Tesla shareholders recently approved Elon Musk’s $1 trillion pay package. The compensation plan has the potential to make the world’s richest person also the world’s first trillionaire. While that’s great for Musk, is it really the best use of Tesla’s capital, to mint a trillionaire, when the company is facing significant headwinds?

That’s about as rhetorical as a question can get…

Prudent use of capital doesn’t just apply to executive compensation. Mismanagement of capital can lead to reduced shareholder returns, in the form of reduced or suspended dividends. The most important element of a quality dividend stocks lies in ability to pay that dividend.

If a company’s cash flows aren’t enough to support its dividend payments, it can’t sustain or grow its dividends. On the other hand, companies that generate ample cash flows provide a safe income and have opportunities to further increase their dividends.

My Dividend Growth Stocks Model Portfolio includes stocks that get an Attractive-or-better rating and companies that not only produce ample free cash flow to support their dividend payments, but also consistently increase their dividend payments over time.

Below is an overview of one of the stocks from the latest edition of my Dividend Growth Model Portfolio.

Free Stock Pick: Amdocs, Ltd. (DOX)

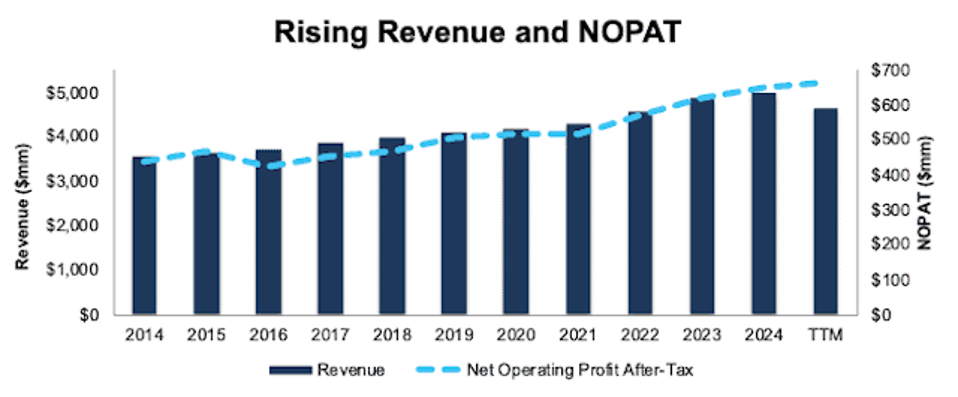

Amdocs has grown revenue and net operating profit after-tax (NOPAT) by 2% and 4% compounded annually, respectively, since 2014. The company’s NOPAT margin improved from 12% in 2019 to 14% in the trailing-twelve-months (TTM), while invested capital turns fell from 1.0 to 0.9 over the same time. The improvement in NOPAT margin is enough to offset falling invested capital turns and drive return on invested capital (ROIC) from 11% in 2019 to 12% over the TTM.

Figure 1: Amdocs’ Revenue & NOPAT Since 2014

Free Cash Flow Exceeds Dividend Payments

Amdocs has increased its regular, quarterly dividend from $0.29/share in 3Q19 to $0.53/share in 3Q25. The quarterly dividend, when annualized, equals $2.12/share and provides a 2.5% dividend yield.

More importantly, Amdocs’ cumulative free cash flow (FCF) easily exceeds its dividend payments. From 2019 through the first nine months of 2025, Amdocs generated $2.9 billion (29% of current enterprise value) in FCF while paying over $1.3 billion in dividends. See Figure 2.

Figure 2: Amdocs’ FCF vs. Dividends Since 2019

Companies with FCF well above dividend payments provide higher-quality dividend growth opportunities. On the other hand, dividends that exceed FCF cannot be trusted to grow or even be maintained.

DOX Is Undervalued

At its current price of $84/share, DOX has a price-to-economic book value (PEBV) ratio of 1.0. This ratio means the market expects Amdocs’ NOPAT to never grow from TTM levels. This expectation seems overly pessimistic given that Amdocs has grown NOPAT by 5% and 4% compounded annually over the last five and ten years, respectively.

Even if Amdocs’s:

- NOPAT margin remains at 14% (equal to TTM NOPAT margin) through 2034,

- revenue grows at consensus rates in 2025 (-10%), 2026 (4%), and 2027 (5%), and

- revenue grows 2% each year thereafter (equal five-year CAGR) through 2034, then

the stock would be worth $98/share today – a 17% upside. In this scenario, Amdocs’ NOPAT would grow just 3% compounded annually through 2034.

Add in Amdocs’ 2.5% dividend yield and a history of dividend growth, and it’s clear why this stock is in October’s Dividend Growth Stocks Model Portfolio.

Critical Details Found in Financial Filings by My Firm’s Robo-Analyst Technology

Below are specifics on the adjustments I make based on Robo-Analyst findings in Amdocs’ 6-Ks and 20-Fs:

Income Statement: I made over $200 million in adjustments with a net effect of removing over $150 million in non-operating expense.

Balance Sheet: I made over $1 billion in adjustments to calculate invested capital with a net increase of over $300 million. The most notable adjustment was for accumulated goodwill amortization.

Valuation: I made over $1 billion in adjustments with a net decrease of just under $800 million to shareholder value. The most notable adjustment to shareholder value was total debt.