Despite low holiday sales projections, the toymaker’s shares are rising

Summary

- The Aggregated Portfolio shows Mattel is the most popular toy company among gurus.

- The company is hoping to replicate the success of the “Barbie” movie with other films based on its brands.

- While the company operates in a cyclical sector, its prospects are promising.

It is once again the most wonderful time of the year, which means children of all ages are busy mailing letters to Santa Claus while parents search for the best bargains to fill stockings.

While CNBC reported several prominent toymakers warned holiday sales may be lackluster this year due to consumers cutting back on spending as a result of inflationary pressure, the National Retail Federation‘s annual survey found Americans are still looking for some holiday cheer. It expects seasonal sales to increase between 3% and 4% from 2022 numbers.

Further, although companies operating in the consumer cyclical space are susceptible to supply chain shortages and rising costs, toys usually remain in demand during the holidays.

Regardless of how holiday sales actually turn out this year, gurus are still finding value in the sector. According to GuruFocus’ Aggregated Portfolio, a Premium feature based on 13F and NPORT-P filings, Mattel Inc. (MAT, Financial) was the leisure stock that was most popular among gurus as of the end of the third quarter.

Investors should be aware 13F and NPORT-P filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Held by a total of eight gurus, this is unsurprising since, according to the survey, two of the company’s most popular products are also among the top toys for this holiday season. Spurred by the release of the “Barbie” movie this past summer, Barbie ranks number one among the most popular toy brands for girls. Its Hot Wheels cars rank second among boys.

Headquartered in El Segundo, California, the toy company, which was founded in 1945, has a number of iconic brands in its portfolio, including Barbie, Hot Wheels, Fisher-Price and American Girl.

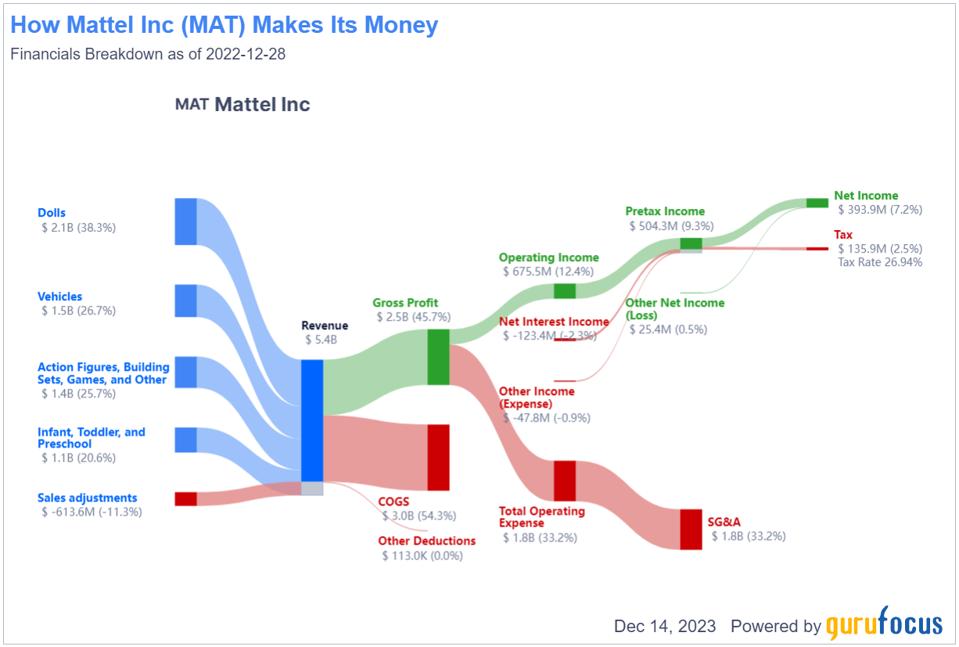

Mattel operates through four main segments, consisting of Dolls, Vehicles, Action Figures, Building Sets, Games and Other and Infant, Toddler and Preschool. In 2022, Dolls contributed the most to revenue with $2.10 billion in sales.

Of the eight Premium gurus invested in Mattel, PRIMECAP Management (Trades, Portfolio) has the largest stake with 11.78% of its outstanding shares. John Rogers (Trades, Portfolio), Mason Hawkins (Trades, Portfolio), the T Rowe Price Equity Income Fund (Trades, Portfolio) and Steven Cohen (Trades, Portfolio) also have sizeable holdings.

Despite its popularity, however, the stock did see a number of gurus reduce their positions between 1.17% and 59.59% during the quarter. Only Jefferies Group (Trades, Portfolio) increased its investment by 30.15%. Regardless, the stock still has a combined weight of 12.63% in their equity portfolios.

Further, there has been a more bearish sentiment toward the stock over the past two quarters with heavy selling activity.

As for insiders, there was a spike in selling among Mattel insiders in July and August of this year. There have been no insider buy transactions since February of 2019.

The increased selling activity among gurus and insiders alike may not be a bad sign, though, as the shares enjoyed a period of elevated prices following the release of the “Barbie” movie, which was directed by Greta Gerwig and starred Margot Robbie in the titular role, on July 21. As such, they could have just been taking advantage of a profit-taking opportunity.

