In Belém earlier this month before COP30 got fully underway, U.N. Secretary-General António Guterres lambasted world leaders for failing to keep global warming below 1.5°C. Coming in the wake of the failure of delegates at the International Maritime Organisation’s to vote to adopt landmark regulations to drastically cut emissions, the omens were not auspicious.

These would have made shipping the first sector with binding global emissions targets. After ten years’ of negotiations, the IMO had agreed in April an ambitious greenhouse gas reduction target of 8-21% by 2030 and 30-63% by 2035.

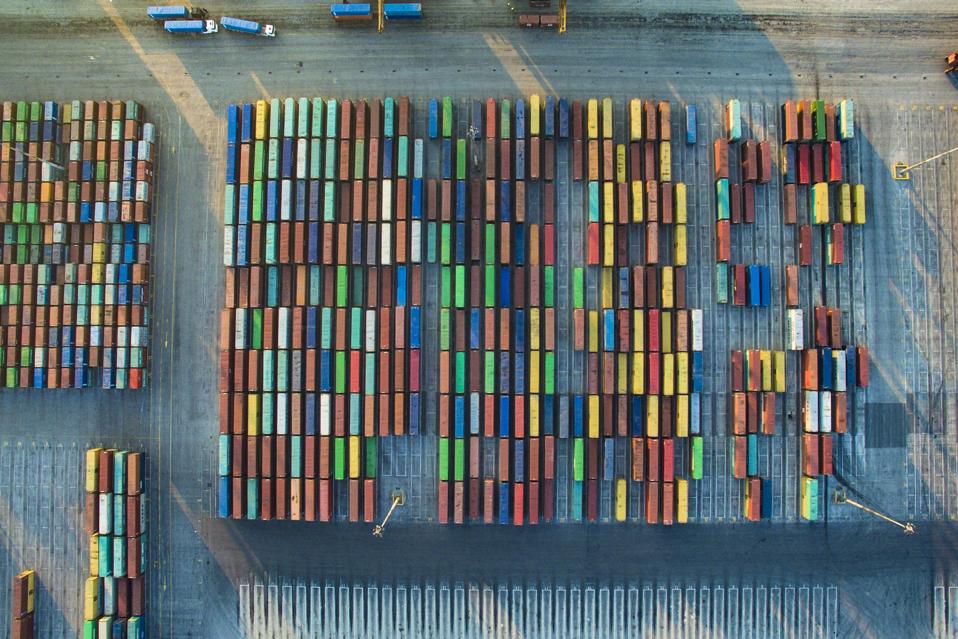

The IMO package included limits on the level of emissions per unit of energy and setting a global price for maritime carbon emissions. Shipping generates three per cent of global emissions.

Revenues were to be recycled back into the scheme to help fund zero- and near-zero-emission technologies, making transition costs fairer for poorer countries.

Without the scheme, shipping emissions could rise by as much as 50% by 2050.

However, in October, intense lobbying from Washington led to several nations, including China and Greece changing their stance. The Financial Times reported one IMO veteran describing the U.S. delegation as “behaving like gangsters,” disrupting proceedings and challenging the chair. U.S. Secretary of State Marco Rubio later hailed the delay as a “huge win” for the Trump administration.

What It Means For Decarbonisation

For the IMO, and the environment, it’s a setback. But what does it mean to those in the shipping industry?

“Norway has been steaming ahead for years in the transition to lower emissions,” says Helene Tofte, director of the Norwegian Shipowners Association. Shipping accounts for 10 – 15 % of GDP in Norway.

She believes the immediate impact of the IMO delay in countries such as Norway will be very limited. Europe already has the tightest regional net zero shipping regulations and targets in the world, and Tofte expects EU countries will continue to fulfil them.

However, if the transition delay becomes prolonged, the implications could have a significant impact on shipping companies, creating uncertainty and higher costs.

As Tofte says, “We’ve been asking for one set of global regulations for many years, not just to have some certainty, but so that everybody will follow the same regulations. If more regional regulations come in instead, with one set in Europe, another in China and so on, it will make it much more difficult for the industry.”

Regional Momentum

Elsewhere, for innovative companies that have invested heavily in green technology, demand remains strong. Torbjörn Bäck, Group CEO of Swedish battery-systems provider Echandia, argues that the market will continue to surge ahead.

“The momentum toward more electrification in maritime remains strong, particularly in Europe and among forward-leaning governments, owners, naval architects, and operators,” he says.

“The market drivers are higher efficiency, better comfort and improved safety in many different areas of application. For example, fuel savings, the provision of heavy power levels for cranes and propulsion systems, back-up power and many more areas.”

“Regional leadership (for example Nordics, EU, India, Singapore, part of US) is already creating practical examples that others will be able to follow at the right time,” adds Bäck.

The drive towards greater efficiency – such as adding wind sails to the decks of cargo vessels or using AI to streamline operations – isn’t just about the environment after all. It’s about cost reduction.

Nevertheless, Lloyd’s List journalist Declan Bush argues the anticlimax ‘leaves shipping in the green purgatory to which it has become accustomed.’

The delay adds another layer of uncertainty: multiple regional standards are harder to navigate than one global rulebook.

More importantly, the IMO proposal’s real strength lay in its redistributive design—channelling revenues to poorer nations most vulnerable to problems caused by warming. In the Trump-led zeitgeist, is this achievable?

Tofte questions the nature of discussions and plans the leading members of the IMO will have before the next conference, at which the motion is likely to be re-presented. “How will they try to steer this process? It’s not just about what we would like to achieve but what is it possible to achieve, the way the world looks right now?”

If IMO representatives want to ensure maritime emissions fall to even 30% by 2035, they may all need to take the gloves off in 2026.