Bitcoin rallied from $42,000 in January to $72,000 by March 12 to set a new all-time-high (ATH) a week after its 2021 ATH of $70,000, while the U.S. Federal Reserve kept interest rates unchanged in its March 19-20 meeting, though rate cuts are expected later in 2024.

Uncertain and volatile macroeconomic conditions may play a role in the price of bitcoin, half of the world’s population is voting this year in elections, however, two key factors can been attributed to bitcoin’s positive performance and bringing the bulls back to crypto.

First, the U.S. SEC approved 11 spot bitcoin exchange-traded funds (ETFs) in January, after several months of delay. While the regulator did not endorse bitcoin, the ETFs serve 10 years of pent-up demand to better bring bitcoin to the public, as pointed out by MicroStrategy CEO, Michael Saylor.

The approval has helped to consolidate BTC’s position as a global asset class, regaining some of the public confidence lost following the FTX bankruptcy. Notably, bitcoin ETFs are getting over $2 billion in daily capital inflows, which is roughly 30 percent of BTC’s total inflow as of March 13.

Blackrock’s bitcoin ETF was the fastest growing ETF in history to hit the $10 billion mark in funds under management, in less than two months, and is now lauded by many as trust in new digital technology is strengthened.

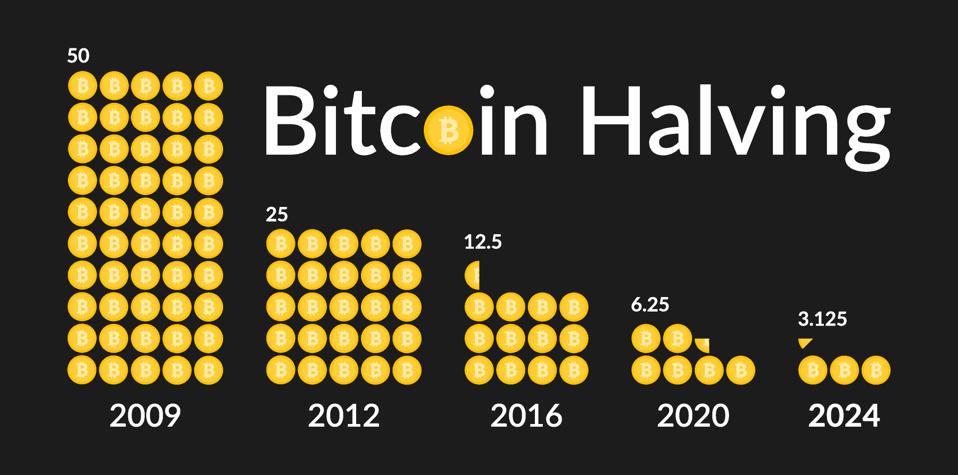

The second factor is that the ETFs arrived just before the 4th Bitcoin Halving event, expected sometime mid-April. For the uninitiated, bitcoin halving is the process by which the Bitcoin network algorithmically reduces the block rewards that miners receive for validating each block of the network by half every 210,000 blocks roughly every four years.

This deflationary mechanism reduces bitcoin’s supply and sometime in April mining production will reduce from 900 to 450 BTC daily. Halving usually has a positive impact on BTC prices and this one is likely to be the most consequential halving in bitcoin’s history.

“The bitcoin halving event is widely regarded as a significant catalyst for positive price action in the bitcoin market,” says Alissa Ostrove, Chief of Staff at CCData, “The reduction in supply, assuming demand remains constant or increases, can lead to a rise in the price of bitcoin.”

The demand impact is the equivalent to buying $8.5 billion of bitcoin every year, or $23 million daily, for the next four years. Combine this with the ETF-led demand we are currently witnessing and 2024 could be the year of bitcoin’s public mainstream mass adoption.

Historically, this supply shock plays a positive role in driving higher prices, during the breakout phase which tends to follow the halving over the span of 3 cycles, as denoted in the chart.

