It is generally thought that improving consumers’ financial literacy will increase the financial health of the population, a goal that we (the financial service sector) support. I see worthy articles about how teaching finance to Gen Z will help them to get on the property ladder, prepare for a long retirement and generally lead a better life, but I am unconvinced. It might be better forget about it and let the bots take the helm.

Financial Literacy And Digital Literacy

In the post-Industrial economy, not only financial literacy but digital financial literacy is a fundamental and desirable necessity for the population, just as basic literacy was in the old economy. And if we want people to make better choices about money, and become more resistant to the tidal wave of fraud that may soon overwhelm us, then we (the industry) need to find a way to deliver a accelerated combination of the financial literacy that to some extent grows with age and the digital literacy that historically has not.

(The Capital One Insights Center’s research found that digital financial literacy increases with age, noting that 74% of consumers over 65 rank highly on both digital and financial literacy compared to only 28% of those ages 18-24. The report defines digital literacy as understanding a combination of basic financial knowledge and being able to protect oneself online from phishing attacks and other financial scams.)

Consumers of all ages continue to struggle with financial literacy, the report shows, with more than 40% of consumers lacking basic financial knowledge. Despite high digital literacy scores, lower financial literacy means only half of Americans can be classed as are digitally financially literate. The fingures increase with age. Older consumers ranked higher in both digital and financial literacy. Of the 65+ population, 74% rank highly on both digital and financial literacy, nearly three times higher than the 18-24 year old population.

The financial education gap is real. Gen Z has the lowest financial literacy rates among U.S. generations, with just 38% of financial literacy questions answered correctly in recent assessments. Hardly surprising, you might think, when a third of Gen Z Americans obtain financial advice from TikTok (compared with a sixth of millenials)and a third from YouTube, while only a quarter seek help from actual financial advisors. So how is that working out for them? Well, just to illustrate the general dynamic, back in July investors lost billions of dollars betting on a handful of small US-listed Chinese stocks that plunged in value shortly after being heavily promoted on social media in a typical “pump and dump”.

The UK public are just as bad at managing their money. A Bank of England report from last year showed that while Britiah households have been depositing more into interest-paying accounts, some £300 billion is sitting in accounts not paying any interest at all. Frankly, bots could do better and it seems that the public are already heading in that direction, with more than half of all British adults using ChatGPT and the like to make financial decisions, which seems to me to be a clear indication that once they can get AI to go further and actually make the decisions for them (and then get on and execute the transactions), they will.

(There is a Ph.D waiting to be written about the differences between Brits, who cite financial advice and help with work emails as their primary use of AI and Americans, who cite therapy and personal developments as their main reasons for using AI.)

So what should society do about this? The usual response is to think about improving financial literacy and for well-meaning reasons there are those who think that while financial literacy can sometimes take a backseat to other priorities, it should in fact be the table stakes for all of us in the financial services community.

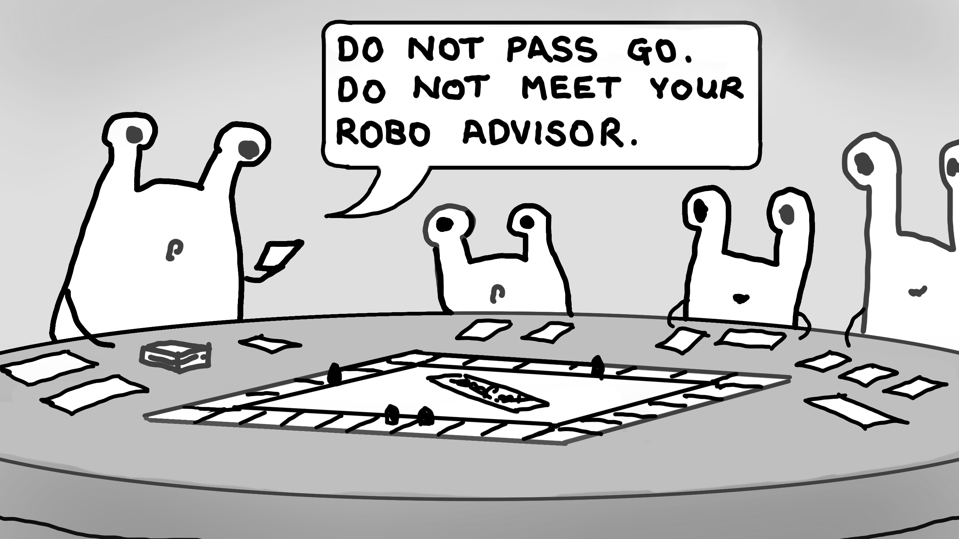

A common focus is on children, the thinking being that if we can help children to understand finances at an early age then we are giving them a sound foundation. Writing about children’s financial literacy in The Financial Times, Clear Barrett talked about going online to buy the well-known game of childhood capitalist indoctrination, Monopoly. She was making a point about teaching kids about money but Monopoly teaches them that acquring wealth is all about acquiring property, not about starting businesses, inventing new products or creating value in other ways. I’m with her on that, surely we should begin doing something about financial literacy by encouraging children to play games that will teach them more about how to get rich other by inheriting land or becoming social media influencer?

(One partcular game that might help in that regard is Crunch, a card game that teaches the rudiments of banking. Each player is a banker and, in essence, you have to collect asset cards so that you can make loans and investments. The banker with the most money at the end wins: it doesn’t matter whether their bank goes bankrupt or not. If you over-extend the bank but manage to trouser the treasure before the roof falls in, more power to your elbow.)

Given that as far as I can tell, most British schoolchildren want to be on reality TV rather than becoming engineers or farmers, I think Clear might have her work cut out trying to ger the kids round the table to play a game at all. This is why I think we may as well give up on trying to teach financial literacy at completely, and just hand over control of their bank accounts to bots that comply with the FCA Duty of Care.

(By the way, Claer wrote that she was “stunned to see that a totally cashless version is now available”. Well, I hate to be that guy, but actually cashless Monopoly has been around for as long as I’ve been writing blog posts about cashlessness!)

Financial Literacy Needed, For Sure

It seems to me that rather than waste of time and money trying to teach financial literacy to a disinterested cadre of consumers who have only the most basic arithmetic skills, a better way to increase the overall financial health of the public would be to get them out of the loop

JP Koning says that he is not a fan of mandatory investor education classes as envisaged by former chair of the Federal Deposit Insurance Corporation (FDIC) Sheila Bair, who suggested that improving financial literacy via early financial education might be a way to stop future FTX-style disasters. I’m not sure. I am of the general opinion that any strategy that relies on consumer education to improve financial health is doomed. Surely a much better way to protect consumers is to get bots to deal with the finance sector for them.