The company continues to navigate market turbulence with tech advances

By Yiannis Zourmpanos

Summary

- Alibaba’s stock plunged 20% in 2023, dropping to around $73, echoing its price after the 2014 IPO.

- Despite the downturn, Alibaba maintains a robust financial status, with cash reserves accounting for one-third of its $186 billion market value.

- Under Eddie Wu’s leadership, Alibaba is integrating e-commerce with AI-driven cloud services.

- The launch of the Zhenyue 510 chip by subsidiary T-Head underscores Alibaba’s commitment to self-reliance in chip design and cloud service enhancement.

- Facing a blend of geopolitical, economic and market challenges in 2024, Alibaba’s adaptability and diverse portfolio position it to leverage potential growth opportunities.

In 2023, Alibaba Group Holding Ltd. (BABA, Financial) witnessed a 20% drop in its stock value, plummeting to about $73, a price echoing its 2014 post-IPO period. This decline has left investors in a quandary, weighing the merits of holding onto their shares or seeking tax-loss harvesting opportunities.

However, the share price has factored in these challenges, reflecting China’s broader economic and regulatory climate. As Alibaba strides forward, its strategic agility in the face of geopolitical and market challenges, particularly in the artificial intelligence-driven cloud sector, positions it as a resilient player in the global tech arena.

Alibaba’s strategic decisions regarding asset reorganization strategies reflect a solid approach to navigating market adversities. The decision against pursuing a complete spinoff of the Cloud Intelligence Group due to uncertainties from U.S. export restrictions on advanced computing chips is significant and represents the proactive caution exercised by the company to be immune to the complex geopolitical landscape.

Currently, the company focuses on developing sustainable growth models based on the emerging AI-driven demand for cloud computing services. Notably, Alibaba showcased strong revenue growth across segments like AIDC (presumably Alibaba’s Artificial Intelligence Data Center), Cainiao (its logistics arm) and digital media entertainment. However, Alibaba’s Cloud Intelligence Group displayed mixed performance at the top line during the reported period.

The revenue from the Cloud Intelligence Group marked a modest increase of 2% year over year, mainly driven by Alibaba’s consolidated businesses, as revenue excluding these entities experienced a slight decrease. Further, the revenue generated by public cloud products and services contributed over 70% of the external cloud revenue, showing a strong demand for cloud infrastructure and model training services.

Fundamentally, this growth is derived when the segment faces potential challenges in revenue growth from model training and related services due to expanded export control rules in the U.S., restricting the export of advanced computing chips and semiconductor manufacturing equipment to China.

Interestingly, looking at the bottom line of the Cloud Intelligence Group narrative, it is way more substantial, as its adjusted Ebitda surged by 44%, primarily based on increased revenue from public cloud products and services and improving operational efficiency.

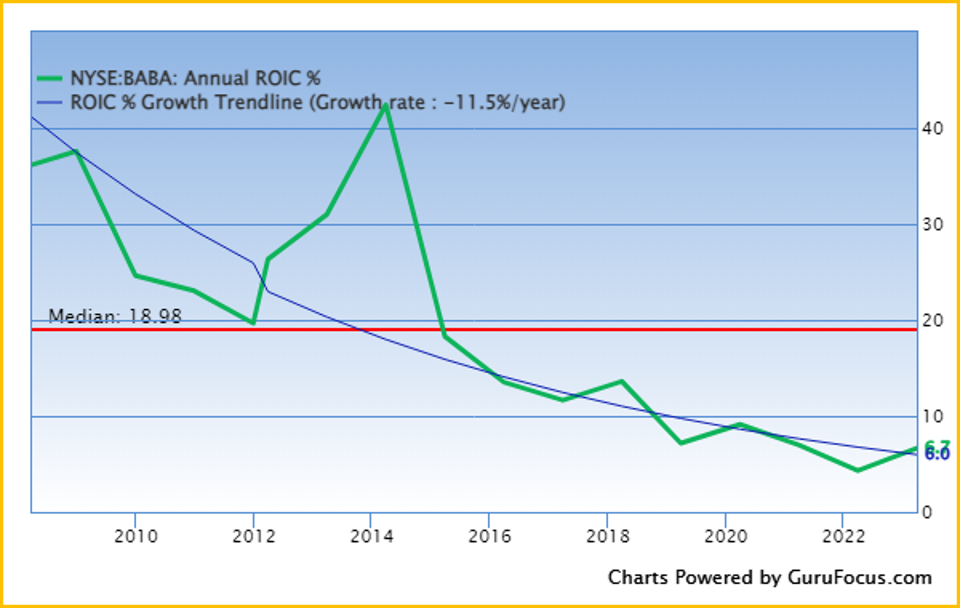

The robust demand for public cloud products and services indicates sustained interest in cloud infrastructure and related solutions. Alibaba’s focus on this sector may allow the company to capitalize on the growing need for cloud computing, especially in the context of AI-driven services. Based on this fundamental, the company aims to elevate its return on invested capital from single-digit to double-digit figures.