Increased scarcity, with constant demand, drives prices higher. As supply continues to reduce, the existing coins become more valuable. The reduction in supply combined with the illiquidity of the supply held by longer-term BTC holders and ETF accumulation creates greater price action.

The supply shock catalyst draws attention to bitcoin and the asset class, which ultimately leads to new inflows as expectations of higher prices are widely mooted, largely as a result of the cyclical price action which seems to follow halving events.

Ostrove adds, “These cycles create expectations for investors which potentially act as a positive feedback loop when considering historical patterns associated with the event.”

The potential returns in this cycle might not mirror the staggering highs of past cycles, largely due to bitcoin’s expanded market capitalization. It is, however, to be noted that this is the first cycle with substantial institutional participation and significant inflows from spot bitcoin ETFs .

This new dynamic could potentially contribute to reshaping bitcoin’s historic market behavior, adding a new layer of complexity along with the new organic demand to the asset class.

The Road To $100,000

Historically, BTC has reached new ATHs a couple of months after the halving event, however it’s different this time.

Crypto educator and lead content creator at Cryptonauts, Nathan Leung points out, “Money is flowing out of gold and other commodity ETFs and flowing into bitcoin ETFs at record rates. Both fiat and digital currencies are coming into BTC ETFs, while the the digital gold (bitcoin) is getting scarcer.

“More people are buying bitcoin than there’s available. This will further drive BTC’s value as the world is waking up. That’s why BTC broke the ATH before the halving this time and not after as in past halvings – It is the first time in the asset’s history.”

The biggest impact of a halving event is that it makes a finite digital asset even scarcer. It can be seen as a pinnacle of the network’s deflationary commitment, enshrined in computer code and executed mathematically, without any external control or intervention.

Even Justin Wu, a hardcore “altcoiner” who hasn’t invested in bitcoin since 2017 agrees on the importance of the halving proclaiming, “While I don’t follow BTC prices as such, it’s impossible and stupid to deny the impact each halving event has on the crypto industry at large. The encoding of principals and the assurance it gives to users, for better or worse, is very important in my view.”

The dual impact of ETFs and the upcoming halving has excited market analysts about BTC’s price action for this year.

Blockstream CEO, Adam Back, believes that BTC is undervalued at $72,000. He has predicted the asset to cross the $100,000 mark before the halving and while this seemed absurd a few months back, it may just now be possible.

Echoing Back’s conviction, WIZZ (@CryptoWizardd) said, “ETFs are positive news because they bring mainstream attention to crypto. More attention means more growth. And that’s why BTC will continue its rally post-halving. There’ll be some volatility, but my target is $110,000, with an ATH of around $120,000.”

Bitcoin has been the best performing investment of the new millennia. Charlie Billelo’s asset class total returns since 2011 provides one of the most illuminating reasons bitcoin is so popular – an annualized return of 148.9 percent over a 13 year period with 3 draw down years says it all. Average American investors are signalling they want a piece of this growth.

What About The Miners?

As TDVC partner and TDX CEO, Constantin Kogan, pointed out, “Bitcoin’s destiny is fixed by a mathematical formula. But the halving is a key risk factor for miners. While bigger operations must have already prepared for the event, smaller firms inherently weigh rewards against risks.”

Indeed, some miners could go out of business post-halving, however, the subsequent price increase makes up for reduction in block rewards from 6.25 to 3.125 BTC per block.

Kogan add, “The halving makes bitcoin scarcer, so it attracts new investors, traders, and drives the price. While reduced rewards could increase selling pressure for miners, the rising price incentivizes holding.”

Overall, bitcoin halving is a predefined, semi-predictable mechanism that miners are aware of from the beginning. Moreover, once the 21 million BTC supply has been mined, the network will transition into a fully transaction fee based revenue model for miners. While there may be some consolidation along the way, the network design is fundamentally transparent, especially with its incentives.

One way or another, the halving will have a significant impact on the BTC market in 2024 and beyond. How this will actually turn out remains to be seen and depends on a broad range of contingencies. History has a habit of repeating itself, for both good and bad, and smart traders and investors understand this better than most.