Nvidia CEO Jensen Huang turned heads earlier this month when he told the Financial Times he believes China will win the artificial intelligence (AI) arms race due to the country’s expanding power capacity and lack of regulatory bottlenecks that slow things down here in the U.S. Whether Huang is ultimately proven right or wrong, his comment reveals just how hot the race is heating up.

No question about it, the biggest players in AI right now are the U.S. and China. Both superpowers understand that whoever leads in this still burgeoning industry will likely influence global standards, intelligence gathering, national defense, commerce and so much more for decades to come.

From where I stand, the future of AI leadership comes down to three things: chips, power and cybersecurity.

The Fight for the Fastest Silicon

The U.S. dominates when it comes to AI models. OpenAI (which launched ChatGPT three years ago this month), Anthropic, Google, Meta and others remain well ahead of the competition in terms of raw performance and global influence.

China is closing the gap faster than I think many investors realize.

Chinese firms such as DeepSeek, Alibaba and Moonshot are developing highly efficient models that deliver competitive performance while relying on fewer high-end chips. They’re also pushing hard into open source software (OSS), which is expected to accelerate adoption rates across the globe.

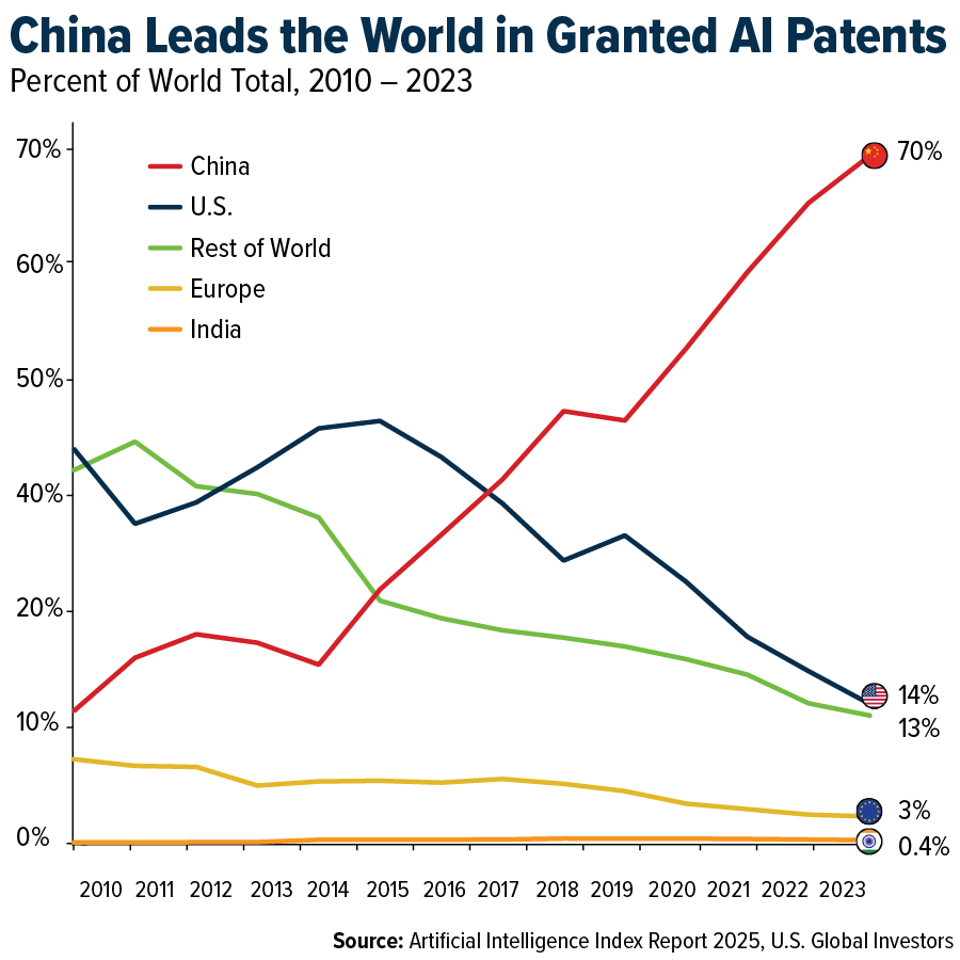

The patent landscape shows just how serious Beijing is. Roughly 70% of all AI-related patents now originate from China, according to Stanford University’s 2025 AI Index Report. Compare this to the U.S., which accounts for around 14%, a figure that’s been declining overall since 2010.

Not every patent translates into commercial success, of course, but they’re an early indicator of national priorities. China wants to be the global hub for AI research and development, and it’s using every tool available to get there.

Meanwhile, U.S. venture capital has become increasingly concentrated. More than 40% of all AI deal value has gone to the top 10 companies raising money this year, with only three companies—OpenAI, Anthropic and xAI—capturing over $50 billion combined through the end of August, according to PitchBook. That’s a lot of capital flowing to a very small group of players.

At U.S. Global Investors, we hold positions in several companies involved in AI chips and cybersecurity platforms, and we continue to see strong momentum in the deployment of compute power. But make no mistake, the competition is intensifying.

The Kilowatt Arms Race

As we all know, training large-language models (LLMs) consumes enormous amounts of electricity, and data centers are popping up faster than many utilities can keep up.

The U.S. hosts nearly half the world’s data centers—more than 4,000 currently, compared to the U.K. in the number two slot with just over 500 data centers—but as is the case with AI models, China is catching up.

Another area where China is surpassing the U.S.? Energy. In an open letter to Michael Kratsios, executive director of the Office of Science and Technology Policy, OpenAI warned that the U.S. is falling behind China, threatening America’s edge on AI, “the most consequential technology since electricity itself.” The tech firm pointed out that China added an astounding 429 gigawatts (GW) of brand new power capacity in 2024, while the U.S. added only 51 GW.

I’m not suggesting that China is guaranteed to win. The U.S. still leads in high-value chips, large-scale model development and private-sector innovation. But power availability and cost are becoming the decisive factors in AI expansion. Nvidia’s Huang has said many times that electricity will determine who can scale AI, and the data is starting to support that view.

Cybersecurity: The New Front Line

The third front in the U.S.-China AI rivalry is digital security. The past year has seen one of the most dramatic escalations in cyber risk that the world has ever seen.

Anthropic, the AI platform that hosts the Claude chatbot, recently revealed the first documented case of a China-linked group using an AI agent to run an entire espionage campaign. The AI handled everything, from reconnaissance to data extraction. Human operators, which Anthropic noted were probably not very sophisticated coders, acted more like supervisors than attackers. Nearly 30 targets were attacked, with AI completing most of the work all on its own.

Meanwhile, U.S. cybersecurity firms are building defensive AI agents that can respond to threats in real time. Palo Alto Networks, which we held in our defense tech ETF as of September 30, has been integrating generative-AI capabilities across its platform and rolling out agent-based tools. The company has also been expanding through acquisitions, announcing last week that it bought cloud-native observability platform Chronosphere for $3.35 billion.

There’s real urgency here. This year, the average cost of a data breach in the U.S. hit $10.2 million, a new record high and the highest cost anywhere in the world, according to IBM.

Final Thoughts

I believe the U.S.-China tech rivalry will guide the direction of AI for years to come. Both nations are moving quickly, and the technologies involved are advancing at a pace we really haven’t seen since at least the early days of the internet. That’s why we hold long-term positions in several firms across the themes I discussed.

As always, stay curious and stay informed!