As SpaceX expands into a critical layer of global infrastructure, powering orbital launch, Starlink broadband, climate and scientific missions, geospatial intelligence, and national-security logistics, investor interest has intensified, prompting many to ask how to buy SpaceX stock or gain exposure to the company’s growth despite its private status. SpaceX has no public ticker, and retail investors cannot purchase shares directly on any U.S. exchange. Access today is limited to a small group of public funds that hold SpaceX privately or to accredited-only secondary markets. Among public vehicles, public–private crossover ETFs offer one of the more accessible paths to indirect exposure, with XOVR appearing as a fund that reports a SpaceX position. Additional exposure, typically in smaller sizes, is available through select mutual funds, certain closed-end structures, and private-market vehicles designed for accredited investors.

How to Gain Exposure to SpaceX (2026)

Because SpaceX is private and has no publicly traded shares, investor access occurs only through funds that hold SpaceX positions within private structures. Among public vehicles, public–private crossover ETFs currently represent one of the more accessible categories; within this group, XOVR is the only U.S.-listed ETF that reports a SpaceX position in its filings. Additional exposure exists through open-end mutual funds such as BPTRX and BFGFX, the closed-end fund DXYZ, and through secondary-market transactions available solely to accredited investors.

Why SpaceX Is the Most Sought-After Private Company

Elon Musk has founded companies that dominate global attention, but SpaceX is the one reshaping real-world infrastructure. With record launch cadence, an expanding satellite constellation, and deepening partnerships across defense, aviation, scientific agencies, and telecommunications, SpaceX has become one of the world’s most strategically important private companies.

Its advantage stems from engineering breakthroughs, vertical integration, cost leadership, and the ability to attract elite technical talent.

A Launch Engine Without Equal

SpaceX closes 2025 targeting roughly 165–170 orbital launches, extending its lead as the most active launch provider in history. This frequency creates a compounding strategic advantage:

- high cadence spreads fixed costs

- rapid iteration accelerates reliability

- legacy players cannot match the cost curve

- institutional clients increasingly default to SpaceX

Starlink: SpaceX’s Transformational Asset

While rockets define SpaceX’s brand, Starlink is its most scalable commercial platform. The network now provides broadband to:

- airlines

- maritime fleets

- underserved communities

- first-responder networks

- developing nations

- defense and intelligence agencies

The next phase, direct-to-cell connectivity with telecom partners, positions Starlink as a potential global communications backbone.

Science, Climate, and Defense Missions Add Durability

SpaceX now launches sophisticated climate-monitoring, Earth-observation, and scientific satellites for U.S. and international agencies. These multiyear missions embed the company into national and allied infrastructure, providing stable revenue uncharacteristic of rapidly scaling private companies.

Starship: The Industrial Breakthrough

Starship, the fully reusable super-heavy system, is designed to reshape:

- heavy-lift logistics

- lunar and deep-space cargo

- defense deployment

- constellation expansion

- space-based manufacturing economics

If Starship reaches full reuse at scale, orbital transport costs could drop dramatically, unlocking new commercial and scientific opportunities.

Can You Buy SpaceX Stock?

- Can retail investors buy SpaceX directly? No, SpaceX is private.

- Is there a SpaceX ticker symbol? No.

- Is a SpaceX IPO expected? None has been announced.

- How do investors gain access? Through funds that hold SpaceX privately.

How Retail Investors Can Get SpaceX Exposure in 2026

Since SpaceX shares are not publicly listed, exposure comes through public funds holding private-company stakes or through private secondary transactions available only to accredited investors.

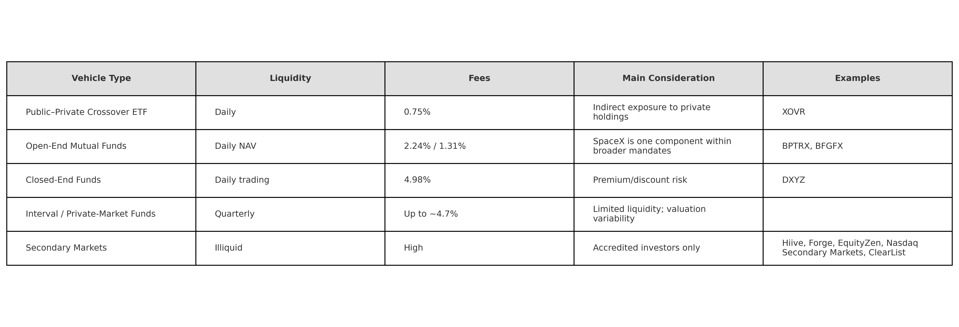

Comparison of SpaceX Access Vehicles

1) Public–Private Crossover ETFs

Public–private crossover ETFs invest across late-stage private companies and public-market innovators within a regulated, exchange-traded structure. They generally offer daily liquidity with NAV-based pricing and lower fees than other vehicles providing access to private holdings. In this category, XOVR is currently the only U.S.-listed ETF that reports a SpaceX exposure, according to public filings. Exposure levels may change over time as funds update their disclosures.

2) Open-End Mutual Funds Holding SpaceX

Baron Partners Fund (BPTRX) – Long-time SpaceX holder; higher fees consistent with active management.

Baron Focused Growth Fund (BFGFX/BFGIX) – Also holds SpaceX, generally at lower fees than BPTRX.

3) Closed-End Funds (Premium Risk)

Destiny Tech100 (DXYZ) – A closed-end fund including private technology holdings. Shares can trade at significant premiums or discounts to NAV.

4) Interval / Venture-Style Funds

Some interval funds invest in late-stage private companies including SpaceX. They offer quarterly liquidity, higher fees, and less frequent valuation updates.

5) Accredited-Only Secondary Markets

Accredited investors may occasionally purchase SpaceX shares through private secondary platforms. These involve:

- high minimum commitments

- multi-year lockups

- pricing uncertainty

Investment Outlook

SpaceX anchors global launch, satellite communications, national-security logistics, and emerging off-planet infrastructure. Because the company remains private, public–private crossover funds offer the most accessible pathway for retail investors seeking indirect exposure, with mutual funds, closed-end funds, and private-market vehicles providing additional, but often more constrained, alternatives. Evaluating these structures requires understanding differences in liquidity, fees, valuation practices, and the potential for premiums or discounts relative to NAV.

—————————————–

Disclosure: Past performance is no guarantee of future results. Please refer to the following link for additional disclosures: https://lnkd.in/e29X6rN

Disclosure: Risk Note: Private-market valuations can be volatile. Fees, holdings, and pricing mechanisms differ by vehicle. Investors should review fund disclosures before investing.

Additional Disclosure Note: The author has an affiliation with Babson College, ERShares, the XOVR ETF and the Entrepreneur 30 Total Return Index (ER30TR). The intent of this article is to provide objective information; however, readers should be aware that the author may have a financial interest in the subject matter discussed. As with all equity investments, investors should carefully evaluate all options with a qualified investment professional before making any investment decision. Private equity investments, such as those held in XOVR, may carry additional risks—including limited liquidity—compared to traditional publicly traded securities. It is important to consider these factors and consult a trained professional when assessing suitability and risk tolerance.