Global merchant payment processing and acquiring net revenue surpassed $91 billion in 2023, and is on pace to exceed $171 billion by 2030, according to S&P Global Market Intelligence’s 451 Research. This large and growing opportunity has resulted in a crowded market awash with similar vendor positioning statements. As a result, many enterprises and investors struggle to identify the capabilities that help separate leaders from laggards. In response to numerous client inquiries on the topic, we have developed the FAST framework to assist payment technology buyers and market stakeholders in better assessing the merchant payment processor vendor landscape.

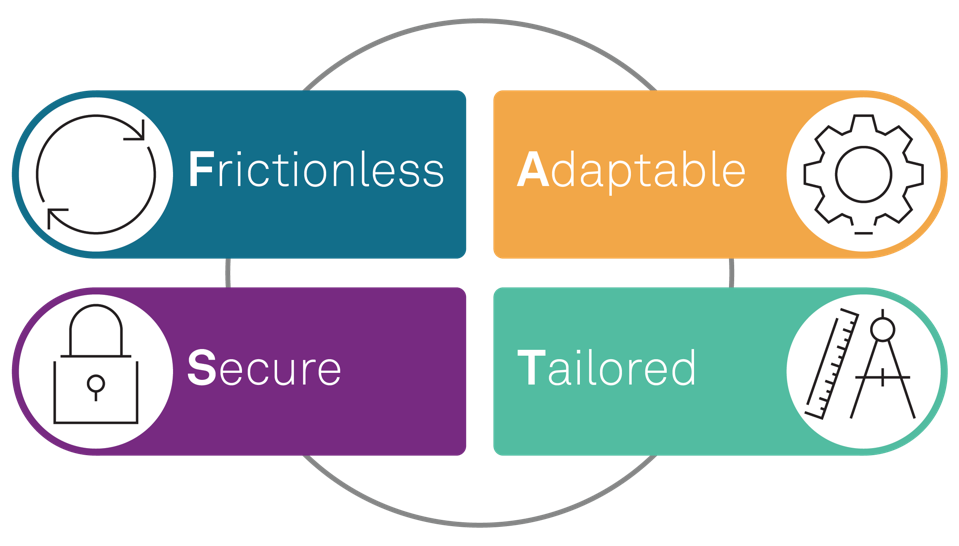

When evaluating merchant payment processors, we organize key capabilities and attributes into what we call the FAST framework: Frictionless, Adaptable, Secure, Tailored. This framework serves as a tool to evaluate vendors, understand the breadth and depth of their offerings, and assess their ability to drive business outcomes for merchant end users. Each of these areas is discussed in greater detail below

Frictionless

Frictionless has been a buzzword associated with payments for the better part of the past decade. While commonly used to describe an ideal experience for the consumer, frictionless is equally important when thinking about how payments are integrated and leveraged by the merchant. Key attributes we look for include:

Alternative payment methods (APMs). Connections into payment methods that appeal to specific demographics and global shoppers are key to driving conversions and creating a winning checkout experience. However, the number and variety of payment methods offered are only part of the equation. We also evaluate vendors’ ability to customize the checkout page (e.g., dynamic presentment) and their ability to abstract the development and contractual complexity of “turning on” payment methods for merchants.

Overall ease of integration. This includes the development work required to go live, the use of modern APIs, multiple integration options (e.g., no code, API), documentation, platform modularity and composability, preexisting integrations into various software packages (e-commerce, CRM, accounting), and implementation support.

Global connectivity. Payment processors with robust global capabilities can help merchants more easily expand their business and reach new customers. Here, critically important factors include local acquiring, local presence and expertise, APMs, local card network and payment rail integrations, multicurrency and FX management capabilities, dynamic currency conversion, checkout form customizations, and ability to accommodate local regulations (such as PSD2).

Insight. Strong merchant payment processors make it easy to unlock insight that can be used to better understand customers, identify revenue growth opportunities and optimize costs. Capabilities such as real-time reporting, customizable reports, analytics, dashboards tracking key KPIs and metrics, APIs, and data warehouse integrations are particularly top of mind.

Adaptable

A strong merchant payment processor helps enterprises gain adaptability by creating efficiencies and positioning them to better respond to shifts and market opportunities. We believe adaptability also means that the merchant payment processor is equipped to quickly accommodate customer changes like volume spikes and optimize the transaction flow in real time based on specific attributes. Much of this is predicated on having a modern tech stack. Key attributes we look for include:

Uptime and scalability. Downtime results in lost revenue and negative impacts to customer lifetime value. Here, even basis points matter — the difference between 99.9% uptime and 99.999% uptime is more than 8.5 hours per year that a merchant is unable to accept payments. Scalability is also essential to ensure the merchant payment processor can accommodate spikes in order flow during peak periods.

