Taking a closer look at one of the largest companies in the pharmaceutical industry

By Nathan Aisenstadt

Summary

- The company’s management increased the financial guidance for 2023 non-GAAP diluted EPS from $7.35 to $7.65 to $7.50 to $7.65.

- During the three months ended Sept. 30, Bristol-Myers Squibb repurchased $4 billion of shares.

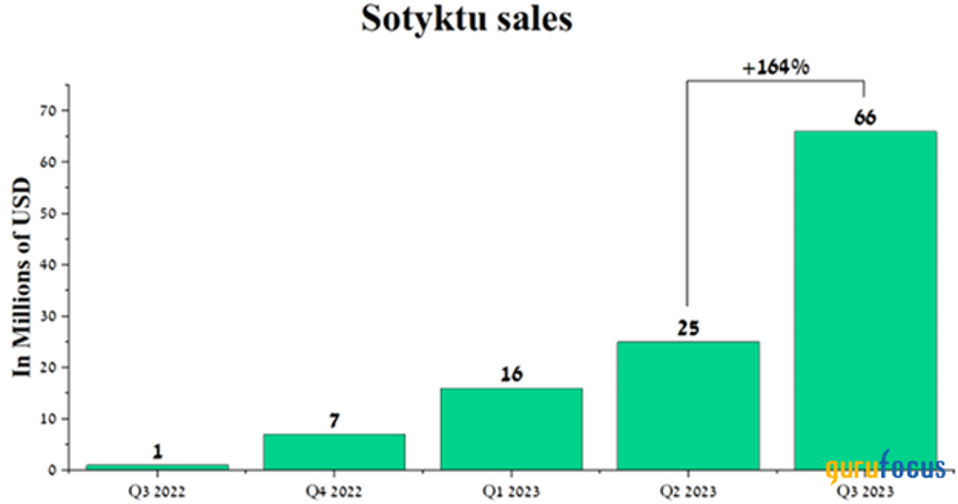

- Sotyktu sales were $66 million, an increase of 164% quarter over quarter, primarily due to its competitive advantages in the global psoriasis treatment market.

- Since the first quarter of 2022, an increasing number of generic versions of Revlimid began to appear on the market, which is the main factor that led to a decrease in demand for its blockbuster.

- We continue our analytics coverage of Bristol-Myers Squibb with an outperform rating for the next 12 months.

Since early July, Bristol-Myers Squibb Co.’s (BMY, Financial) share price has been under downward pressure due, in part, to growing concerns among financial market participants about the ability of its management to offset declining sales of Revlimid and Sprycel and the negative impact of President Biden’s Inflation Reduction Act on the pharmaceutical industry.

At the same time, the Princeton, New Jersey-based company’s financial results for the third quarter of 2023, published on Oct. 26, exceeded analysts’ expectations. First, the company’s management increased the financial guidance for 2023 non-GAAP diluted earnings per share from $7.35 to $7.65 to $7.50 to $7.65. Second, demand for innovative medicines such as Sotyktu, Reblozyl, Opdualag, Breyanzi and Zeposia continues to be extremely high since their regulatory approval.

Sotyktu (deucravacitinib) is a drug that received its first regulatory approval in the third quarter of 2022 for treating moderate to severe plaque psoriasis, one of the highly prevalent chronic inflammatory skin diseases. Its cumulative sales were $66 million in the third quarter of 2023, an increase of 164% quarter over quarter, primarily due to its competitive advantages in the global psoriasis treatment market, its mechanism of action based on selective inhibition of the tyrosine kinase 2 (TYK2) enzyme and its oral route of administration.

Source: Author’s elaboration, based on quarterly securities reports

At the same time, Opdivo (nivolumab), which is Bristol-Myers Squibb’s blockbuster and whose sales amounted to about 20.7% of its total revenue for the three months ended Sept. 30, pleased us with the increase in demand for it despite raised competition in the global oncology drugs market. Sales of this fully human anti-PD-1 monoclonal antibody were $2.27 billion for the third quarter, an increase of 11.1% year over year due to its label expansion and higher demand for the treatment of patients with various types of gastric, bladder, non-small cell lung cancer and melanoma.

Source: Author’s elaboration, based on quarterly securities reports

Moreover, we would like to note that sales of other PD-1 inhibitors showed more modest quarter-over-quarter growth. So sales of Regeneron Pharmaceuticals’ (REGN, Financial) Libtayo increased by only $22 million, sales of Merck’s (MRK, Financial) Keytruda grew by $67 million and sales of GSK’s (GSK, Financial) Jemperli did not change at all.

Source: Author’s elaboration, based on quarterly securities reports

On the other hand, the rate of decline in Revlimid (lenalidomide) sales has slowed, which is excellent news for both the company’s investors and its financial position. Bristol-Myers Squibb’s medicine has been approved by regulatory authorities to combat such deadly diseases as multiple myeloma, myelodysplastic syndrome, mantle cell lymphoma and follicular lymphoma.

Since the first quarter of 2022, an increasing number of generic versions of Revlimid began to appear on the market, which is the main factor that led to a decrease in demand for the blockbuster drug. However, its sales were $1.43 billion for the third quarter of 2023, down 2.7% from the previous quarter. Moreover, if we consider the results of earlier quarters, the rate of decline in Revlimid sales was significantly higher. As a result, we believe that Bristol-Myers Squibb management’s business strategies aimed at minimizing the damage from increased competition in the global oncology drugs market are beginning to bear fruit.

Source: Author’s elaboration, based on quarterly securities reports

More globally, in an effort to regain a share of the global cancer therapeutics market and minimize expected revenue losses from patent expirations on some of Bristol-Myers’ key drugs over the next seven years, it acquired Mirati Therapeutics (MRTX, Financial) for up to $5.8 billion. We believe Mirati’s portfolio of product candidates is broad, and many have demonstrated significantly superior efficacy in clinical studies relative to Food and Drug Administration-approved competitors.

