What a time to be a contrarian!

The economy is en fuego as AI boosts productivity (even if, yes, it’s cooling payrolls). Yet the mainstream crowd is hunkered down, terrified of an AI bubble.

That sets up some very attractive deals in 8%-paying closed-end funds (CEFs), many of which have gone on sale in the last few weeks.

2 “North Star” CEFs Show Us What to Do Now

To get a feel for the setup in front of us, all we need to do is look at two things.

First, the Atlanta Fed’s GDPNow indicator, the most current economic “barometer” we have. In the recently completed third quarter, it’s telling us the economy grew a solid 4% annualized. Cooking!

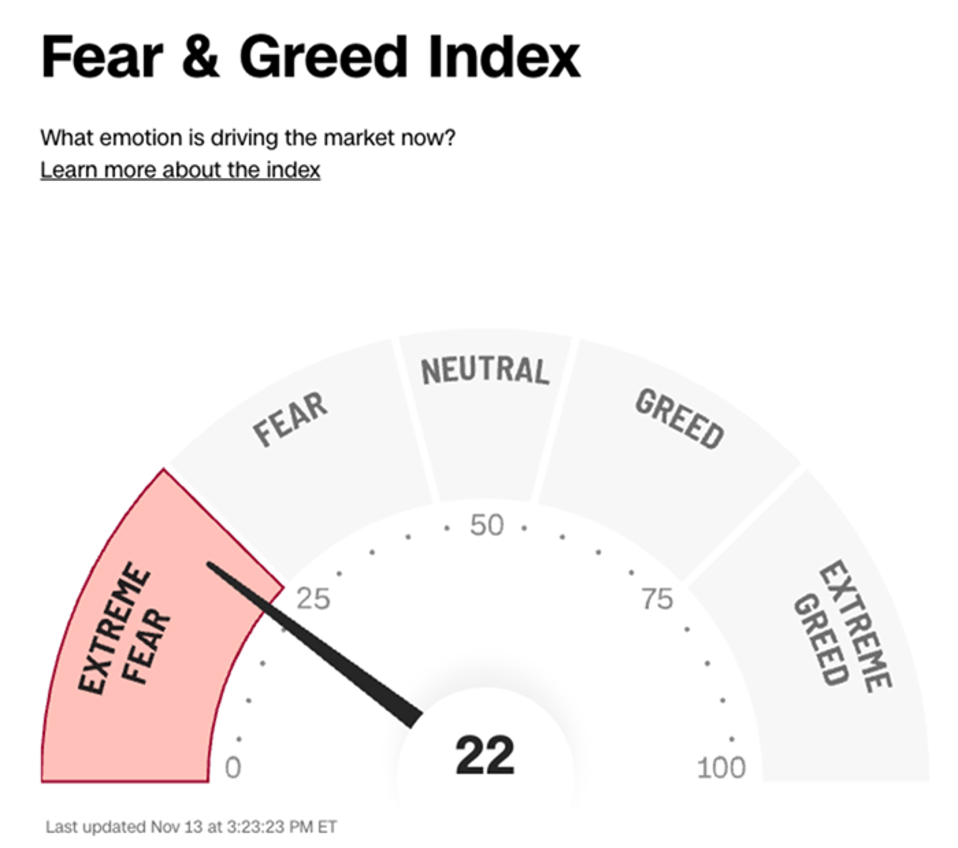

Meantime, the “dumb money” is in full panic mode. Consider the CNN Fear & Greed index, a fairly reliable “investor mood ring”:

Look, I get the bubble fears. But here’s the thing: When you strip out tech and look at things on an equal-weight basis, the S&P 500 is only up about 7% this year. To put that in context, the index has returned around 10% annualized since 1957. So that 7.2% figure isn’t much of a worry.

This is why we want to steer clear of an index fund like the SPDR S&P 500 ETF (SPY) and go with a CEF instead: The latter are run by human managers who can “pick their spots” for bargains.

