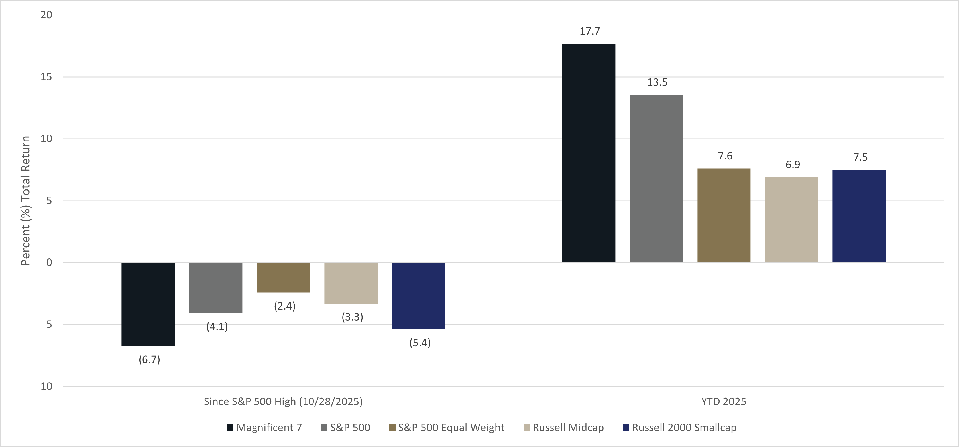

After the bounce on Friday, the S&P 500 is still 4.1% below the late-October peak. Even a stellar earnings report from NVIDIA (NVDA) failed to ignite a rally, as technology stocks fared worse than the broader market during this downturn. So what’s ailing stocks?

The proximate cause of the recent weakness can be divided into five primary drivers:

- Economic Jitters,

- Federal Reserve Policy,

- Artificial Intelligence Spending,

- Risk Appetite, and

- Valuation.

Economic Jitters

While the US government has reopened, economic releases are still delayed, so there is less visibility than usual into the strength of the economy. Last week, the delayed September jobs report was released. While nonfarm payrolls grew by a better-than-expected 119,000, the details were less impressive than the headline figure. Notably, past months were revised lower, which is typically an indicator of a softening labor market when it happens consistently, as has been the case recently.

The 4-week average of initial claims for unemployment benefits shows no signs of rapid deterioration; instead, it is slowly trending higher.

Continuing claims for unemployment benefits have continued to climb, reflecting the increasing difficulty the unemployed face in finding a new job.

One of the less supportive details of the September jobs report was that the unemployment rate rose to an above-expected 4.4% from 4.3%. While the absolute level of unemployment remains relatively low, the Sahm Rule, which has a robust track record of predicting recessions, uses a 0.5 percentage point rise in the three-month average of the unemployment rate above the lowest level in the past twelve months as a trigger. The September data took the indicator to 0.23 percentage points above the low, which is below the level needed to predict a recession but is moving in that direction.

Taking the whole into account, the US economy and job market appear to be softening in the fourth quarter, though there are no signs of extreme deterioration yet.

Looking at how economically sensitive stocks are trading relative to less sensitive defensive stocks indicates that stocks are pricing in less optimism about the economy. The current state could be characterized as a retreat from extremely low odds of recession being priced into stocks, rather than a warning signal of imminent collapse.

Federal Reserve Policy

The Fed funds futures markets had been pricing in around a 100% chance of a December rate cut from the Federal Reserve (Fed) right up until the end of October, when the odds fell sharply, coinciding with the S&P 500’s decline from its peak. The probability of a December rate cut fell to 30% after the release of the minutes from the October Fed meeting, which showed most Fed officials opposed a December easing.

Markets had been counting on an easing of the restrictive monetary policy to get the US economy through the soft patch and the drag from tariffs. When that seems less likely, stocks tend to suffer as more uncertainty needs to be priced into valuations.

The odds of a December cut have moved higher again, but that is likely connected to stock weakness rather than new fundamental data. Notably, the delayed October jobs report is scheduled for December 16, which is after the December 10 Fed meeting, so Fed officials will need to rely on other indicators in making their monetary policy decision.

Artificial Intelligence Spending

As mentioned earlier, even blow-out earnings and increased forward guidance from NVIDIA (NVDA) couldn’t break the market out of its funk. In addition, technology stocks have underperformed since late October in the sell-off. This market action suggests that some of the dark cloud emanates from concerns about the massive spending needed to support the artificial intelligence (AI) boom.

