- How Dividend Stocks Fit Into an Investing Strategy

- 3 Top Dividend Stocks To Buy in 2026

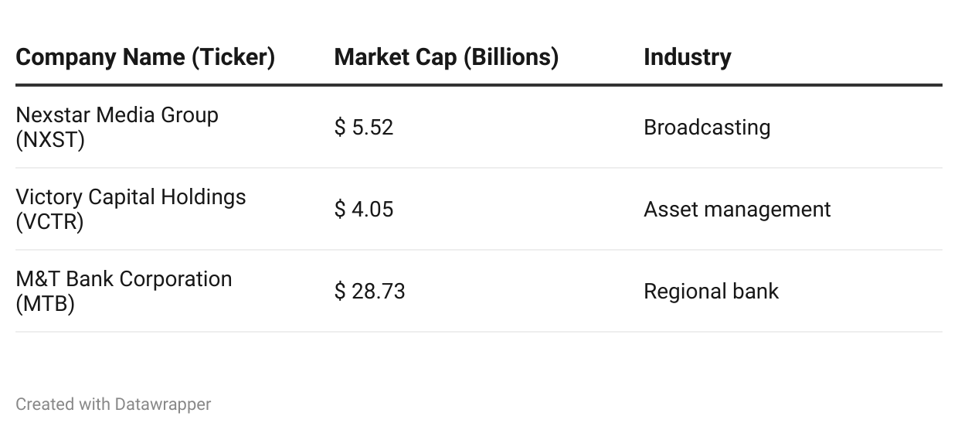

- 1. Nexstar Media Group (NXST)

- 2. Victory Capital Holdings (VCTR)

- 3. M&T Bank Corporation (MTB)

- 2 Best Monthly Dividend Stocks for 2026

- 1. Phillips Edison & Company (PECO)

- 2. Healthpeak Properties (DOC)

- 2 High-Yield Dividend Stocks To Watch in 2026

- 1. MFA Financial (MFA)

- 2. Annaly Capital Management (NLY)

- Risks And Challenges For Dividend Stocks

- Bottom Line

If the recent run-up in growth stocks has made your portfolio feel more volatile, it may be time to balance things out with dividend stocks. Below are three high-quality dividend payers, plus two monthly and two high-yield options that may suit your investing strategy in 2026. Metrics come from stockanalysis.com and company websites.

How Dividend Stocks Fit Into an Investing Strategy

Dividend stocks share profits through periodic cash payments. While these payouts are usually smaller than potential gains from fast-moving growth stocks, cash dividends are more concrete—and less likely to evaporate during market swings.

Companies that maintain long-term dividend programs typically have experienced leadership teams, predictable growth and strong balance sheets. Combined with recurring cash distributions, these qualities can help stabilize a portfolio and offer downside protection.

Dividend stocks also work well for long-term investors. Automatically reinvesting dividends allows compounding to build over time, creating a growing income engine that can help fund retirement or other major financial goals.

3 Top Dividend Stocks To Buy in 2026

These three dividend stocks offer solid yields, low payout ratios and positive 2026 earnings outlooks.

1. Nexstar Media Group (NXST)

Nexstar Media Group by the numbers:

- Stock price: $182.18

- Dividend yield: 4.1%

- Payout ratio: 45.9%

- Consecutive years of dividend growth: 12

- Five-year FCF growth: 6.4%

- 2026 EPS growth expectation: 87%

Nexstar Media Group Overview

Nexstar Media Group produces and distributes news, sports and entertainment content through more than 200 owned or partner TV stations and a large network of local station websites. The company also owns a 31.3% stake in TV Food Network.

Why NXST Is A Top Choice

Nexstar’s combination of a strong yield, low payout ratio and consistent dividend growth stands out—but its 2026 outlook is even more compelling.

The company is pursuing growth through NewsNation, The CW and the planned acquisition of Tegna, Inc., expected to close in the second half of 2026 pending regulatory approval. Nexstar anticipates $300 million in revenue and cost synergies, with Tegna projected to increase Nexstar’s standalone adjusted free cash flow by 40% in year one.

2. Victory Capital Holdings (VCTR)

Victory Capital Holdings by the numbers:

- Stock price: $63.34

- Dividend yield: 3.1%

- Payout ratio: 49.7%

- Consecutive years of dividend growth: 6

- Five-year FCF growth: 7.1%

- 2026 EPS growth expectation: 14.7%

Victory Capital Overview

Victory Capital is a global asset manager overseeing $313 billion across institutional, intermediary and retail channels. It also operates 26 VictoryShares ETFs covering equity, fixed income and alternative strategies.

Why VCTR Is A Top Choice

Victory Capital has nearly doubled its annual dividend since 2022, moving from $1 to $1.96. Its payout ratio remains reasonable, and its yield sits comfortably above 3%.

Momentum is strong heading into 2026, with the company tracking toward a 49% revenue increase and a 39% EPS increase for 2025. Growth is helped by the acquisition of Amundi US and a 15-year partnership with Amundi that expands Victory Capital’s global reach.

