President Biden released his budget recently, stating it would reduce the deficit by $3 trillion over the next decade. It’s true that smaller deficits would result in a slower growing national debt. Interestingly, his budget weighs in at a whopping $7.3 trillion, approximately $2.6 trillion more than current revenue. It’s also close to $500 billion more than the highest level of spending, which occurred in fiscal year ending September 30, 2021. If passed, it would be the highest level of spending, ever. How will spending much more than you collect result in smaller deficits? Let’s look at this along with each party’s approach to reducing the debt. The contrast is noteworthy.

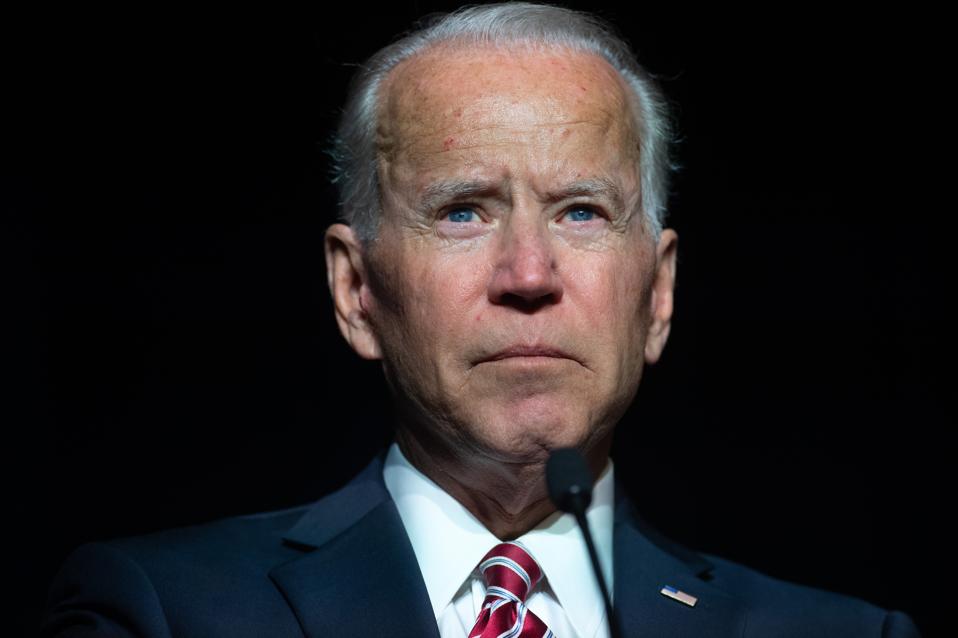

Biden’s Budget Proposal

It’s important to understand that a president’s budget rarely makes it into law. Why? Because Congress oversees spending, not the president. The president may choose to sign Congresses budget or not, but the budget process is under the purview of Congress. Regardless, discussing Biden’s budget reveals a bit about his philosophy in terms of dealing with the economy and use of social programs. As you might imagine, a $7.3 trillion budget has a lot in it. Here are a few highlights from the president’s budget with a focus on tax increases.

As mentioned, the budget calls for $7.3 trillion in spending. With a backdrop of $4.7 trillion in revenue, the deficit would be about $2.6 trillion. How do larger deficits today bring about smaller deficits over the next 10 years? The answer is that the economy must grow at a rapid pace and lead to an increase in collected revenue. When you ask democrats how they would reduce the national debt, they will suggest tax increases on the rich. Since most Americans are not rich, and many are struggling to make ends meet, this message has a wide appeal and has become popular in recent decades.

The president’s budget assumes revenue will increase by $4.9 trillion over the next decade. Part of this is due to tax increases such as a new 25% minimum tax on billionaires. This provision assumes the rich will simply lay down and accept paying higher taxes. Some may, but it is more likely that those affected will take action to reduce their tax liability, which will result in less tax revenue collected.

The budget also includes other tax hikes such as raising the corporate income tax to 28% and increasing the corporate minimum tax rate on the largest corporations from 15% to 21%. One additional budget item is to deny tax deductions on corporations that pay any employee more than $1 million. While a few of the other tax hikes may have a chance of passing, denying tax deductions to corporations that pay any employee more than $1 million will not. At least not yet. This provision targets upper management who routinely collect over $1 million in compensation. According to Equilar.com, even the lowest paid CEO in the top 100 list earned over $17 million in 2021. This part of Biden’s budget would eliminate tax deductions on most large U.S. corporations. If it were law, tax inversions would likely increase as U.S. corporations would leave the U.S. in favor of lower tax domiciles such as Ireland. Remember, corporations are focused on profits and will employ strategies to keep taxes low.

The Difference Between Democrats and Republicans on the National Debt and Deficit

I mentioned above that when asked how to reduce the national debt, Democrats and Republicans offer a very different response. Both parties indicate the need to increase revenue. Democrats suggest raising taxes on the rich while Republicans say we need to grow the economy. Although the Republicans come closest to the best answer, neither is entirely correct. The best answer is to grow the economy AND cut spending. In essence, the federal government has a spending problem, not a revenue problem. Bringing revenue up to the current level of expenses would require a multitude of new taxes and a strong economy. Interestingly, we have a strong economy today, and yet, we still have record deficits. Therefore, growing the economy is vital, but we must get spending under control.

This is really a long-standing debate between socialism and capitalism. Both views attempt to address the needs of citizens, but each has a very different approach. Socialism relies on the government to meet those needs while capitalism works to get people off welfare and become productive, tax-paying members of society. However, the longer socialism exists, the more dependent people become, and the more difficult it is getting people off welfare.

With our current strong economy, Congress is capitalizing on this opportunity to spend more. Both parties are guilty, and with this being an election year, we should expect overspending to continue as politicians seek to remain in power. Will a record level of spending help bring about a reduction in the deficit over the next decade? It’s doubtful, but a lot could happen in the next decade.