Super Micro Computer (SMCI) shares are down 31.0% over the last 21 trading days. This recent decline highlights worries regarding intensified competition in the AI server market and shrinking margins following an earnings miss. Despite strong demand for AI-related equipment, these operational challenges and market pressures have contributed to investor caution. But significant drops frequently compel a harder question: is this weakness fleeting, or does it indicate more profound issues?

Separately, see – AVGO Stock To $700 Amid Google Partnership?

Before evaluating its downturn resilience, let’s examine the current position of Super Micro Computer.

- Size: Super Micro Computer is a $20 billion company with $21 billion in revenue, currently trading at $33.32.

- Fundamentals: Revenue growth over the past 12 months stands at 11.9%, with an operating margin of 4.4%.

- Liquidity: Displays a Debt to Equity ratio of 0.24 and a Cash to Assets ratio of 0.29.

- Valuation: The stock is presently trading at a P/E multiple of 25.0 and a P/EBIT multiple of 20.1.

- Has provided a (median) return of 30.9% within a year after sharp declines since 2010. Refer to SMCI Dip Buy Analysis.

These indicators suggest a Moderate operational performance and a Moderate valuation, positioning the stock as Fairly Priced. For further information, refer to Buy or Sell SMCI Stock.

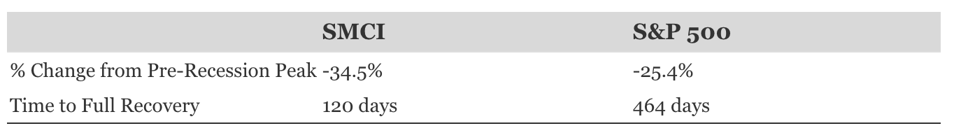

This leads us to a crucial factor for investors anxious about this decline: how resilient is SMCI stock if the markets decline further? Here, our downturn resilience framework becomes relevant. If SMCI stock drops another 20-30% to $23 – can investors remain at ease? It appears the stock experienced a slightly worse impact than the S&P 500 index during different economic downturns, as indicated by (a) the extent of the stock’s decline and (b) how swiftly it bounced back. Below, we explore each downturn more closely.

2022 Inflation Shock

- SMCI stock decreased by 34.5% from a peak of $35.33 on 7 August 2023 to $23.15 on 21 September 2023, compared to a peak-to-trough drop of 25.4% for the S&P 500.

- Nevertheless, the stock fully recovered to its pre-crisis high by 19 January 2024.

- Since then, it rose to $118.81 on 13 March 2024 and is currently trading at $33.32.

2020 Covid Pandemic

- SMCI stock declined 45.8% from a high of $2.95 on 5 February 2020 to $1.60 on 18 March 2020, compared to a peak-to-trough decline of 33.9% for the S&P 500.

- Nevertheless, the stock fully recovered to its pre-crisis high by 8 June 2020.

2018 Correction

- SMCI stock decreased by 59.6% from a peak of $2.89 on 4 January 2017 to $1.17 on 8 November 2018, compared to a peak-to-trough decline of 19.8% for the S&P 500.

- However, the stock completely recovered to its pre-crisis high by 22 January 2020.

2008 Global Financial Crisis

- SMCI stock plummeted 66.3% from a high of $1.14 on 5 June 2007 to $0.39 on 13 November 2008, contrasting with a peak-to-trough decline of 56.8% for the S&P 500.

- Yet, the stock achieved full recovery to its pre-crisis peak by 22 December 2009.

Feeling anxious about SMCI stock? Consider a portfolio approach.

Portfolios Are The Smarter Way To Invest

Individual stocks can surge or plunge, but one truth stands: remaining invested matters. The right portfolio can aid you in staying invested, capturing potential upsides, and mitigating the downsides linked with any single stock.

The Trefis High Quality (HQ) Portfolio, which includes a selection of 30 stocks, has a history of reliably outperforming its benchmark that encompasses all three – the S&P 500, S&P mid-cap, and Russell 2000 indices. What accounts for this? Collectively, HQ Portfolio stocks have yielded better returns with reduced risk in comparison to the benchmark index; offering a steadier investment experience, as demonstrated in HQ Portfolio performance metrics.