Visa (V) stock may represent a good buying opportunity at this moment. Why? Because it offers high margins – indicative of pricing power and efficiency in cash generation – at a lower price. Companies like this yield consistent, predictable profits and cash flows, which mitigate risk and enable capital reinvestment. The market generally rewards such attributes.

What Is Occurring With V

V has increased by 4.3% thus far this year, but is currently priced at 38% less based on its P/S (Price-to-Sales) ratio as compared to one year ago.

This is what’s going positively for the company. The stock, which has a 4.3% return year-to-date, reflects Visa’s robust transaction model. In fiscal year 2025, net revenue rose 11% to $40 billion, driven by a 9% rise in payment volumes and an 11% increase in higher-margin cross-border transactions. Recent partnerships, such as advancing stablecoin settlement in CEMEA to an annualized run rate of $2.5 billion, enhance operations and reduce friction. The management’s 14% increase in dividends indicates confidence in ongoing cash generation, further backed by strategic fee modifications to promote efficient processing.

V Boasts Strong Fundamentals

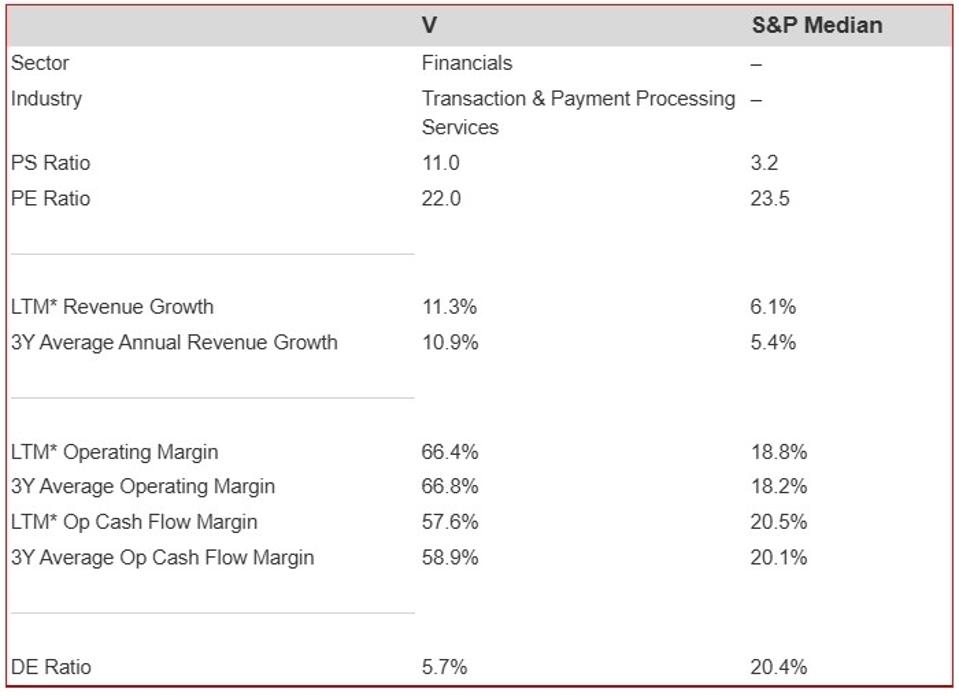

- Recent Profitability: Approximately 57.6% operating cash flow margin and 66.4% operating margin LTM.

- Long-Term Profitability: Around 58.9% operating cash flow margin and 66.8% operating margin over the last 3-year average.

- Revenue Growth: Visa experienced growth of 11.3% LTM and 10.9% over the last 3-year average, but this is not solely a growth narrative.

- Available At a Discount: With a P/S multiple of 11.0, V stock is accessible at a 38% discount compared to a year ago.

Below is a brief comparison of V’s fundamentals against S&P medians.

*LTM: Last Twelve Months

Don’t Anticipate a Guarantee, However

While V stock may present a compelling investment opportunity, it’s always prudent to consider a stock’s history of downturns. Visa’s stock isn’t exempt from tough periods either. It plunged approximately 52% during the Global Financial Crisis, experienced a 36% decline during the Covid recession, and fell nearly 29% during the inflation shock of 2022. Even the 2018 correction saw it drop nearly 19%. Thus, while it may appear robust on paper, these declines indicate that it can still face challenges along with the wider market when situations get unstable. However, the risk extends beyond major market collapses. Stocks can decline even when markets are performing well – consider incidents such as earnings announcements, business news, and changes in outlook. Read V Dip Buyer Analyses to understand how the stock has bounced back from significant declines in the past.

If you seek additional information, review Buy or Sell V Stock.

How We Reached Our Conclusion About V Stock

Visa attracted our attention due to its fulfillment of the following criteria:

- Market capitalization exceeding $10 billion

- High cash flow from operations (CFO) margins or operating margins

- Significantly reduced in value over the prior year

However, if V doesn’t appear sufficiently promising to you, here are some alternative stocks that also meet these requirements:

Importantly, a portfolio created starting on 12/31/2016 with stocks that meet the outlined criteria would have performed as follows:

- Average 12-month forward returns of nearly 19%

- 12-month win rate (the percentage of selections yielding positive returns) of about 72%

The Optimal Way to Invest Is Through Portfolios

Individual selections may exhibit volatility, but maintaining your investment is what is crucial. A diversified portfolio enables you to stay the course, capitalize on gains, and lessen losses.

The Trefis High Quality (HQ) Portfolio, comprised of 30 stocks, has a proven history of exceeding its benchmark performance that includes all three – the S&P 500, S&P mid-cap, and Russell 2000 indices. Why does this occur? Collectively, HQ Portfolio stocks achieved better returns with reduced risk compared to the benchmark index; a less tumultuous journey, as shown in HQ Portfolio performance metrics.