The Federal Open Market Committee (FOMC) will meet on December 10 to decide if it will continue to cut short-term interest rates (after a 0.25% reduction at the October meeting) or hold the fed funds rate at current levels.

The outcome of this meeting is less certain than other recent FOMC decisions due to the lack of economic data, a byproduct of the federal government shutdown. The Bureau of Labor Statistics (BLS) announced it will not release October inflation and employment data because it was not collected during the shutdown. November data will be released after the FOMC meeting, with the employment report publishing on December 16 and the inflation report on December 18.

The lack of data so close to a Fed meeting is concerning. It leaves policymakers without the most current data upon which to base their decisions. As a result, a majority of members have said that the dearth of information will be a factor in the committee’s deliberations.

A Fed Divided: Hawks Versus Doves

Additionally, there appears to be a growing bifurcation within the FOMC between the “hawks” and the “doves.” Hawks are those members who would prefer tighter monetary policy (no rate cut) to combat potentially rising inflation, and doves are those who would prefer easier monetary policy (continued rate cuts) to support a potentially weakening job market.

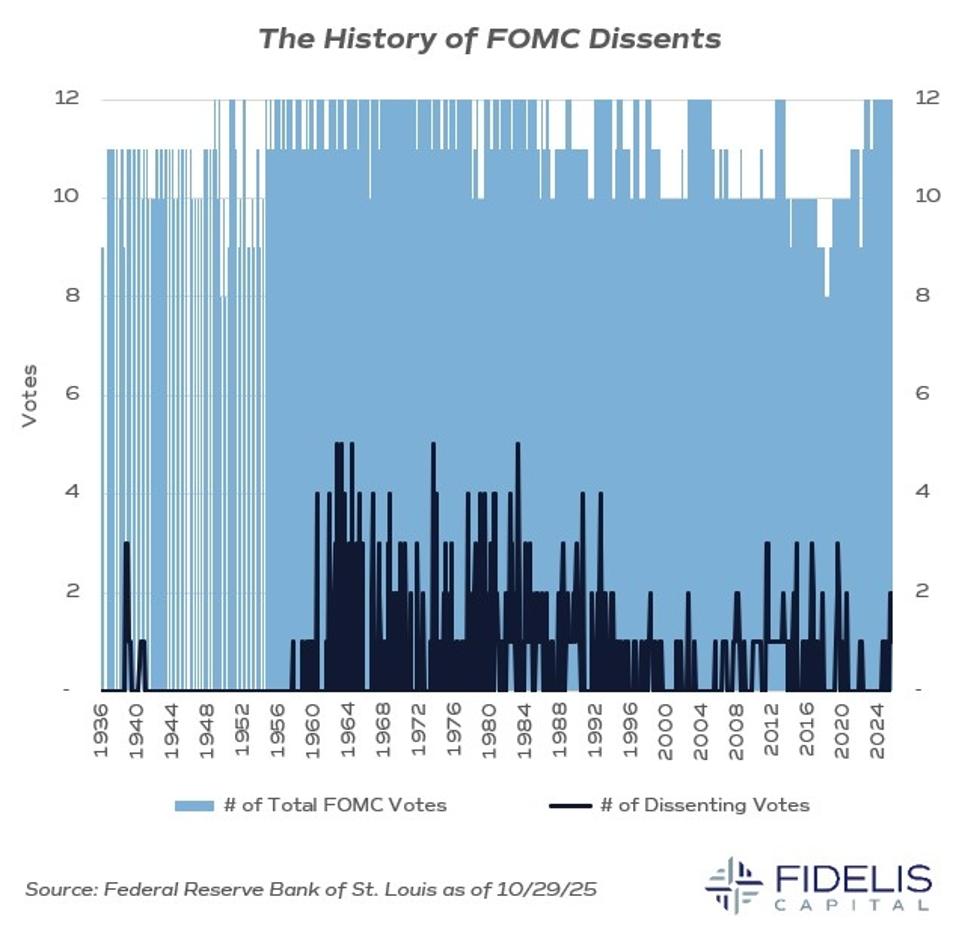

The tally of the votes from the October 28-29 meeting highlighted the split within the committee. When fully appointed, there are 12 voting members of the FOMC. Of those 12, there were two recent dissenters to the majority action of a 0.25% interest rate cut—one favoring no cut and one favoring a more aggressive 0.50% rate cut.

Are Dissenting Votes Common?

Dissenting FOMC votes are nothing new. Since 1936, 36% of the meetings have concluded with at least one dissenting vote. When there have been such vote(s), the median number of those objecting is just one. It is rare to have four or more non-majority votes, and there have been only five instances in the history of the FOMC where there were five dissenters.