3. M&T Bank Corporation (MTB)

M&T Bank Corporation by the numbers:

- Stock price: $186.96

- Dividend yield: 3.2%

- Payout ratio: 34.3%

- Consecutive years of dividend growth: 8

- Five-year FCF growth: 30.0%

- 2026 EPS growth expectation: 12.1%

M&T Bank Overview

M&T Bank provides retail and commercial banking through its network of roughly 1,300 branches across the Eastern U.S., managing more than $211 billion in assets.

Why MTB Is A Top Choice

MTB increased its quarterly dividend to $1.50, following a smaller raise in 2024. Its dividend strength—paired with a sub-40% payout ratio—is supported by an active share-repurchase program.

Recent earnings beat expectations on revenue and EPS, with improvements in net interest margin and efficiency ratio. M&T continues to focus on conservative lending and asset-quality improvements, helping build resilience heading into 2026.

2 Best Monthly Dividend Stocks for 2026

These monthly dividend stocks deliver yields above 3%.

1. Phillips Edison & Company (PECO)

PECO by the numbers:

- Stock price: $34.65

- Dividend yield: 3.6%

- Annual dividend: $1.25

- 2026 EPS growth expectation: 21.5%

PECO Overview

PECO owns more than 300 grocery-anchored neighborhood shopping centers across 31 states. As a REIT, it pays no corporate tax but must distribute at least 90% of taxable income to shareholders—resulting in higher payout ratios and yields.

Note: REIT dividends are taxed as ordinary income.

Why PECO Is A Top Choice

PECO pays a monthly dividend of $0.1083, or about $1.30 annually.

The company has consistently grown revenue and net income since 2021. Its latest quarter beat EPS expectations by 25%, and management raised 2025 guidance for both Nareit FFO and core FFO. PECO also benefits from consistently high occupancy rates and an investment-grade balance sheet that supports acquisition-driven growth.

2. Healthpeak Properties (DOC)

DOC by the numbers:

- Stock price: $17.35

- Dividend yield: 7.0%

- Annual dividend: $1.22

- 2026 EPS growth expectation: 20.7%

DOC Overview

Healthpeak Properties, also a REIT, owns outpatient medical facilities, labs and continuing care retirement communities (CCRCs).

Why DOC Is A Top Choice

DOC pays a monthly dividend of $0.10167, totaling $1.22 annually.

The company has grown revenue and doubled FFO since 2021 through acquisitions, new development and rent increases supported by contracted escalators. Its 2026 outlook is supported by an aging population, limited new outpatient medical supply and rising property values that can create profitable sale opportunities.

2 High-Yield Dividend Stocks To Watch in 2026

Looking for double-digit yields? These two stocks are on track to deliver some of the highest payouts in 2026.

1. MFA Financial (MFA)

MFA by the numbers:

- Stock price: $9.28

- Dividend yield: 15.5%

- Annual dividend: $1.44

- Five-year FCF growth: 14.3%

- 2026 EPS growth expectation: 29.6%

MFA Overview

MFA Financial is a mortgage REIT investing in residential mortgages, mortgage-backed securities and business-purpose loans through its subsidiary Lima One Capital.

Why MFA Is A Top Choice

MFA’s $1.44 annual dividend translates to a 15.6% yield. The company increased its quarterly dividend this year but previously lowered it in 2022.

MFA has navigated varied economic cycles since 1998, maintaining relatively consistent net interest income. Expected lower interest rates in 2026 may further reduce borrowing costs.

The company’s Q3 dividend exceeded distributable earnings, raising sustainability questions but signaling commitment to shareholder returns. Earnings were pressured by credit losses on legacy loans. To improve future results, MFA is refocusing on target assets, cutting general and administrative costs by 7%–10% and repurchasing shares below book value.

2. Annaly Capital Management (NLY)

NLY by the numbers:

- Stock price: $21.65

- Dividend yield: 12.9%

- Annual dividend: $2.80

- Five-year FCF growth: 27.3%

- 2026 EPS growth expectation: 1.0%

Annaly Overview

Annaly Capital Management is a mortgage REIT investing in agency mortgage-backed securities, residential real estate and mortgage servicing rights.

Why NLY Is A Top Choice

NLY pays $2.80 per share annually, yielding 12.9%. While it raised its quarterly dividend this year, it reduced the payout in 2023.

Since going public in 1997, Annaly has returned 1,022% to shareholders—outpacing the S&P 500. Its scale, diversified strategies and consistent dividend coverage help support its high yield.

In the latest quarter, NLY reported GAAP net income per share of $1.21, up from $0.05 a year earlier. Earnings available for distribution rose to $0.73 per share, while book value ended the quarter at $19.25

Risks And Challenges For Dividend Stocks

Dividend stocks can strengthen a portfolio, but they carry risks. Two major considerations are dividend cuts and limited growth potential.

Dividend Cuts

A dividend cut reduces income immediately and can trigger a stock price drop as investors reset expectations.

High-yield stocks can be especially risky if the payout is unsustainably high—or if the high yield reflects a declining share price.

Limited Growth Potential

Dividend stocks rarely deliver explosive growth. Companies that avoid paying dividends often reinvest more capital into expansion.

Dividend investing involves a trade-off: income versus potential price appreciation. The best choice depends on your goals and overall portfolio mix.

Bottom Line

Whether you want reliability, monthly payouts or double-digit yields in 2026, focus on companies with strong balance sheets, durable business models and a clear commitment to shareholder returns.