Optimizers. The ability to drive topline revenue growth has become an important source of value for merchant payment processors. Here we look for capabilities that help optimize the transaction flow and drive higher authorizations. This includes dynamic account updater, retry logic for failed transactions, transaction routing (such as PIN debit routing), network tokens, preauthorization data sharing arrangements with card issuers, and dynamic 3D Secure.

Single platform. A single platform is a critical architectural attribute directly supporting performance, data quality, uptime, innovation speed, developer experience and more. Here it is important to look beyond patchworks and identify providers with truly unified processing stacks, simple APIs and cloud infrastructure. We also place priority on modularity and composability, which allows merchants to choose the capabilities that are right for their business today, and expand over time.

Omnichannel. Tightly integrated omnichannel payment capabilities help reduce complexity while creating a seamless and consistent payment experience across channels. This elevates the customer experience, and helps create a single view of the customer for the merchant. Strong omnichannel capabilities go beyond traditional browser and point-of-sale-based payments to encompass emerging checkout experiences like pay-by-link and Tap to Pay on the iPhone. Several of the capabilities we look for include omnichannel tokens, multiple point-of-sale terminal device options, card-linked loyalty, unified reporting, and extensive point-of-sale and e-commerce software integrations.

Adjacent capabilities. While not a requirement for every business, adjacent capabilities beyond core processing services can help merchants capitalize on opportunities to improve and innovate their business. Embedded finance offerings like card issuance and working capital, along with more traditional offerings like gift card programs and in-house fraud prevention engines, can deepen the level of value a merchant payment processor can provide.

Secure

Although strong security is nonnegotiable when it comes to merchant payment processing, providers can distance themselves from the pack by employing various optimizations to drive improvements to top- and bottom-line performance and the overall customer experience. Best-in-class providers obsess over the fine-tuning that makes security more advanced and invisible. Key attributes we look for include:

Dynamic network tokens and EMV’s 3-D Secure. Network tokens and EMV 3-D Secure have a strong story for lowering acceptance costs and fraud while lifting authorizations. In fact, 52% of e-commerce merchants tell us they believe EMV 3D-Secure will provide “significant value” for their business over the next three years, and 44% say the same for network tokens, according to 451 Research’s Customer Experience & Commerce, Merchant Study 2023. While offering streamlined access is important, strong providers can help merchants employ these technologies dynamically to maximize successful transactions.

Fraud prevention capability. Nearly all merchant payment processors offer a fraud prevention capability. Many are through partnerships with third-party fraud prevention vendors, and a select few offer homegrown solutions. For those offering capabilities through partnerships, we look at the depth and quality of the integration. Those with in-house capabilities are measured against independent providers in areas like false decline mitigation, customizability, issuer partnerships, and ability to prevent various types of fraud threats.

Tools to minimize chargebacks. Chargebacks remain a persistent challenge for merchants, and can result in significant operational complexity and financial damage. Services that assist with optimizing and automating dispute responses can help increase win rates and drive operational efficiencies.

Data privacy and security. Capabilities that increase security and reduce compliance burden, such as vaulting, tokenization, end-to-end encryption and hosted payment pages, can add significant value for merchants. We are especially intrigued by security capabilities that drive optimizations, multiprocessor vaulting, and the ability to programmatically remove stagnant credentials. Looking ahead, increasingly on our radar will be adherence to PCI DSS 4.0, which has a looming March 2025 compliance deadline.

Tailored

Merchant payment processors should offer flexible and well-tailored capabilities aligned with the individual business requirements and priorities of their customers. This is realized through a combination of expertise, platform architecture and specific capabilities. Key attributes we look for include:

Local expertise. Merchants selling into specific geographies should look for payment processors that have a boots-on-the-ground presence with integrations into local providers (APMs, acquirers) and close ties with local regulators. Local expertise and presence can have a significant impact on a merchant’s ability to win international customers and deliver the payment experiences they expect.

Vertical and business model expertise. Each industry vertical and business model has its own payment nuances that often require customized capabilities. From EBT payments in grocery and payouts in marketplaces to invoicing in SaaS and extended authorizations in travel, payment processors need to deeply understand the requirements of the customer segments they serve and have capabilities highly tailored to their needs.

Support. Beyond 24/7 multichannel customer support and dedicated account management, we view advisory services and implementation services as important value-adds sought after by enterprise payment technology buyers. Merchant payment processors should have frameworks in place to foster responsive support and deeper collaboration and strategy development.

Partner ecosystem. A robust partner ecosystem inclusive of software providers, systems integrators, agencies, professional services and hardware vendors (point-of-sale terminals) ensures merchants have the support they need to get up and running quickly. Formal partner programs (training, sales enablement) complete with partner portals and benefits (sponsorships, events) play an important role in fostering a strong and engaged partner ecosystem.