Source: Corporate Presentation

In addition to experimental drugs, the FDA approved Mirati’s Krazati (adagrasib) for treating patients with KRAS G12C-mutated locally advanced or metastatic NSCLC in the fourth quarter of 2022. Its sales were $13.4 million for the second quarter of 2023, an increase of 112.7% year over year.

Source: Author’s elaboration, based on quarterly securities reports

We expect the growth rate of this drug to accelerate in the coming quarters, including due to the controversial results of Amgen’s (AMGN, Financial) Lumakras (sotorasib) obtained during the phase 3 clinical trial. The results of the phase 3 CodeBreaK 200 led, among other things, to the fact that on Oct. 5, the FDA’s Oncologic Drugs Advisory Committee voted negatively on the question: “Can the primary endpoint, PFS per BICR, be reliably interpreted in CodeBreaK 200?”

Source: Oncologic Drugs Advisory Committee Meeting

The experts’ decision was due, among other things, to “potential sources of bias in the PFS primary analysis dataset” that ultimately cast doubt on the objectivity of the data obtained in the Amgen clinical trial.

Source: ODAC meeting briefing document

Moreover, median overall survival was 11.3 months in the docetaxel group versus 10.6 months in the Lumakras (sotorasib) group.

Source: ODAC meeting briefing document

As a result, these results are not statistically significant, which ultimately casts doubt on the efficacy of Amgen’s product and the benefit of its use by patients suffering from KRAS G12C-mutated locally advanced or metastatic NSCLC.

The third quarter of 2023 showed mixed results. On one hand, Bristol-Myers’ revenue continues to decline year over year, but its earnings per share beat analysts’ consensus estimates in eight of the last nine quarters. Moreover, the company’s gross margin was 77.29% for the third quarter, an increase of 2.91% compared to the previous quarter. Additionally, this financial metric remains higher than its key competitors in the health care sector, such as GSK, Pfizer (PFE, Financial) and Roche Holding (XSWX:ROG, Financial).

Source: Author’s elaboration, based on Seeking Alpha data

Moreover, only a minority of the company’s drugs continue to decline, both year over year and quarter over quarter.

Source: Author’s elaboration, based on quarterly securities reports

Bristol-Myers Squibb is expected to release its financial report for the fourth quarter of 2023 on Feb. 2. According to Seeking Alpha, revenue for the quarter is anticipated to range from $10.67 billion to $11.59 billion, which is 2.9% higher than analysts’ expectations for the third quarter of 2023.

Besides, according to our model, the company’s total revenue will be slightly below this range and amount to $11.1 billion. The company’s quarterly revenue growth will be driven by the continued increase in sales of its oncology and immunology products, partially offset by our expected decline in demand for Revlimid, Abecma and Sprycel.

Source: Author’s elaboration, based on Seeking Alpha data

Due to continued strong demand for Opdivo, Onureg and Yervoy, we expect the company’s operating income margin to reach 19.1% for 2023. Furthermore, this financial indicator will decrease to 18.6% despite the increase in prices for its products and the weakening of the U.S. dollar relative to other foreign currencies. The decline in its operating income margin for 2024 will be primarily due to the acquisition of Mirati Therapeutics and lower sales of Revlimid and Sprycel.

According to Seeking Alpha, BMY’s fourth-quarter earnings per share is expected to be between $1.70 and $1.91, up slightly from the consensus estimate for the third quarter of 2023. Conversely, according to our model, the company’s earnings per share will be in this range and reach $1.75.

Moreover, the company’s trailing 12-month non-GAAP price-earnings ratio is 6.93, 57.78% lower than the sector average. Additionally, the forward non-GAAP price-earnings ratio is 7.01, which is 27.87% lower than the average over the past five years, indicating that financial market participants remain conservative about Bristol-Myers Squibb’s prospects.

Source: Author’s elaboration, based on Seeking Alpha

Since 2019, the company has been pursuing an active mergers and acquisitions policy, which led to an increase in its total debt to $51.68 billion by the end of 2020. First of all, this was due to the need to finance the acquisition of Celgene and MyoKardia.

However, at the end of September 2023, the company’s total debt was about $39.32 billion, decreasing by $12.36 billion compared to 2020. On the other hand, even with the company’s Ebitda declining year over year, its total debt/Ebitda ratio continues to remain stable, reaching 2.15 times in the trailing 12 months.

Source: Author’s elaboration, based on Seeking Alpha data

Given the relatively rapid expansion of the company’s portfolio of product candidates, its stable free cash flow and total cash and short-term investments that exceed $7.68 billion, we do not expect Bristol-Myers Squibb to have significant difficulty repaying the senior notes maturing between 2024 and 2062.

Bristol-Myers Squibb is one of the largest companies in the pharmaceutical industry.

Key financial risks such as increased competition between Revlimid and its generic versions, the negative impact of President Biden’s Inflation Reduction Act and declining sales of Abecma and Sprycel continue to weigh on the company’s share price, which has fallen more than 20% over the past six months.

Source: Author’s elaboration, based on Seeking Alpha

On the other hand, the company’s growing margins, its dividend yield exceeding 4.3%, continued increasing demand for medicines such as Sotyktu, Zeposia and Opdualag and the high rate of expansion of its portfolio of experimental drugs are crucial factors making Bristol-Myers Squibb an attractive asset for long-term investors.

We continue our analytics coverage of Bristol-Myers Squibb with an outperform rating for the next 12 months.

I/we have no positions in any stocks mentioned, and have no plans to buy any new positions in the stocks mentioned within the next 72 hours.