The voting result from October’s meeting was unusual in comparison to past meetings because there were dissenters on both sides of the majority’s vote. Throughout the history of the FOMC, there have been only 28 times when the committee registered votes for both more hawkish and more dovish actions than that of the majority.

What Fedspeak Is Telling Us About The December Meeting

The recently released FOMC minutes also depict the increasing division within the committee, stating:

“Many participants were in favor of lowering the target range for the federal funds rate at this meeting, some supported such a decision but could have also supported maintaining the level of the target range, and several were against lowering the target range.”

The latest comments from Fed members seem to confirm this split. In the weeks since the October meeting, both voting and non-voting members have been strongly advocating for their differing views. Non-voting members, although important for the debate, can be discounted given the contentious nature of the current board.

Unfortunately, the blackout period in which members must refrain from making comments began November 29 and extends through the Fed’s meeting on December 10, so we will not have any additional comments until Powell is standing at the podium.

Will The Fed Decision Cause Market Volatility?

This disagreement among FOMC members has led to uncertainty in future monetary policy, and financial markets do not like uncertainty. It leads to an increase in volatility.

Since the last FOMC meeting, market volatility has risen. The VIX Index, a measure of equity market volatility, moved above 25 on November 20, the highest level since President Trump’s tariff announcements in April. Additionally, the ICE MOVE Index, a measure of bond market volatility, has also risen since the last FOMC meeting.

Granted, not all the recent increases in volatility can be directly attributed to the Fed. Rich equity valuations are also to blame, but the perceived indecisiveness from the most powerful central bank in the world has not helped the situation.

Interpretive data from fixed-income markets has reflected this indecisiveness. For example, the probability of a rate cut in December, derived from the fed funds futures market, has been quite volatile since the October meeting. The probability of a December cut has ranged from a high of nearly 100% to a low of 29%. A probability greater than 50% suggests the market is expecting a cut, and the same is true in reverse. The chart below reflects the market’s current confusion.

The Most Likely Outcome for the December Meeting

The importance of the December 10 meeting and its potential impact on markets cannot be overstated. In my opinion, it is likely the most important FOMC vote in recent years. Equity market valuations are rich, volatility is high, the impact from tariffs are mostly unknown, economic data is lacking, and political pressure on the FOMC has been on the rise. A mistake by the FOMC, given this environment, would most likely lead to a negative outcome for both financial markets and the US economy.

In a best-case scenario, the upcoming FOMC vote would be unanimous, sending a confident message to the markets that the Fed has a clear view on the economic trajectory and has a strong hand at the helm. I do not think this is a likely outcome. It appears to me that more than a few FOMC members are already entrenched in their view for the vote.

In what I believe to be the most likely outcome, the FOMC vote would show more dissenters than the two in October. Regardless of the decision, either hawkish or dovish, it is unlikely to garner more than eight or nine of the possible 12 votes. That equates to three or four dissenters. In such a scenario, it is likely that market volatility will remain elevated, and investor focus will switch to the January 28 meeting. To further complicate the matter, the voting membership will change in the new year. This change in voting ranks could cause a shift in the hawkish/dovish composition of the committee, thereby affecting the January decision.

In a worst-case scenario, the December FOMC vote would result in five dissenters, or, in an extreme scenario, a tie vote. To be clear, we do not believe five dissenters are likely and a tie is even more remote. Under these two outcomes, market volatility will likely increase above existing levels. Market participants would view the FOMC as lacking leadership and confidence, effectively being rudderless.

As an aside, there has never been a tie vote. The FOMC’s Rules of Organization do not have a provision to handle tie votes, and the committee would have to amend the rules should such an event occur. To reiterate, the likelihood of this occurrence is extremely low. I believe Chair Powell would be able to avoid such an outcome.

The Bottom Line: Expect Dissents, Don’t Write Off Market Volatility, Prepare For An Interest Rate Cut

Investors and market participants would be wise to read the comments and speeches of voting FOMC members to get a sense of which way they may vote. In reviewing comments from the last few weeks, the numbers, in my opinion, lead to a close call in either direction but lean towards an interest rate cut with a rise in dissentions.

Monitoring market behavior in the week and days prior to an FOMC meeting can also help investors assess the likelihood of any potential monetary policy change. At a minimum, it’s informative to understand the market’s implied expectations, even if the market is occasionally wrong.

As always, investor portfolios should be aligned with their specific goals, objectives and risk tolerance. This is the best way to manage investment portfolios for the long run, regardless of the outcome of any particular market event.