Eddie Wu, Alibaba’s newly appointed CEO, has taken a more assertive role in the company by realigning its management and directly overseeing its main e-commerce division. This move comes as Alibaba faces increased competition from PDD Holdings (PDD, Financial) and ByteDance.

Wu, who unexpectedly took over the cloud division, replacing Daniel Zhang, is now leading the e-commerce and cloud segments, marking a significant shift in the company’s leadership structure. Wu’s strategy focuses on integrating e-commerce with cloud services and leveraging AI for future growth. Thus, the change aims to consolidate Alibaba’s e-commerce platforms, Taobao and Tmall, which have been losing market share.

Concurrently, PDD has emerged as Morgan Stanley’s top pick in China’s e-commerce sector, surpassing Alibaba with a $196 billion market cap. Despite this, Alibaba retains a positive outlook among brokers, with a majority maintaining buy ratings, contrasting slightly with PDD’s even stronger buy recommendations. Therefore, Alibaba faced a downgrade by Morgan Stanley from overweight to equal weight, with a reduced price target of $110 to $90. The downgrade is attributed to the company’s slower-than-expected recovery and uncertainties from halting its cloud business spinoff.

Source: Bloomberg

Alibaba’s chip design subsidiary, T-Head, introduced the Zhenyue 510 chip, a RISC-V-based controller IC for enterprise solid-state drives (SSDs), at the Apsara cloud computing conference. It’s designed to enhance performance in Alibaba Cloud’s data centers, specifically targeting applications like AI training, online transactions and big data analysis, promising a 30% reduction in latency compared to existing ICs.

Fundamentally, the introduction of the Zhenyue 510 demonstrates Alibaba’s drive toward self-reliance in chip design. Also, enhancing performance with reduced latency suggests improved efficiency in handling data-intensive tasks, potentially attracting more enterprises to utilize Alibaba Cloud services. By leveraging an open-standard architecture, Alibaba aims to mitigate the risks associated with U.S. export controls on specific IP providers.

Looking forward, in-house chip designs tailored for cloud services may bolster Alibaba Cloud’s competitiveness by offering enhanced capabilities and potentially cost-effective solutions. This could attract more customers, contributing to revenue growth in the long term.

Notably, this capability is familiar to Alibaba. T-Head previously launched the Hanguang 800 neural processing unit in 2019 for AI tasks and the Yitian 710 Arm-based CPU in 2021 for cloud servers. These chips and the XuanTie 910 IoT processor primarily serve in-house purposes, indicating Alibaba’s focus on developing proprietary hardware for its services.

Finally, if Chinese companies widely adopt RISC-V at a macro level, it could challenge the dominance of established U.S.-based architectures. Therefore, this shift might form distinct technological ecosystems, impacting global tech standards and market dynamics.

China’s stock market outlook in 2024, mainly for Alibaba, is shaped by a mix of challenges and opportunities. Recent downgrades by Moody’s Investors Service, affecting various Chinese companies reflect concerns over China’s economic and fiscal stability. Additionally, key risks, such as the property sector downturn and inflationary pressures, continue to impact market sentiment.

Despite these challenges, portfolio managers emphasize the need for more government policy support, especially in the property sector, to stabilize the market. The high inventory levels in lower-tier cities indicate a prolonged period of adjustment. Along with other tech giants, Alibaba is also navigating changes in the global economic landscape, including U.S. chip export restrictions.

India and Japan have benefited from the weakness in China’s stock market, but this trend might reverse if Beijing implements aggressive economic rescue measures. Investors are advised to maintain a balanced exposure to Chinese stocks, as rapid changes in policy could quickly shift market sentiment.

The potential for upcoming IPOs of Chinese companies could also be a significant factor. Successful listings indicate increased investor confidence and attract international investments back to China. Also, companies focusing on cost containment, market diversification and growth through self-help strategies will likely stand out. Combining cost-saving measures with structural growth, this approach could shift investment focus from purely value-driven to a more blended style, considering quality, earnings momentum and price momentum.

For Alibaba, this landscape presents both hurdles and possibilities. The company’s ability to adapt to policy changes, manage its diverse portfolio effectively and leverage its strengths in e-commerce and technology will be crucial in navigating 2024’s unpredictable market conditions.

Despite this downturn, Alibaba’s financial health remains robust, with cash reserves constituting a third of its $186 billion market value. The conglomerate’s diverse portfolio, including its dominant e-commerce arm in China, cloud computing, logistics operations and a stake in Ant Financial, collectively value the company at approximately $130 per share. Therefore, this figure is strikingly higher than its current stock price, underscoring a potential undervaluation.

Under Wu’s leadership, the company is refocusing its strategy to integrate e-commerce with AI-driven cloud services, responding to competitive and regulatory challenges. Moreover, its initiative in proprietary chip design, like the Zhenyue 510, demonstrates a commitment to technological advancement and efficiency in cloud computing.

Looking ahead to 2024, Alibaba navigates a complex landscape of geopolitical, economic and market challenges. However, its ability to adapt and leverage its diverse portfolio will be key to overcoming these hurdles and capitalizing on potential growth opportunities.

I am/we currently own positions in the stocks mentioned, and have NO plans to sell some or all of the positions in the stocks mentioned over the next 72 hours.