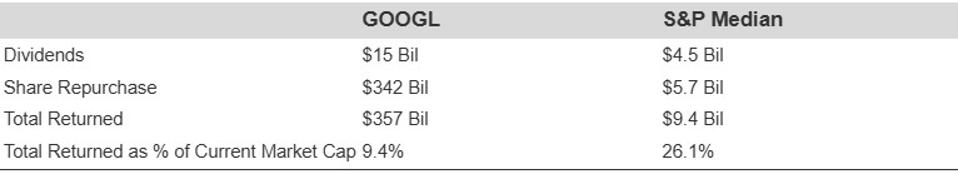

Over the past ten years, Alphabet (GOOGL) stock has delivered an enormous $357 Bil back to its investors through actual cash in the form of dividends and share buybacks. Let’s examine some figures and see how this capacity for payouts compares with the largest capital-returning companies in the market.

Interestingly, GOOGL stock has delivered the 3rd greatest total to its shareholders in history.

Why should you care? Because dividends and share buybacks represent direct, tangible returns of capital to investors. They also indicate management’s confidence in the financial health and capacity to produce sustainable cash flows of the company. There are other stocks like this as well. Below is a list of the top 10 companies ranked by total capital returned to investors through dividends and stock buybacks.

Top 10 Stocks By Total Shareholder Return

For a complete ranking, visit Buybacks & Dividends Ranking

What do you notice here? The total capital returned to shareholders as a percentage of the current market cap seems inversely related to growth expectations for reinvestments. Stocks such as Meta (META) and Microsoft (MSFT) are expanding considerably quicker, in a more predictable manner, compared to the others, yet they have returned a significantly lesser proportion of their market cap to shareholders.

That’s the flip side of substantial capital returns. While they are appealing, one must consider the question: Am I giving up growth and solid fundamentals? With that in mind, let’s analyze some figures for GOOGL. (see Buy or Sell Alphabet Stock for more information)

Alphabet Fundamentals

- Revenue Growth: 13.4% LTM and 11.0% last 3-year average.

- Cash Generation: Almost 19.1% free cash flow margin and 32.2% operating margin LTM.

- Recent Revenue Shocks: The lowest annual revenue growth for GOOGL in the past 3 years was 5.3%.

- Valuation: Alphabet stock is traded at a P/E ratio of 23.6

*LTM: Last Twelve Months

The table provides a solid overview of what to expect from GOOGL stock, but how about the associated risk?

GOOGL Historical Risk

Google isn’t free from pullbacks either. It fell by approximately 65% during the Global Financial Crisis, dropped 44% during the inflationary shock, and declined 31% throughout the Covid pandemic. Even the correction in 2018 brought it down more than 23%. While solid fundamentals are important, these declines illustrate how susceptible even top stocks can be when the market shifts.

The Trefis High Quality (HQ) Portfolio, comprising 30 stocks, has a history of consistently outperforming its benchmark, which includes all three – the S&P 500, S&P mid-cap, and Russell 2000 indices. Why is that? Collectively, HQ Portfolio stocks have provided better returns with lower risk compared to the benchmark index; resulting in a less volatile experience, as shown in HQ Portfolio performance metrics.