Those which did make it back to highs within a year, but took a more extended period of time. About 12% of stocks were in this group.

- Examples include HCA (April 2022), YPF (September 2021) and TECK (June 2022).

- No Recovery to Highs – Many with significant lag since initial drop. About 68% of stocks were in this group.

- Examples include ALB (November 2022), MU (January 2022), AFRM (November 2021), RBLX (November 2021), DDOG (November 2021), DASH (November 2021), and SOFI (February 2021).

Now for the current batch of stocks that initially dropped sharply in January.

Image5

Some notes on the results from above:

- Stocks regularly fell much further from the initial drop, which appeared more in-line with 2021–2022 by percent loss, but closer to 2023–2024 by time to lows.

- In both 2021–2022 and 2025 cases, the group of stocks ultimately fell to a median of 50% off highs. However, the lows were reached more quicker in 2025 (51 days) versus 2021-2022 (151).

- In 2023–2024, the group of stocks fell to a median of 35% off highs and only took 26 days to reach lows.

- The rally from lows has appeared more like the 2023–2024 cases, with the group clearly outperforming the S&P 500 from the initial lows.

- But the current group of stocks remains a median of 15% off highs and only three made it back to highs: RKLB (very quickly but just briefly after drop), CLS (very quickly but just briefly after drop), and GEV (this week). This is after a similar amount of time has passed (four months) where many stocks in the 2023–2024 cases were already making it back to highs.

- It is also notable that while we have favored earlier re-entry in some of these stocks (PWR, GEV, ALAB, CLS, NVDA, NOW) as they have broken above March or April base midpoint highs, most have not fully completed bases yet.

So overall, enough time has passed to begin judging the health of the recoveries. Clearly these types of sell-offs have acted better than 2021–2022, but are taking longer given they are coming from deeper corrections versus 2023–2024). It remains early to judge those making it back to highs versus those not, as right sides of bases are generally being built. But here are three examples of stocks in the group:

- One back at highs – GEV, which took a bit longer than the median stock in 2023–2024 to reach lows, but a similar amount of time to make it back to highs.

- One acting like the median stock in the 2025 group – CIEN, which took the same time and fell the same amount to lows, and has rallied back to a similar current percent from highs (setting up more like the ”back-to-highs” category from 2023–2024, but still too early to be sure).

- And one much worse than the median – MRVL, which fell further and has rallied back much less than the 2025 group (more similar to 2021–2022 stocks).

Kenley Scott, Director, Global Sector Strategist at William O’Neil + Company, was the lead author and made significant contributions to the data compilation, analysis, and writing for this article.