The stock has posted a gain of over 7% year to date.

Sporting a $6.57 billion market cap, Mattel shares were trading around $19.15 on Thursday with a price-earnings ratio of 83.27, a price-book ratio of 3.33 and a price-sales ratio of 1.30.

The GF Value Line suggests the stock is modestly undervalued currently based on its historical ratios, past financial performance and analysts’ future earnings projections.

At 74 out of 100, the GF Score indicates the company is likely to have average performance going forward due to the cyclical nature of its business. It received a high momentum rank, but more moderate ratings for profitability, financial strength and value as well as low growth marks.

Mattel reported third-quarter results in October.

For the three months ended Sept. 30, the company posted net income of $146 million, or adjusted earnings of $1.08 per share. While net income was down from the prior-year quarter, earnings per share increased. Revenue also grew 9% from a year ago to $1.92 billion.

MAT Data by GuruFocus

In a statement, Chairman and CEO Ynon Kreiz said the quarterly performance “reflects the successful execution of [its] strategy to grow Mattel’s IP-driven toy business and expand [its] toy offering.”

“Consumer demand for our product increased in the quarter, and we continued to outpace the industry. Our results benefited from the success of the ‘Barbie’ movie, which became a global cultural phenomenon, and marked a key milestone for Mattel,” he said. “We are very well positioned competitively and expect to gain market share in the fourth quarter and full year.”

Looking ahead to the full year, Mattel upped its guidance. It now anticipates an adjusted gross margin of 47% to 48%, compared to 47% previously. Its adjusted earnings per share were increased to a range of $1.15 to $1.25 from $1.10 to $1.20 previously. Adjusted Ebitda is now expected to be between $925 million and $975 million. It was previously projected to be $900 million to $950 million.

However, it also noted holiday sales may be lower due to consumers cutting back on unnecessary spending in light of increasing inflation.

Following the massive success of the “Barbie” movie, Mattel has made plans to produce content on some of its other iconic brands.

As part of that initiative, the company announced on Dec. 13 a partnership with Paramount Pictures and Temple Hill Entertainment to develop a feature film based on its American Girl line of historical dolls and books, an idea that was previously spoofed by “Saturday Night Live.”

Lindsey Anderson Beer, who is known for “Sierra Burgess Is a Loser” and “Pet Sematary: Bloodlines,” will write the screenplay as well as produce. In a statement, she expressed her excitement for being involved in creating “the American Girl movie [she has] wanted to see since childhood.”

“Growing up, my sister and I were American Girl girls. I had Kirsten, and she had Molly. They didn’t feel like dolls to play with, rather real people whose worlds we got to imagine ourselves in,” Anderson Beer said. “They are historically accurate toys and accessories that feature elaborate and immersive backstories uniquely suited to bring to screen. I am so excited to tell a story that tackles the issues of girlhood in a real and compelling way.”

In a statement, Robbie Brenner, the president of Mattel Films, also commented on bringing the iconic dolls to the big screen.

“American Girl is a beloved franchise, rich in history and storytelling with millions of devoted fans,” he said. “Through dolls, books, live experiences and television movies, the brand has captured hearts for decades.”

Created in 1986, the brand’s history is not quite as long as Barbie’s, but a movie may still generate good profits for the toymaker due to its popularity among millennial women.

At the end of the third quarter, Mattel had cash and cash equivalents of $455.7 million on its balance sheet. This was up from $349 million last year. Total inventories came in at $790.5 million, down from $1.08 billion in the year-ago quarter.

MAT Data by GuruFocus

Further, long-term debt stood at $2.33 billion and shareholders’ equity was $2.03 billion. Both figures increased slightly from the prior-year quarter.

MAT Data by GuruFocus

In addition to a solid Altman Z-Score of 3.02, indicating the company is in good standing financially, the Piotroski F-Score ranks 5 out of 9. This means its operations are typical of a stable company. However, GuruFocus warning signs show Mattel’s return on invested capital of 1.85% is eclipsed by its weighted average cost of capital of 6.29%, implying it may not be capital efficient.

The business predictability rank is also low at one out of five stars. While GuruFocus research found companies with this rating typically return an average of 1.1% annually over a 10-year period, a decline in revenue per share over the past 12 months has resulted in the rank being put on watch.

Despite the potential for lower holiday sales, a number of other toy companies stand to benefit from the season, including Hasbro Inc. (HAS, Financial), Funko Inc. (FNKO, Financial), Jakks Pacific Inc. (JAKK, Financial) and Build-A-Bear Workshop Inc. (BBW, Financial). However, they do not have the brand power Mattel does.

The company is further boosted by its solid strategy for generating new revenue streams from its intellectual property as it pursues other movie deals for its various brands.

Based on these developments, I would not be surprised if the stock continues to move higher and guru ownership increases. As such, I feel the stock may be a good value opportunity currently.

I/we have no positions in any stocks mentioned, and have no plans to buy any new positions in the stocks mentioned within the next 72 hours.