The performance of legacy auto companies in the third quarter of 2025 may have surprised some investors. Same for the steep decline in EV adoption, while internal combustion engine and hybrid vehicles sales stay steady.

But, my regular readers should not be surprised. I’ve predicted this turn of events since the early days of EVs.

I first made General Motors (GM) a Long Idea in March 2018 and most recently reiterated my thesis in June 2025. Since my last report, GM is up 44% after beating Street earnings estimate for the third quarter and raising guidance for the full year 2025.

With the recent jump in stock price, investors may think it’s time to pump the brakes. On the contrary, I think it’s time to step on the gas.

As an industry leader with the proven ability to generate profits in good and bad times, General Motors’ stock remains undervalued and continues to provide strong upside potential.

GM offers favorable Risk/Reward based on the company’s:

- improving market share in key markets,

- ability to transition between ICE and hybrid vehicle manufacturing,

- superior profit margins compared to peers,

- strong dividends and buybacks, and

- cheap stock: current price implies profits will permanently decline from current levels.

What’s Working

Legacy OEMs Remain on Top

My overarching thesis on the auto industry remains intact: the death of legacy automakers is greatly exaggerated. History has shown that legacy automakers can build hybrid and EVs, while generating billions in cash flow from legacy internal combustion engine (ICE) production. The ability to serve multiple markets provides lasting competitive advantages.

As 2025 nears its end, my thesis looks stronger than ever. Automakers such as Tesla (TSLA) reported year-over-year (YoY) declines in vehicle deliveries while legacy OEMs continue to achieve strong internal combustion engine (ICE) and hybrid vehicle deliveries.

Taking Market Share on All Fronts

Beyond the headline top- and bottom-line beat and the 2025 guidance raise in its 3Q25 earnings report, General Motors continues to grow its market share in its key truck and SUV markets.

Year-to-date (YTD) through 3Q25, the company is on pace to lead the industry in sales of full-size:

- pickups for the 6th straight year.

- SUVs for the 51st straight year.

YTD through 3Q25, General Motors held 41% and 60% share in the full-size pickups and full-size SUV markets, respectively.

The strength in these two markets drives General Motors’ U.S. ICE market share to 17.4% through the first nine months of 2025, which is up 0.5 percentage points YoY.

Additionally, General Motors ranked #1 in total U.S. sales with 710,000 vehicle deliveries in 3Q25, an increase of 8% YoY.

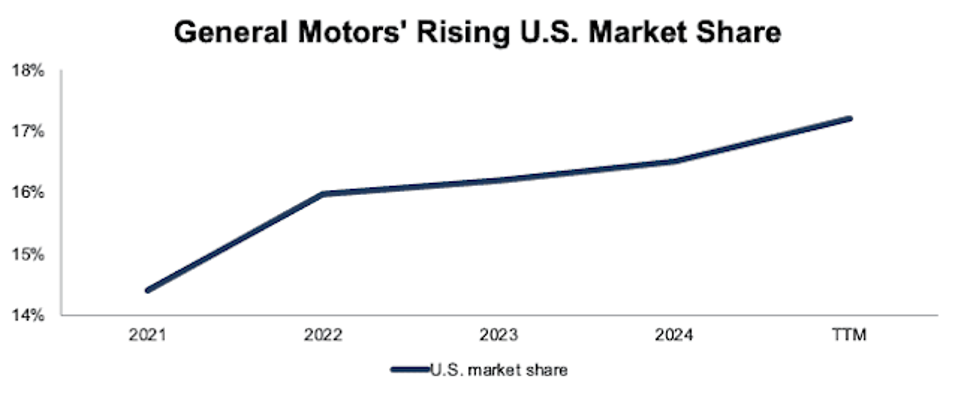

Longer term, General Motors’ total U.S. market share (all vehicle types) increased from 14.4% in 2021 to 17.2% in the TTM ended 3Q25.

Figure 1: General Motors’ Total U.S. Market Share: 2021 – TTM

Adapting to the “New” EV Market

Around the world and especially in the United States, EV adoption has slowed significantly, and demand will fall further after the termination of the tax incentives for EV purchases. Accordingly, many OEMs are scaling back EV production to refocus on legacy ICE and hybrid vehicles.

Despite the slowdown, General Motors’ management “expects to reduce EV losses in 2026 and beyond.” Additionally, the company continues to take EV market share, even if EV adoption will be lower than nearly everyone planned.

General Motors leads the EV industry with the highest market share growth YTD compared to any other OEM. At the end of 3Q25, General Motors holds the #2 market share position in the U.S. EV market.