Just looking at the five companies, Alphabet (GOOGL), Amazon.com (AMZN), Meta Platforms (META), Microsoft (MSFT), and Oracle (ORCL), the forecasted capital expenditures (capex) are eye-popping at between $350 and $400 billion for 2026. Generally, investors penalize the valuations of companies embarking on large-scale capex, as there is always a question about whether the returns to shareholders from this spending will be sufficient. Further, these technology companies have been very asset-light, which is usually a much more attractive business model than a capital-intensive one.

The previous discussion paints a rather dismal picture, but there is a bullish case to be made. The artificial intelligence revolution is likely to drive increased productivity, so providers could stand to reap the benefits if that happens. The massive spend could act as a moat around the businesses, with few companies having the resources to compete. These are no ordinary companies, as they generate prodigious cash flows and have globally dominant firms, so it would be foolish to assume they will fail to monetize AI services.

Risk Appetite

The more speculative edges of the stock market have seen more significant declines since late October. For example, the IPOX SPAC index, which measures the returns from Special Purpose Acquisition Vehicles (SPACs), has fallen by 16.5% since October 28 but is still 21.1% higher year-to-date.

Even the most well-known cryptocurrency, Bitcoin, has not been immune, falling to near its year-to-date lows and posting a year-to-date decline. Despite being considered a diversifier or electronic gold by some proponents, Bitcoin’s price movement has been similar to that of stocks this year. However, the recent sell-off has been more severe.

Even the increased spread on investment-grade corporate bonds, which are the compensation investors demand for the additional default risk relative to US Treasuries, reflects the decreased appetite for risk. While spreads remain relatively low, they have returned to the level last seen during the tariff worries earlier in the year.

Valuation

The S&P 500’s estimated forward price-to-earnings ratio is 24.3 times, which is a historically challenging level. US stocks should trade at higher valuations due to a superior return on equity, which measures the earnings a company generates from the capital provided by shareholders. The appropriate valuation premium relative to historical averages, and whether the elevated return on equity is sustainable, are open questions.

US companies have seen superior and improving profit margins, which is the percentage of revenue that ends up as bottom-line profits. The US technology sector is a crucial factor in the S&P 500’s exceptional profitability.

Valuation is a poor predictor of short-term performance, but the characteristics underlying US valuations and profitability provide crucial insights. Concerns about the future profitability of technology leaders following increased capex spending are a pivotal issue for stocks.

What To Watch This Week

Several regularly scheduled economic releases remain delayed in the holiday-shortened week. Still, Tuesday’s September retail sales will be closely watched for clues about the holiday shopping season, and the consumer is crucial to the outlook for US economic growth.

Since the October jobs report is scheduled for December 16, which is after the December 10 Fed meeting, Wednesday’s Federal Reserve Beige book takes on more importance than usual, with Fed officials needing to look for alternate indicators of labor market health. No comments from Fed officials are scheduled during the holiday week, and the communications blackout begins on Saturday until the December meeting.

Despite the Thanksgiving holiday, 11 S&P 500 companies are scheduled to report earnings. Best Buy (BBY), Dell Technologies (DELL), and Analog Devices (ADI) are three of the notable earnings releases.

Summary

While there are some concerns about the US economic outlook, and fourth-quarter growth seems to be softening, it is too early to become overly concerned. In addition to the short-term restoration of federal pay and food stamp funding, the economy will receive significant stimulus from the One Big Beautiful Bill Act (OBBBA) in the first quarter of 2026. Strategas estimates that about $285 billion in business and consumer tax cuts will provide support for the economy in 2026.

So far, the market has pulled back from exceptionally high confidence in the US economy, avoiding a recession. Fundamentals and the betting odds still point to the base case of no recession being the right one at the moment. Visibility remains limited due to the delayed economic data from the shutdown, so the situation should be monitored closely.

Despite concerns about massive AI infrastructure spending, the technology sector has continued to post exceptional profitability and earnings growth. Some of the more expensive stocks should face some headwinds as the weight of expectations can cause more indigestion, but increasing AI adoption should provide comfort for investors in the technology sector and stocks as a whole. Given the revolutionary nature of artificial intelligence technology, no one can be certain of the profitability of these massive capital expenditures. Still, given their profitability history and free cash flow generation, the technology leaders should be given the benefit of the doubt as the wait for more evidence and increasing AI adoption continues.