What’s more, as I wrote last week, CEFs are a “go-to” for us at times like these because these funds are a small market. That means CEF buyers tend to be individual investors—there’s just not enough cash in play here for the big guys to bother with.

But there’s plenty for us! Plus, without competition from institutional players (and their algorithms), we get more bargain opportunities. In addition, CEF investors tend to be conservative sorts, so when the needle moves to “fear” (or better yet “extreme fear,” where it is now), they’re much quicker to sell. And when they do, CEF discounts to net asset value (NAV) get wider. That’s our “in”!

Here are two CEFs paying 6%+ and sporting double-digit discounts today. The first is run by a well-known value-investing guru. The second is a young tech fund paying a huge 9.7% dividend that just delivered its first-ever payout hike.

CEF #1: A Top “Rinse-and-Repeat” Play for Double-Digit Gains

There are few managers better at “picking their spots” than Mario Gabelli. If you’ve been a member of my Contrarian Income Report service for a while, you’ll recall his Gabelli Dividend & Income Trust (GDV), which we’ve tapped for nice double-digit returns a couple times.

The first was from early October 2020 till February 2022, when we booked a solid 44% total return. Then we came back and dipped in for just three months, from October 2023 till January 2024, for another 10.8% return.

Now, as we near the end of 2025, I’m keeping an eye on GDV again. Why? Because our man Mario’s been putting on a clinic this year, racking up a 16.6% return on GDV’s market price, as of this writing, ahead of the S&P 500’s 13.9%.

For that, you might think GDV would be trading close to par. Ha!

Sure, its discount has narrowed a bit, but 10.4% is still far too big for a fund performing this well. That’s an opportunity—as is the fact that GDV’s discount has momentum, showing that it’s getting on at least some CEF investors’ radar.

We also like the fact that Mario is looking to other sectors beyond tech, which matches up with our view that industries like finance will be next to streamline their businesses. As you can see below, only three of GDV’s top-1o holdings are AI plays—Microsoft (MSFT), Alphabet (GOOGL) and poster child NVIDIA (NVDA).

Now, far be it for us to turn up our noses at a 6.2% dividend, but Gabelli’s payout is a bit low for a CEF. However, we can look forward to upside from that closing discount and Mario’s stock picking to make up the difference.

Plus, the dividend—paid monthly—has been rising, so we can consider that 6.2% a “starter yield” on a buy today.

(Note that those dips in late 2021 and late 2022 are special dividends, not cuts!)

All of this makes now a good time to consider GDV—especially if you’re looking for a bargain-priced, high-yield way to diversify beyond tech.

CEF #2: A 9.7% Dividend That Just Jumped

Now just because we’re leaning into GDV’s non-tech bent doesn’t mean we’re turning away from tech. But again, we’re picking our spots—and that’s where the Neuberger Berman Next Generation Connectivity Fund (NBXG) comes in.

NBXG goes in the opposite direction of GDV, holding the main tech names: Amazon.com (AMZN), Meta and Microsoft are all here, as are some more aggressive tickers, like Robinhood Markets (HOOD) and “adjacent” plays like AT&T (T).

Plus, the fund is generous on the dividend front, with a 9.7% payout. And shareholders just bagged their first-ever dividend hike (NBXG hasn’t been around long, having launched in May 2021):

Moreover, the fund has outrun the NASDAQ on a total-return basis this year.

Which brings us to the discount, which is a sweet deal at 12%. But as you can see below, the markdown has largely moved sideways this past year, despite the fund’s strong performance:

That means we can’t expect much upside from the closing discount, and will be looking to the fund’s portfolio to drive gains. That’s not a bad thing, but I’d wait till that markdown is below 13% before considering this one—and look to GDV till then.

Brett Owens is Chief Investment Strategist for Contrarian Outlook. For more great income ideas, get your free copy his latest special report: How to Live off Huge Monthly Dividends (up to 7.6%) — Practically Forever.