EV unit sales in the Chevrolet, GMC, and Cadillac brands grew 113%, 109%, and 88% YoY, respectively through the first nine months of 2025. This growth has persisted for multiple periods, as highlighted in Figure 2. For context, Tesla’s unit sales fell 4% YoY through the first nine months of 2025.

General Motors notes in its 3Q25 earnings presentation, Chevrolet is the #2 U.S. EV brand while the Equinox EV is the best-selling non-Tesla EV. Additionally, Cadillac is the best-selling luxury EV brand in the U.S. YTD.

Based on data from Cox Automotive, Chevrolet, Cadillac, and GMC sales accounted for a total of 14% of EV unit sales through the first nine months of 2025.

General Motors’ ability to grow its share of the EV market despite scaling down its EV operations is impressive. Add in that the company is also growing its share of the overall auto market, and you have a company that appears to have made some very smart decisions over the past several years.

Figure 2: Chevrolet, Cadillac, and GMC Number of EV Sales: 3Q23 – 3Q25

Solid Fundamentals for More Than a Decade

General Motors has grown both revenue and net operating profit after-tax (NOPAT) by 2% compounded annually from 2010 through the TTM ended 3Q25. See Figure 3. More recently, General Motors has grown revenue and NOPAT by 6% and 3% compounded annually since 2019.

Figure 3: General Motors’ Revenue and NOPAT: 2010 – TTM ended 3Q25

The company’s Core Earnings, a proven superior earnings measure that excludes unusual gains/losses, grew 2% compounded annually from 2010 through the TTM.

Investors only analyzing GAAP net income may not realize just how profitable General Motors is. The company’s Core Earnings are higher than GAAP net income in each of the three last fiscal years as well as the TTM. Over the TTM, General Motors’ Core Earnings are $8.5 billion while GAAP net income is $4.8 billion.

Identifying differences in Core Earnings and GAAP Earnings, or what I call Earnings Distortion, drives novel alpha, as proven by the Bloomberg New Constructs Core Earnings Leaders Index. The index tracks the 100 companies whose Core Earnings exceed GAAP earnings by the most relative to the size of the company.

Second Highest Margins Among Peers

General Motors also has the second highest profit margins among global auto manufacturers, which include, Toyota Motor (TM), Ford Motor (F), Tesla (TSLA), Honda Motor (HMC), and more.

General Motors has the second highest invested capital turns and third highest return on invested capital (ROIC) among peers. See Figure 4.

General Motors’ superior operational efficiency is driven in part by its low incentive spend. The company’s incentives as a percentage of average transaction price (ATP) equaled just 4.0% compared to the industry average of 6.9% in 3Q25.

Figure 4: General Motors Profitability vs. Peers: TTM

Significant Cash Flow Generation

General Motors has generated large cash flows for over a decade now, and recent results look just as strong as years past.

General Motors generated a cumulative $45.0 billion (60% of enterprise value) in free cash flow (FCF) from 2014 through 3Q25. See Figure 5. Over the TTM, General Motors generated $7.9 billion in FCF.

Figure 5: General Motors’ Cumulative Free Cash Flow Since 2014

Potential for 5%+ Yield

After suspending its dividend during COVID-19, General Motors reinstated a dividend of $0.09/share in 3Q22. Since then, General Motors increased its dividend to $0.15/share in 4Q25. When annualized, General Motors’ standard dividend provides investors a 0.9% yield. Since 2022, the company has paid $2.2 billion (3% of market cap) in cumulative dividends.

General Motors also returns capital to shareholders through share repurchases. From 2022 through 3Q25, the company repurchased $24.2 billion (37% of market cap) of shares.

In February 2025, General Motors increased the capacity under its existing share repurchase program by $6 billion to an aggregate $6.3 billion of shares. Additionally, the company approved an accelerated share repurchase (ASR) program of $2 billion.

As of September 30, 2025, General Motors has $2.8 billion of shares remaining under its existing repurchase authorization.

Should the company repurchase shares at its TTM repurchase rate, it would deplete its remaining repurchase authorization, which equals 4.3% of the current market cap.

When combined, the dividend and share repurchase yield could reach 5.2%.

Importantly, General Motors generates more than enough FCF to pay dividends and repurchase shares. Since 2022, when General Motors reinstated its dividend and ramped up repurchases, the company has spent $26.4 billion on dividends and repurchases. Over the same time, the company generated $27.1 billion in FCF.

Reducing Shares Outstanding

General Motors’ large repurchases have also meaningfully reduced its shares outstanding from 1.5 billion in 2021 to 987 million at the end of 3Q25. See Figure 6.

I like companies that choose to return capital to shareholders instead of spending it on costly acquisitions or executive bonuses that rarely drive shareholder value creation. Companies that sport strong enough cash flows to consistently lower their shares outstanding, like General Motors, offer excellent value.

Figure 6: General Motors’ Shares Outstanding: 2021 – 3Q25

What’s Not Working

EV Losses Will Persist

Despite the company’s proven ability to take market share in the EV market, the weakened demand and slowed adoption of EVs hurts the business. In 3Q25, the company recorded a $1.6 billion EV charge, which consists of noncash impairments and supplier contract cancellation costs. Management noted in the 3Q25 earnings report that they “expect future charges”, but by addressing overcapacity, they “expect to reduce EV losses in 2026 and beyond.”

EVs remain the company’s “North Star”, in the words of CEO Mary Barra. However, the company will have to manage the slowdown and determine appropriate production capacity once a more normal demand for EVs is established. In the meantime, the company generates billions in cash flow from its existing ICE operations and remains highly profitable.

Tariffs Remain a Drag on Profits

Despite lowering its tariff impact outlook by $500 million and raising its adjusted EBIT outlook in its 3Q25 earnings report, its undeniable that tariffs have negatively impacted General Motor’s profitability.

The positive revisions are certainly a testament to management’s ability to move production where possible in an attempt to mitigate the impact of tariffs. Going forward, General Motors plans to further mitigate tariffs by expanding existing U.S. production and onshoring other production.

Management announced in the 3Q25 earnings call that the company will more than double Chevrolet Equinox production in Kansas. The company plans to onshore the Chevrolet Blazer to its Tennessee plant and produce the Cadillac Escalade at its Orion Michigan plant, previously converted to EV production, once it comes back online in 2027.

Despite the uncertainty, management noted in the 3Q25 earnings call that they “expect next year [2026] to be even better than 2025.”

Such a scenario would be great news for prospective investors, because General Motors’ current stock price implies its profits will fall significantly, as I’ll show below.

Current Price Implies Permanent Profit Decline

At its current price of $70/share, GM’s price-to-economic book value (PEBV) ratio is 0.6. This ratio means the market expects the company’s NOPAT to permanently fall 40% from TTM levels. Such an expectation looks overly pessimistic given that the company has grown NOPAT by 3% compounded annually over the past five years and 2% compounded annually since 2010.

Additionally, consensus estimates for General Motors’ EPS imply a 4% YoY decline in 2025 followed by YoY improvement in both 2026 and 2027.

Below, I use my reverse discounted cash flow (DCF) model to quantify the cash flow expectations for different stock price scenarios for GM.

In the first scenario, I quantify the expectations baked into the current price. If I assume:

- NOPAT margin falls to 3.0% (below TTM margin of 4.8% and 5-year average of 6.5%) from 2025 to 2034,

- revenue grows at consensus estimates in 2025 (-1%) and 2026 (0%), and

- revenue grows 2% (equal to 10-year CAGR) each year thereafter through 2034, then

the stock would be worth $70/share today – equal to the current stock price. In this scenario, General Motors’ NOPAT would fall 6% compounded annually from 2025 – 2034 to just $6.5 billion. For reference, the last time General Motors earned below $6.5 billion in NOPAT was 2013, when it earned $5.6 billion NOPAT. In 2020, General Motors earned $6.8 billion in NOPAT, which ranks as its second-lowest NOPAT since 2013.

Shares Could Go 40%+ Higher Even If Profits Decline Over the Next Decade

If I instead assume General Motors’:

- NOPAT margin falls to 4.0% (still below TTM margin of 4.8%) through 2034,

- revenue grows at consensus estimates in 2025 (-1%) and 2026 (0%), and

- revenue grows 2% (equal to 10-year CAGR) each year thereafter through 2034, then

the stock would be worth $98/share today – a 40%+ upside to the current price. In this scenario, General Motors’ NOPAT would still fall 3% compounded annually through 2034. Should the company’s NOPAT grow more in line with historical levels, the stock has even more upside.

Figure 7 compares General Motors’ implied future NOPAT in these scenarios to its historical NOPAT. For reference, General Motors’ economic book value, or no growth value, sits at $111/share.

Figure 7: GM’s Historical and Implied NOPAT: DCF Valuation Scenarios